Annual Report 2006 ISS Global A/S

Annual Report 2006 ISS Global A/S

Annual Report 2006 ISS Global A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

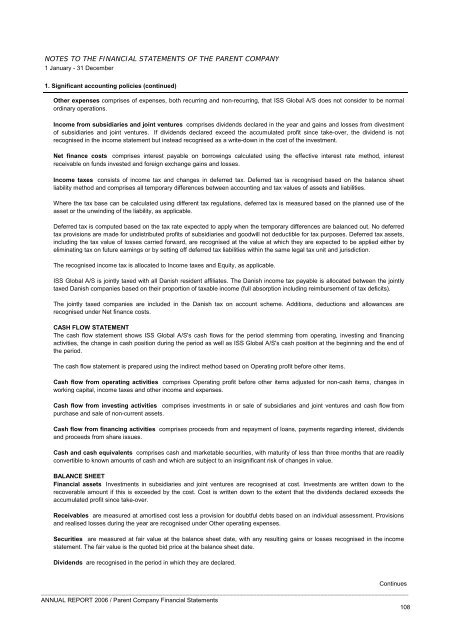

NOTES TO THE FINANCIAL STATEMENTS OF THE PARENT COMPANY<br />

1 January - 31 December<br />

1. Significant accounting policies (continued)<br />

Other expenses comprises of expenses, both recurring and non-recurring, that <strong>ISS</strong> <strong>Global</strong> A/S does not consider to be normal<br />

ordinary operations.<br />

Income from subsidiaries and joint ventures comprises dividends declared in the year and gains and losses from divestment<br />

of subsidiaries and joint ventures. If dividends declared exceed the accumulated profit since take-over, the dividend is not<br />

recognised in the income statement but instead recognised as a write-down in the cost of the investment.<br />

Net finance costs comprises interest payable on borrowings calculated using the effective interest rate method, interest<br />

receivable on funds invested and foreign exchange gains and losses.<br />

Income taxes consists of income tax and changes in deferred tax. Deferred tax is recognised based on the balance sheet<br />

liability method and comprises all temporary differences between accounting and tax values of assets and liabilities.<br />

Where the tax base can be calculated using different tax regulations, deferred tax is measured based on the planned use of the<br />

asset or the unwinding of the liability, as applicable.<br />

Deferred tax is computed based on the tax rate expected to apply when the temporary differences are balanced out. No deferred<br />

tax provisions are made for undistributed profits of subsidiaries and goodwill not deductible for tax purposes. Deferred tax assets,<br />

including the tax value of losses carried forward, are recognised at the value at which they are expected to be applied either by<br />

eliminating tax on future earnings or by setting off deferred tax liabilities within the same legal tax unit and jurisdiction.<br />

The recognised income tax is allocated to Income taxes and Equity, as applicable.<br />

<strong>ISS</strong> <strong>Global</strong> A/S is jointly taxed with all Danish resident affiliates. The Danish income tax payable is allocated between the jointly<br />

taxed Danish companies based on their proportion of taxable income (full absorption including reimbursement of tax deficits).<br />

The jointly taxed companies are included in the Danish tax on account scheme. Additions, deductions and allowances are<br />

recognised under Net finance costs.<br />

CASH FLOW STATEMENT<br />

The cash flow statement shows <strong>ISS</strong> <strong>Global</strong> A/S's cash flows for the period stemming from operating, investing and financing<br />

activities, the change in cash position during the period as well as <strong>ISS</strong> <strong>Global</strong> A/S's cash position at the beginning and the end of<br />

the period.<br />

The cash flow statement is prepared using the indirect method based on Operating profit before other items.<br />

Cash flow from operating activities comprises Operating profit before other items adjusted for non-cash items, changes in<br />

working capital, income taxes and other income and expenses.<br />

Cash flow from investing activities comprises investments in or sale of subsidiaries and joint ventures and cash flow from<br />

purchase and sale of non-current assets.<br />

Cash flow from financing activities comprises proceeds from and repayment of loans, payments regarding interest, dividends<br />

and proceeds from share issues.<br />

Cash and cash equivalents comprises cash and marketable securities, with maturity of less than three months that are readily<br />

convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.<br />

BALANCE SHEET<br />

Financial assets Investments in subsidiaries and joint ventures are recognised at cost. Investments are written down to the<br />

recoverable amount if this is exceeded by the cost. Cost is written down to the extent that the dividends declared exceeds the<br />

accumulated profit since take-over.<br />

Receivables are measured at amortised cost less a provision for doubtful debts based on an individual assessment. Provisions<br />

and realised losses during the year are recognised under Other operating expenses.<br />

Securities are measured at fair value at the balance sheet date, with any resulting gains or losses recognised in the income<br />

statement. The fair value is the quoted bid price at the balance sheet date.<br />

Dividends are recognised in the period in which they are declared.<br />

Continues<br />

_____________________________________________________________________________________________________________<br />

ANNUAL REPORT <strong>2006</strong> / Parent Company Financial Statements<br />

108