Annual Report 2006 ISS Global A/S

Annual Report 2006 ISS Global A/S

Annual Report 2006 ISS Global A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

1 January – 31 December. Amounts in DKK millions<br />

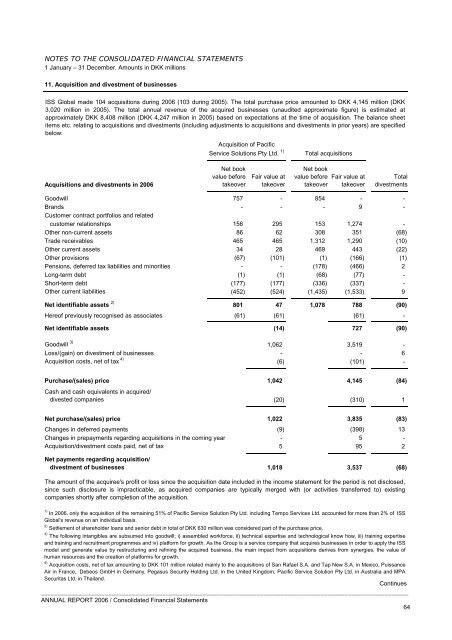

11. Acquisition and divestment of businesses<br />

<strong>ISS</strong> <strong>Global</strong> made 104 acquisitions during <strong>2006</strong> (103 during 2005). The total purchase price amounted to DKK 4,145 million (DKK<br />

3,020 million in 2005). The total annual revenue of the acquired businesses (unaudited approximate figure) is estimated at<br />

approximately DKK 8,408 million (DKK 4,247 million in 2005) based on expectations at the time of acquisition. The balance sheet<br />

items etc. relating to acquisitions and divestments (including adjustments to acquisitions and divestments in prior years) are specified<br />

below:<br />

Acquisitions and divestments in <strong>2006</strong><br />

Net book<br />

value before<br />

takeover<br />

Goodwill 757<br />

Brands<br />

Customer contract portfolios and related<br />

-<br />

customer relationships 156<br />

Other non-current assets 86<br />

Trade receivables 465<br />

Other current assets 34<br />

Other provisions (67)<br />

Pensions, deferred tax liabilities and minorities -<br />

Long-term debt (1)<br />

Short-term debt (177)<br />

Other current liabilities (452)<br />

Net identifiable assets 2)<br />

801<br />

Hereof previously recognised as associates (61)<br />

Fair value at<br />

takeover<br />

-<br />

-<br />

295<br />

62<br />

465<br />

28<br />

(101)<br />

-<br />

(1)<br />

(177)<br />

(524)<br />

Net identifiable assets (14)<br />

Goodwill 3)<br />

Acquisition of Pacific<br />

Service Solutions Pty Ltd. 1)<br />

Loss/(gain) on divestment of businesses<br />

1,062<br />

-<br />

Acquisition costs, net of tax 4)<br />

(6)<br />

Purchase/(sales) price<br />

Cash and cash equivalents in acquired/<br />

1,042<br />

divested companies (20)<br />

Net purchase/(sales) price 1,022<br />

Changes in deferred payments (9)<br />

Changes in prepayments regarding acquisitions in the coming year<br />

-<br />

Acquisition/divestment costs paid, net of tax 5<br />

Net payments regarding acquisition/<br />

divestment of businesses 1,018<br />

47<br />

(61)<br />

Total acquisitions<br />

Net book<br />

value before<br />

takeover<br />

854<br />

-<br />

153<br />

308<br />

1,312<br />

469<br />

(1)<br />

(178)<br />

(68)<br />

(336)<br />

(1,435)<br />

1,078<br />

Fair value at<br />

takeover<br />

-<br />

9<br />

1,274<br />

351<br />

1,290<br />

443<br />

(166)<br />

(466)<br />

(77)<br />

(337)<br />

(1,533)<br />

788<br />

(61)<br />

727<br />

3,519<br />

-<br />

(101)<br />

4,145<br />

(310)<br />

3,835<br />

(398)<br />

5<br />

95<br />

Total<br />

divestments<br />

The amount of the acquiree's profit or loss since the acquisition date included in the income statement for the period is not disclosed,<br />

since such disclosure is impracticable, as acquired companies are typically merged with (or activities transferred to) existing<br />

companies shortly after completion of the acquisition.<br />

1)<br />

In <strong>2006</strong>, only the acquisition of the remaining 51% of Pacific Service Solution Pty Ltd. including Tempo Services Ltd. accounted for more than 2% of <strong>ISS</strong><br />

<strong>Global</strong>'s revenue on an individual basis.<br />

2)<br />

Settlement of shareholder loans and senior debt in total of DKK 630 million was considered part of the purchase price.<br />

3)<br />

The following intangibles are subsumed into goodwill; i) assembled workforce, ii) technical expertise and technological know how, iii) training expertise<br />

and training and recruitment programmes and iv) platform for growth. As the Group is a service company that acquires businesses in order to apply the <strong>ISS</strong><br />

model and generate value by restructuring and refining the acquired business, the main impact from acquisitions derives from synergies, the value of<br />

human resources and the creation of platforms for growth.<br />

4)<br />

Acquisition costs, net of tax amounting to DKK 101 million related mainly to the acquisitions of San Rafael S.A. and Tap New S.A. in Mexico, Puissance<br />

Air in France, Debeos GmbH in Germany, Pegasus Security Holding Ltd. in the United Kingdom, Pacific Service Solution Pty Ltd. in Australia and MPA<br />

Securitas Ltd. in Thailand.<br />

Continues<br />

_____________________________________________________________________________________________________________<br />

ANNUAL REPORT <strong>2006</strong> / Consolidated Financial Statements<br />

64<br />

3,537<br />

-<br />

-<br />

-<br />

(68)<br />

(10)<br />

(22)<br />

(1)<br />

2<br />

-<br />

-<br />

9<br />

(90)<br />

-<br />

(90)<br />

-<br />

6<br />

-<br />

(84)<br />

1<br />

(83)<br />

13<br />

-<br />

2<br />

(68)