MARCH 2008

cn0308_0172

cn0308_0172

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Bank of<br />

Michigan:<br />

Working for<br />

Business<br />

Times are tough in Michigan, but<br />

don’t tell that to the folks at the<br />

Bank of Michigan in Farmington<br />

Hills. While many financial institutions<br />

are struggling, the Bank of Michigan<br />

was named the fastest-growing bank<br />

in Southeast Michigan by Crain’s<br />

Detroit Business in June 2007.<br />

“We’ve doubled our growth in each of<br />

our three years,” said President<br />

Michael G. Sarafa. “I attribute that to<br />

the fact that a growing number of people<br />

are comfortable banking with us.<br />

We’ve become a destination of<br />

choice.”<br />

Bank of Michigan’s Commercial<br />

Loan Department is especially thriving.<br />

Loan specialists embrace the<br />

mission of making available a variety<br />

of loan products specifically designed<br />

for business, be it business financing,<br />

working capital, capital expenditures<br />

or real estate loans.<br />

As a preferred Small Business<br />

Administration (SBA) Lender, Bank of<br />

Michigan is uniquely positioned to<br />

help the entrepreneur. Benefits of<br />

Bank of Michigan’s SBA loans<br />

include longer maturities than most<br />

bank loans; smaller down payments;<br />

longer terms; no balloon payments;<br />

no covenants; multiple interest rate<br />

options (floating, adjustable or fixed)<br />

and — perhaps most importantly —<br />

fast credit approval.<br />

“With an SBA loan, qualifying criteria<br />

are generally more flexible than<br />

conventional loans,” Sarafa noted.<br />

SBA programs offered at the Bank<br />

of Michigan include SBA 7(a), which<br />

provide funds for a variety of business<br />

services; SBA 504 for purchasing<br />

real estate or equipment, generally<br />

for projects of more than<br />

$500,000; and the Low Doc Program<br />

for loan requests under $150,000.<br />

Loans can be made as high as $2<br />

million and fixed rates are available<br />

for up to seven years — a schedule<br />

that offers great peace of mind in<br />

these uncertain economic times.<br />

For commercial real estate, the<br />

Bank of Michigan offers a fixed rate<br />

for an initial term of up to 60 months<br />

and amortization schedules of up to<br />

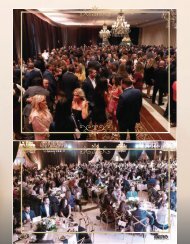

Pictured from left: Cindy Jensen (Commercial Lender), Tom Linden (Chief Credit Officer), Lydia Bahoura (Credit Analyst),<br />

Michael Sarafa (President) and Barry Boozan (Commercial Lender).<br />

25 years depending on property type.<br />

Of course, any bank is only as<br />

good as the people behind it. Sarafa<br />

is proud of his Commercial Lending<br />

team.<br />

Chief Credit Officer Tom Linden<br />

has a vast amount of experience in<br />

small business underwriting. “He is<br />

very prudent,” Sarafa said, “but also<br />

very creative.”<br />

Commercial Lender Cindy Jensen,<br />

who joined Bank of Michigan after<br />

more than 30 years experience at<br />

Michigan National Bank and its various<br />

successors, “is probably the<br />

most experienced small business<br />

lender in the entire state,” Sarafa<br />

said.<br />

Barry Boozan, also a Commercial<br />

Lender, has created a niche specialty<br />

working with healthcare providers as<br />

well as other professional services.<br />

“Barry has a substantial credit background<br />

and a strong focus on customer<br />

service and going the extra<br />

mile to get a deal done,” Sarafa said.<br />

Credit Analyst Lydia Bahoura<br />

helps prepare the loan packages and<br />

financial spreadsheets and keep the<br />

files updated. “She is the gatekeeper<br />

for the loan department,” Sarafa<br />

added.<br />

The team is led by Sarafa.<br />

“Mike has been a great asset to<br />

the bank since he moved from vice<br />

chairman of the board to President<br />

and CEO at the beginning of 2006,”<br />

said Michael George, chairman of the<br />

Chaldean Federation of America and<br />

an advisor to the bank. “Mike is<br />

always out and about at community<br />

events, he understands financing and<br />

has a good sense of judgment,” he<br />

continued.<br />

Indeed, Sarafa is deeply ingrained<br />

in the Chaldean community, having<br />

just completed two terms as president<br />

of the Chaldean Iraqi American<br />

Association of Michigan (CIAAM),<br />

where he still serves as a board<br />

member.<br />

Attorney Burt Kassab, vice chairman<br />

of the Bank of Michigan board,<br />

said Sarafa’s former work as executive<br />

director of the Associated Food<br />

and Petroleum Dealers puts him<br />

squarely in the corner of small businesses.<br />

“Mike has a deep understanding<br />

and awareness of the needs of small<br />

business owners,” Kassab said. “The<br />

bank has done well under his leadership.”<br />

The Bank of Michigan offers all the<br />

benefits of a small institution —<br />

backed with the security of the considerable<br />

assets of Capitol Bancorp<br />

Limited, a $5-billion publicly traded<br />

corporation. Although technically a<br />

bank holding company, Capitol<br />

Bancorp considers itself in the bank<br />

development business because it is<br />

an active, proactive and dynamic partner<br />

with the banks.<br />

Besides Michigan, Capitol<br />

Bancorp’s affiliate banks are located<br />

in 16 states, including California,<br />

Texas and New York. Plans are<br />

underway to expand into additional<br />

markets.<br />

“It’s the perfect combination,”<br />

Sarafa says. “We’re a small, community<br />

bank where everyone knows your<br />

name and is dedicated to helping<br />

your business succeed with the<br />

utmost of professionalism and confidentiality.<br />

Capitol Bancorp gives us<br />

the financial muscle and stability that<br />

is crucial in today’s economy.”<br />

Times may be tough, but the<br />

Commercial Lending Department at<br />

the Bank of Michigan is ready to help.<br />

“We are poised to continue to<br />

make good loans to qualified borrowers,”<br />

Sarafa said. “When the dust<br />

settles from this housing bust and<br />

general economic downturn, the<br />

Bank of Michigan will not only be<br />

standing but thriving as well.”<br />

Bank of Michigan<br />

30095 Northwestern Highway<br />

Farmington Hills, MI<br />

(248) 865-1300<br />

www.bankofmi.com<br />

BE PREPARED<br />

Seeking a business loan? Bring<br />

along the following information to<br />

ease the process and see quick<br />

results:<br />

• Personal and business tax returns<br />

for the past two to three years<br />

• Updated and signed personal<br />

financial statements<br />

• Business plans and projections<br />

• For real estate loans, appraisals,<br />

environmental reports, surveys, title<br />

work and legal descriptions<br />

ADVERTISEMENT<br />

<strong>MARCH</strong> <strong>2008</strong> CHALDEAN NEWS 51