ANNUAL REPORT 2011 - Kuehne + Nagel

ANNUAL REPORT 2011 - Kuehne + Nagel

ANNUAL REPORT 2011 - Kuehne + Nagel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

62<br />

Consolidated Financial Statements <strong>2011</strong> _ _ _ _ _ _ Accounting Policies<br />

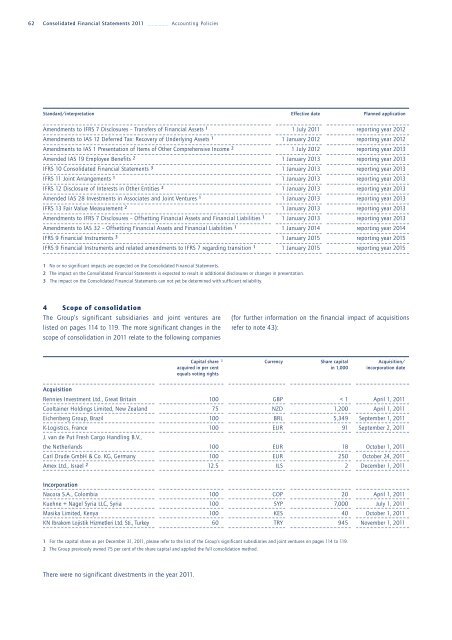

Standard/interpretation Effective date Planned application<br />

Amendments to IFRS 7 Disclosures – Transfers of Financial Assets 1 1 July <strong>2011</strong> reporting year 2012<br />

Amendments to IAS 12 Deferred Tax: Recovery of Underlying Assets 1 1 January 2012 reporting year 2012<br />

Amendments to IAS 1 Presentation of Items of Other Comprehensive Income 2 1 July 2012 reporting year 2013<br />

Amended IAS 19 Employee Benefits 2 1 January 2013 reporting year 2013<br />

IFRS 10 Consolidated Financial Statements 3 1 January 2013 reporting year 2013<br />

IFRS 11 Joint Arrangements 1 1 January 2013 reporting year 2013<br />

IFRS 12 Disclosure of Interests in Other Entities 2 1 January 2013 reporting year 2013<br />

Amended IAS 28 Investments in Associates and Joint Ventures 1 1 January 2013 reporting year 2013<br />

IFRS 13 Fair Value Measurement 2 1 January 2013 reporting year 2013<br />

Amendments to IFRS 7 Disclosures – Offsetting Financial Assets and Financial Liabilities 1 1 January 2013 reporting year 2013<br />

Amendments to IAS 32 – Offsetting Financial Assets and Financial Liabilities 1 1 January 2014 reporting year 2014<br />

IFRS 9 Financial Instruments 3 1 January 2015 reporting year 2015<br />

IFRS 9 Financial Instruments and related amendments to IFRS 7 regarding transition 1 1 January 2015 reporting year 2015<br />

1 No or no significant impacts are expected on the Consolidated Financial Statements.<br />

2 The impact on the Consolidated Financial Statements is expected to result in additional disclosures or changes in presentation.<br />

3 The impact on the Consolidated Financial Statements can not yet be determined with sufficient reliability.<br />

4 Scope of consolidation<br />

The Group’s significant subsidiaries and joint ventures are<br />

listed on pages 114 to 119. The more significant changes in the<br />

scope of consolidation in <strong>2011</strong> relate to the following companies<br />

There were no significant divestments in the year <strong>2011</strong>.<br />

(for further information on the financial impact of acquisitions<br />

refer to note 43):<br />

Capital share 1 Currency Share capital Acquisition/<br />

acquired in per cent in 1,000 incorporation date<br />

equals voting rights<br />

Acquisition<br />

Rennies Investment Ltd., Great Britain 100 GBP < 1 April 1, <strong>2011</strong><br />

Cooltainer Holdings Limited, New Zealand 75 NZD 1,200 April 1, <strong>2011</strong><br />

Eichenberg Group, Brazil 100 BRL 5,349 September 1, <strong>2011</strong><br />

K-Logistics, France<br />

J. van de Put Fresh Cargo Handling B.V.,<br />

100 EUR 91 September 2, <strong>2011</strong><br />

the Netherlands 100 EUR 18 October 1, <strong>2011</strong><br />

Carl Drude GmbH & Co. KG, Germany 100 EUR 250 October 24, <strong>2011</strong><br />

Amex Ltd., Israel 2 12.5 ILS 2 December 1, <strong>2011</strong><br />

Incorporation<br />

Nacora S.A., Colombia 100 COP 20 April 1, <strong>2011</strong><br />

<strong>Kuehne</strong> + <strong>Nagel</strong> Syria LLC, Syria 100 SYP 7,000 July 1, <strong>2011</strong><br />

Masika Limited, Kenya 100 KES 40 October 1, <strong>2011</strong><br />

KN Ibrakom Lojistik Hizmetleri Ltd. Sti., Turkey 60 TRY 945 November 1, <strong>2011</strong><br />

1 For the capital share as per December 31, <strong>2011</strong>, please refer to the list of the Group’s significant subsidiaries and joint ventures on pages 114 to 119.<br />

2 The Group previously owned 75 per cent of the share capital and applied the full consolidation method.