Annual Report 2006 ISS Global A/S

Annual Report 2006 ISS Global A/S

Annual Report 2006 ISS Global A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

1 January – 31 December. Amounts in DKK millions<br />

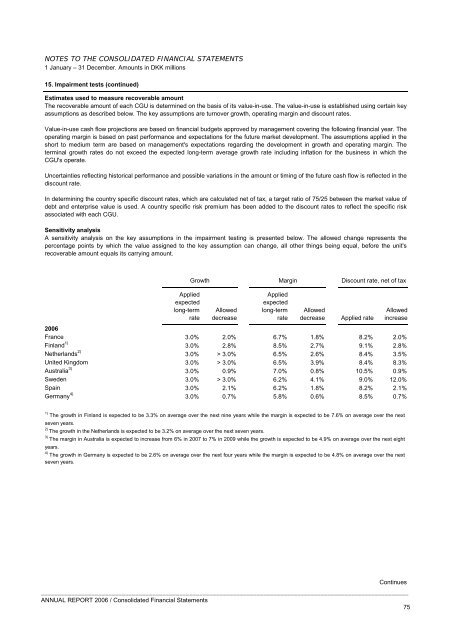

15. Impairment tests (continued)<br />

Estimates used to measure recoverable amount<br />

The recoverable amount of each CGU is determined on the basis of its value-in-use. The value-in-use is established using certain key<br />

assumptions as described below. The key assumptions are turnover growth, operating margin and discount rates.<br />

Value-in-use cash flow projections are based on financial budgets approved by management covering the following financial year. The<br />

operating margin is based on past performance and expectations for the future market development. The assumptions applied in the<br />

short to medium term are based on management's expectations regarding the development in growth and operating margin. The<br />

terminal growth rates do not exceed the expected long-term average growth rate including inflation for the business in which the<br />

CGU's operate.<br />

Uncertainties reflecting historical performance and possible variations in the amount or timing of the future cash flow is reflected in the<br />

discount rate.<br />

In determining the country specific discount rates, which are calculated net of tax, a target ratio of 75/25 between the market value of<br />

debt and enterprise value is used. A country specific risk premium has been added to the discount rates to reflect the specific risk<br />

associated with each CGU.<br />

Sensitivity analysis<br />

A sensitivity analysis on the key assumptions in the impairment testing is presented below. The allowed change represents the<br />

percentage points by which the value assigned to the key assumption can change, all other things being equal, before the unit's<br />

recoverable amount equals its carrying amount.<br />

Growth<br />

Applied<br />

expected<br />

long-term<br />

rate<br />

Allowed<br />

decrease<br />

Applied<br />

expected<br />

long-term<br />

rate<br />

Discount rate, net of tax<br />

Allowed<br />

decrease Applied rate<br />

Allowed<br />

increase<br />

<strong>2006</strong><br />

France 3.0% 2.0% 6.7% 1.8% 8.2% 2.0%<br />

Finland 1)<br />

3.0% 2.8% 8.5% 2.7% 9.1% 2.8%<br />

Netherlands 2)<br />

3.0% > 3.0% 6.5% 2.6% 8.4% 3.5%<br />

United Kingdom 3.0% > 3.0% 6.5% 3.9% 8.4% 8.3%<br />

Australia 3)<br />

3.0% 0.9% 7.0% 0.8% 10.5% 0.9%<br />

Sweden 3.0% > 3.0% 6.2% 4.1% 9.0% 12.0%<br />

Spain 3.0% 2.1% 6.2% 1.8% 8.2% 2.1%<br />

Germany 4)<br />

3.0% 0.7% 5.8% 0.6% 8.5% 0.7%<br />

Continues<br />

_____________________________________________________________________________________________________________<br />

ANNUAL REPORT <strong>2006</strong> / Consolidated Financial Statements<br />

75<br />

Margin<br />

1)<br />

The growth in Finland is expected to be 3.3% on average over the next nine years while the margin is expected to be 7.6% on average over the next<br />

seven years.<br />

2)<br />

The growth in the Netherlands is expected to be 3.2% on average over the next seven years.<br />

3)<br />

The margin in Australia is expected to increase from 6% in 2007 to 7% in 2009 while the growth is expected to be 4.9% on average over the next eight<br />

years.<br />

4)<br />

The growth in Germany is expected to be 2.6% on average over the next four years while the margin is expected to be 4.8% on average over the next<br />

seven years.