Annual Report 2006 ISS Global A/S

Annual Report 2006 ISS Global A/S

Annual Report 2006 ISS Global A/S

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

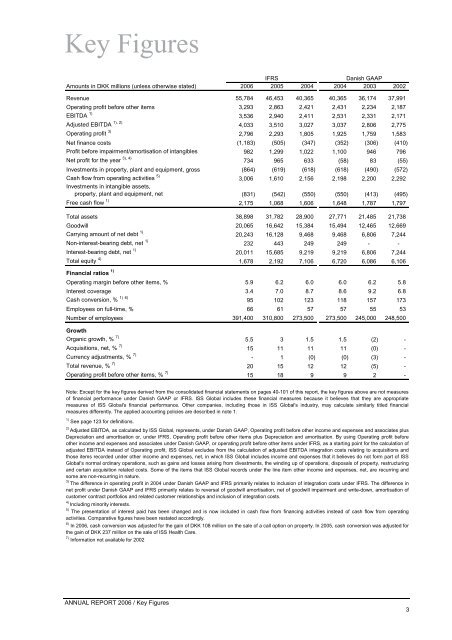

Key Figures<br />

Amounts in DKK millions (unless otherwise stated) <strong>2006</strong><br />

Revenue 55,784<br />

Operating profit before other items 3,293<br />

EBITDA 1)<br />

3,536<br />

1), 2)<br />

Adjusted EBITDA 4,033<br />

Operating profit 3)<br />

2,796<br />

Net finance costs (1,183)<br />

Profit before impairment/amortisation of intangibles 982<br />

3), 4)<br />

Net profit for the year 734<br />

Investments in property, plant and equipment, gross (864)<br />

Cash flow from operating activities 5)<br />

Investments in intangible assets,<br />

3,006<br />

property, plant and equipment, net (831)<br />

Free cash flow 1)<br />

2,175<br />

Total assets 38,898<br />

Goodwill 20,065<br />

Carrying amount of net debt 1)<br />

20,243<br />

Non-interest-bearing debt, net 1)<br />

232<br />

Interest-bearing debt, net 1)<br />

20,011<br />

Total equity 4)<br />

Financial ratios<br />

1,678<br />

1)<br />

Operating margin before other items, % 5.9<br />

Interest coverage 3.4<br />

1) 6)<br />

Cash conversion, % 95<br />

Employees on full-time, % 66<br />

Number of employees 391,400<br />

Growth<br />

Organic growth, % 7)<br />

Acquisitions, net, % 7)<br />

Currency adjustments, % 7)<br />

Total revenue, % 7)<br />

Operating profit before other items, % 7)<br />

1) See page 123 for definitions.<br />

ANNUAL REPORT <strong>2006</strong> / Key Figures<br />

5.5<br />

15<br />

-<br />

20<br />

15<br />

IFRS<br />

2005<br />

46,453<br />

2,863<br />

2,940<br />

3,510<br />

2,293<br />

(505)<br />

1,299<br />

965<br />

(619)<br />

1,610<br />

(542)<br />

1,068<br />

31,782<br />

16,642<br />

16,128<br />

443<br />

15,685<br />

2,192<br />

6.2<br />

7.0<br />

102<br />

61<br />

310,800<br />

3<br />

11<br />

1<br />

15<br />

18<br />

2004<br />

40,365<br />

2,421<br />

2,411<br />

3,027<br />

1,805<br />

(347)<br />

1,022<br />

633<br />

(618)<br />

2,156<br />

(550)<br />

1,606<br />

28,900<br />

15,384<br />

9,468<br />

249<br />

9,219<br />

7,106<br />

6.0<br />

8.7<br />

123<br />

57<br />

273,500<br />

1.5<br />

11<br />

(0)<br />

12<br />

9<br />

Danish GAAP<br />

2004 2003<br />

40,365<br />

2,431<br />

2,531<br />

3,037<br />

1,925<br />

(352)<br />

1,100<br />

(58)<br />

(618)<br />

2,198<br />

(550)<br />

1,648<br />

27,771<br />

15,494<br />

9,468<br />

249<br />

9,219<br />

6,720<br />

6.0<br />

8.6<br />

118<br />

57<br />

273,500<br />

1.5<br />

11<br />

(0)<br />

12<br />

9<br />

36,174<br />

2,234<br />

2,331<br />

2,806<br />

1,759<br />

(306)<br />

946<br />

83<br />

(490)<br />

2,200<br />

(413)<br />

1,787<br />

21,485<br />

12,465<br />

6,806<br />

-<br />

6,806<br />

6,086<br />

6.2<br />

9.2<br />

157<br />

55<br />

245,000<br />

(2)<br />

(0)<br />

(3)<br />

(5)<br />

2<br />

2002<br />

37,991<br />

2,187<br />

2,171<br />

2,775<br />

1,583<br />

(410)<br />

796<br />

(55)<br />

(572)<br />

