ANNUAL REPORT 2011 - Kuehne + Nagel

ANNUAL REPORT 2011 - Kuehne + Nagel

ANNUAL REPORT 2011 - Kuehne + Nagel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

All loans and bank overdrafts are held in the respective Group<br />

companies’ own functional currencies, which mainly is in EUR<br />

60.6 per cent (2010: 67.6 per cent), GBP 28.6 per cent (2010:<br />

None) and USD 7 per cent (2010: 25.4 per cent) on terms of<br />

the prevailing market conditions. The majority of bank overdraft<br />

facilities are repayable upon notice or within one year of<br />

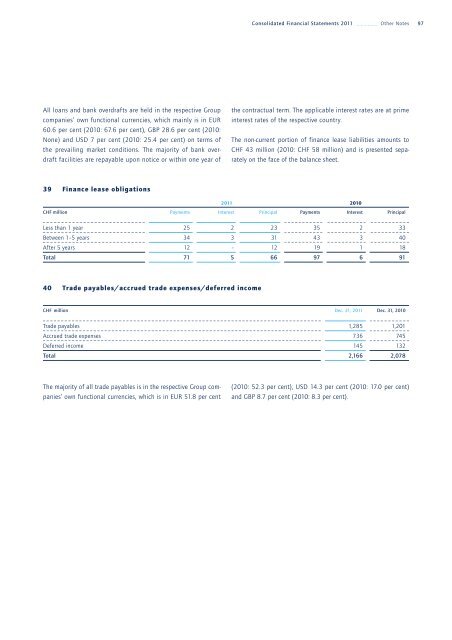

39 Finance lease obligations<br />

Consolidated Financial Statements <strong>2011</strong> _ _ _ _ _ _ Other Notes<br />

<strong>2011</strong> 2010<br />

CHF million Payments Interest Principal Payments Interest Principal<br />

Less than 1 year 25 2 23 35 2 33<br />

Between 1–5 years 34 3 31 43 3 40<br />

After 5 years 12 – 12 19 1 18<br />

Total 71 5 66 97 6 91<br />

40 Trade payables/accrued trade expenses/deferred income<br />

the contractual term. The applicable interest rates are at prime<br />

interest rates of the respective country.<br />

The non-current portion of finance lease liabilities amounts to<br />

CHF 43 million (2010: CHF 58 million) and is presented separately<br />

on the face of the balance sheet.<br />

CHF million Dec. 31, <strong>2011</strong> Dec. 31, 2010<br />

Trade payables 1,285 1,201<br />

Accrued trade expenses 736 745<br />

Deferred income 145 132<br />

Total 2,166 2,078<br />

The majority of all trade payables is in the respective Group companies’<br />

own functional currencies, which is in EUR 51.8 per cent<br />

(2010: 52.3 per cent), USD 14.3 per cent (2010: 17.0 per cent)<br />

and GBP 8.7 per cent (2010: 8.3 per cent).<br />

97