ANNUAL REPORT 2011 - Kuehne + Nagel

ANNUAL REPORT 2011 - Kuehne + Nagel

ANNUAL REPORT 2011 - Kuehne + Nagel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

94<br />

Consolidated Financial Statements <strong>2011</strong> _ _ _ _ _ _ Other Notes<br />

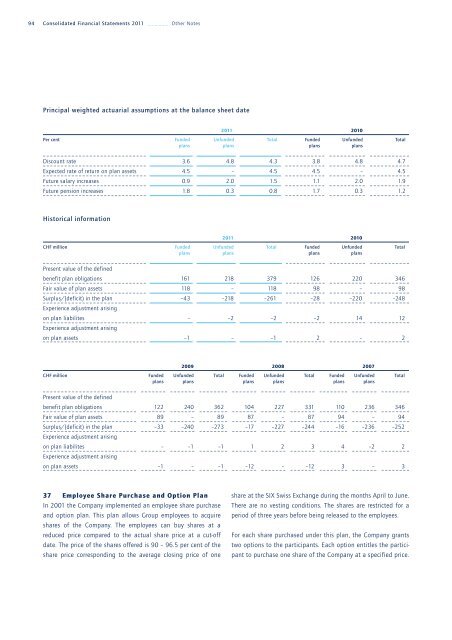

Principal weighted actuarial assumptions at the balance sheet date<br />

<strong>2011</strong> 2010<br />

Per cent Funded Unfunded Total Funded Unfunded Total<br />

plans plans plans plans<br />

Discount rate 3.6 4.8 4.3 3.8 4.8 4.7<br />

Expected rate of return on plan assets 4.5 – 4.5 4.5 – 4.5<br />

Future salary increases 0.9 2.0 1.5 1.1 2.0 1.9<br />

Future pension increases 1.8 0.3 0.8 1.7 0.3 1.2<br />

Historical information<br />

<strong>2011</strong> 2010<br />

CHF million Funded Unfunded Total Funded Unfunded Total<br />

plans plans plans plans<br />

Present value of the defined<br />

benefit plan obligations 161 218 379 126 220 346<br />

Fair value of plan assets 118 – 118 98 – 98<br />

Surplus/(deficit) in the plan<br />

Experience adjustment arising<br />

–43 –218 –261 –28 –220 –248<br />

on plan liabilites<br />

Experience adjustment arising<br />

– –2 –2 –2 14 12<br />

on plan assets –1 – –1 2 – 2<br />

2009 2008 2007<br />

CHF million Funded Unfunded Total Funded Unfunded Total Funded Unfunded Total<br />

plans plans plans plans plans plans<br />

Present value of the defined<br />

benefit plan obligations 122 240 362 104 227 331 110 236 346<br />

Fair value of plan assets 89 – 89 87 – 87 94 – 94<br />

Surplus/(deficit) in the plan<br />

Experience adjustment arising<br />

–33 –240 –273 –17 –227 –244 –16 –236 –252<br />

on plan liabilites<br />

Experience adjustment arising<br />

– –1 –1 1 2 3 4 –2 2<br />

on plan assets –1 – –1 –12 – –12 3 – 3<br />

37 Employee Share Purchase and Option Plan<br />

In 2001 the Company implemented an employee share purchase<br />

and option plan. This plan allows Group employees to acquire<br />

shares of the Company. The employees can buy shares at a<br />

reduced price compared to the actual share price at a cut-off<br />

date. The price of the shares offered is 90 – 96.5 per cent of the<br />

share price corresponding to the average closing price of one<br />

share at the SIX Swiss Exchange during the months April to June.<br />

There are no vesting conditions. The shares are restricted for a<br />

period of three years before being released to the employees.<br />

For each share purchased under this plan, the Company grants<br />

two options to the participants. Each option entitles the participant<br />

to purchase one share of the Company at a specified price.