2,292<br />

(495)<br />

1,797<br />

21,738<br />

12,669<br />

7,244<br />

-<br />

7,244<br />

6,106<br />

5.8<br />

6.8<br />

173<br />

53<br />

248,500<br />

Note: Except for the key figures derived from the consolidated financial statements on pages 40-101 of this report, the key figures above are not measures<br />

of financial performance under Danish GAAP or IFRS. <strong>ISS</strong> <strong>Global</strong> includes these financial measures because it believes that they are appropriate<br />

measures of <strong>ISS</strong> <strong>Global</strong>'s financial performance. Other companies, including those in <strong>ISS</strong> <strong>Global</strong>'s industry, may calculate similarly titled financial<br />

measures differently. The applied accounting policies are described in note 1.<br />

2)<br />

Adjusted EBITDA, as calculated by <strong>ISS</strong> <strong>Global</strong>, represents, under Danish GAAP, Operating profit before other income and expenses and associates plus<br />

Depreciation and amortisation or, under IFRS, Operating profit before other items plus Depreciation and amortisation. By using Operating profit before<br />

other income and expenses and associates under Danish GAAP, or operating profit before other items under IFRS, as a starting point for the calculation of<br />

adjusted EBITDA instead of Operating profit, <strong>ISS</strong> <strong>Global</strong> excludes from the calculation of adjusted EBITDA integration costs relating to acquisitions and<br />

those items recorded under other income and expenses, net, in which <strong>ISS</strong> <strong>Global</strong> includes income and expenses that it believes do not form part of <strong>ISS</strong><br />

<strong>Global</strong>'s normal ordinary operations, such as gains and losses arising from divestments, the winding up of operations, disposals of property, restructuring<br />

and certain acquisition related costs. Some of the items that <strong>ISS</strong> <strong>Global</strong> records under the line item other income and expenses, net, are recurring and<br />

some are non-recurring in nature.<br />

3)<br />

The difference in operating profit in 2004 under Danish GAAP and IFRS primarily relates to inclusion of integration costs under IFRS. The difference in<br />

net profit under Danish GAAP and IFRS primarily relates to reversal of goodwill amortisation, net of goodwill impairment and write-down, amortisation of<br />

customer contract portfolios and related customer relationships and inclusion of integration costs.<br />

4)<br />

Including minority interests.<br />

5)<br />

The presentation of interest paid has been changed and is now included in cash flow from financing activities instead of cash flow from operating<br />

activities. Comparative figures have been restated accordingly.<br />

6)<br />

In <strong>2006</strong>, cash conversion was adjusted for the gain of DKK 108 million on the sale of a call option on property. In 2005, cash conversion was adjusted for<br />

the gain of DKK 237 million on the sale of <strong>ISS</strong> Health Care.<br />

7)<br />

Information not available for 2002<br />

-<br />

-<br />

-<br />

-<br />

-<br />

3