Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

REGIONAL OVERVIEW<br />

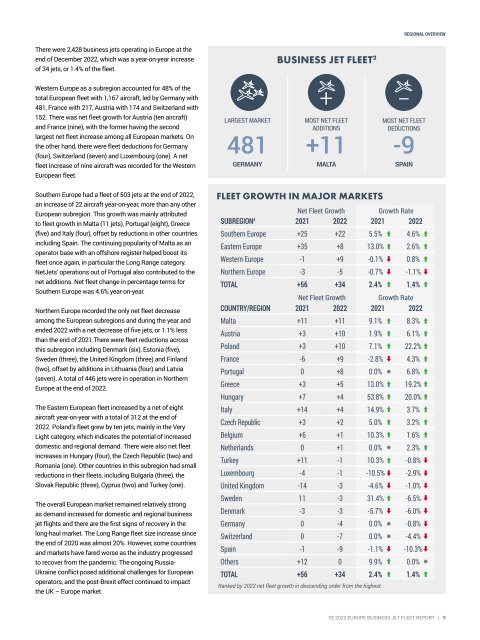

There were 2,428 business jets operating in <strong>Europe</strong> at the<br />

end of December <strong>2022</strong>, which was a year-on-year increase<br />

of 34 jets, or 1.4% of the fleet.<br />

BUSINESS JET FLEET 2<br />

Western <strong>Europe</strong> as a subregion accounted for 48% of the<br />

total <strong>Europe</strong>an fleet with 1,167 aircraft, led by Germany with<br />

481, France with 217, Austria with 174 and Switzerland with<br />

152. There was net fleet growth for Austria (ten aircraft)<br />

and France (nine), with the former having the second<br />

largest net fleet increase among all <strong>Europe</strong>an markets. On<br />

the other hand, there were fleet deductions for Germany<br />

(four), Switzerland (seven) and Luxembourg (one). A net<br />

fleet increase of nine aircraft was recorded for the Western<br />

<strong>Europe</strong>an fleet.<br />

LARGEST MARKET<br />

481<br />

GERMANY<br />

MOST NET FLEET<br />

ADDITIONS<br />

+11<br />

MALTA<br />

MOST NET FLEET<br />

DEDUCTIONS<br />

-9<br />

SPAIN<br />

Southern <strong>Europe</strong> had a fleet of 503 jets at the end of <strong>2022</strong>,<br />

an increase of 22 aircraft year-on-year, more than any other<br />

<strong>Europe</strong>an subregion. This growth was mainly attributed<br />

to fleet growth in Malta (11 jets), Portugal (eight), Greece<br />

(five) and Italy (four), offset by reductions in other countries<br />

including Spain. The continuing popularity of Malta as an<br />

operator base with an offshore register helped boost its<br />

fleet once again, in particular the Long Range category.<br />

NetJets’ operations out of Portugal also contributed to the<br />

net additions. Net fleet change in percentage terms for<br />

Southern <strong>Europe</strong> was 4.6% year-on-year.<br />

Northern <strong>Europe</strong> recorded the only net fleet decrease<br />

among the <strong>Europe</strong>an subregions and during the year and<br />

ended <strong>2022</strong> with a net decrease of five jets, or 1.1% less<br />

than the end of 2021.There were fleet reductions across<br />

this subregion including Denmark (six), Estonia (five),<br />

Sweden (three), the United Kingdom (three) and Finland<br />

(two), offset by additions in Lithuania (four) and Latvia<br />

(seven). A total of 446 jets were in operation in Northern<br />

<strong>Europe</strong> at the end of <strong>2022</strong>.<br />

The Eastern <strong>Europe</strong>an fleet increased by a net of eight<br />

aircraft year-on-year with a total of 312 at the end of<br />

<strong>2022</strong>. Poland’s fleet grew by ten jets, mainly in the Very<br />

Light category, which indicates the potential of increased<br />

domestic and regional demand. There were also net fleet<br />

increases in Hungary (four), the Czech Republic (two) and<br />

Romania (one). Other countries in this subregion had small<br />

reductions in their fleets, including Bulgaria (three), the<br />

Slovak Republic (three), Cyprus (two) and Turkey (one).<br />

The overall <strong>Europe</strong>an market remained relatively strong<br />

as demand increased for domestic and regional business<br />

jet flights and there are the first signs of recovery in the<br />

long-haul market. The Long Range fleet size increase since<br />

the end of 2020 was almost 20%. However, some countries<br />

and markets have fared worse as the industry progressed<br />

to recover from the pandemic. The ongoing Russia-<br />

Ukraine conflict posed additional challenges for <strong>Europe</strong>an<br />

operators, and the post-Brexit effect continued to impact<br />

the UK – <strong>Europe</strong> market.<br />

FLEET GROWTH IN MAJOR MARKETS<br />

Net <strong>Fleet</strong> Growth<br />

Growth Rate<br />

SUBREGION 4 2021 <strong>2022</strong> 2021 <strong>2022</strong><br />

Southern <strong>Europe</strong> +25 +22 5.5% 4.6%<br />

Eastern <strong>Europe</strong> +35 +8 13.0% 2.6%<br />

Western <strong>Europe</strong> -1 +9 -0.1% 0.8%<br />

Northern <strong>Europe</strong> -3 -5 -0.7% -1.1%<br />

TOTAL +56 +34 2.4% 1.4%<br />

Net <strong>Fleet</strong> Growth<br />

Growth Rate<br />

COUNTRY/REGION 2021 <strong>2022</strong> 2021 <strong>2022</strong><br />

Malta +11 +11 9.1% 8.3%<br />

Austria +3 +10 1.9% 6.1%<br />

Poland +3 +10 7.1% 22.2%<br />

France -6 +9 -2.8% 4.3%<br />

Portugal 0 +8 0.0% 6.8%<br />

Greece +3 +5 13.0% 19.2%<br />

Hungary +7 +4 53.8% 20.0%<br />

Italy +14 +4 14.9% 3.7%<br />

Czech Republic +3 +2 5.0% 3.2%<br />

Belgium +6 +1 10.3% 1.6%<br />

Netherlands 0 +1 0.0% 2.3%<br />

Turkey +11 -1 10.3% -0.8%<br />

Luxembourg -4 -1 -10.5% -2.9%<br />

United Kingdom -14 -3 -4.6% -1.0%<br />

Sweden 11 -3 31.4% -6.5%<br />

Denmark -3 -3 -5.7% -6.0%<br />

Germany 0 -4 0.0% -0.8%<br />

Switzerland 0 -7 0.0% -4.4%<br />

Spain -1 -9 -1.1% -10.3%<br />

Others +12 0 9.9% 0.0%<br />

TOTAL +56 +34 2.4% 1.4%<br />

Ranked by <strong>2022</strong> net fleet growth in descending order from the highest.<br />

<strong>YE</strong> <strong>2022</strong> EUROPE BUSINESS JET FLEET REPORT | 9