Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

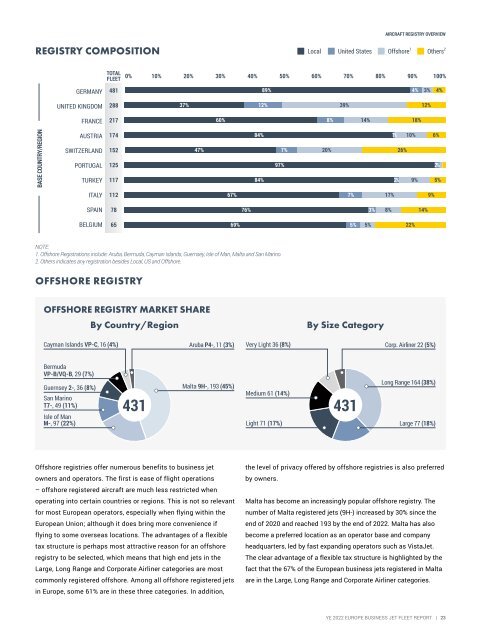

AIRCRAFT REGISTRY OVERVIEW<br />

REGISTRY COMPOSITION<br />

Local United States Offshore 1<br />

Others 2<br />

TOTAL<br />

FLEET<br />

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

GERMANY<br />

481<br />

89% 4%<br />

3%<br />

4%<br />

UNITED KINGDOM<br />

288<br />

37%<br />

12% 39%<br />

12%<br />

FRANCE<br />

217<br />

60%<br />

8% 14% 18%<br />

BASE COUNTRY/REGION<br />

AUSTRIA<br />

SWITZERLAND<br />

PORTUGAL<br />

TURKEY<br />

174<br />

152<br />

125<br />

117<br />

47%<br />

84%<br />

84%<br />

7%<br />

97%<br />

20%<br />

1% 10%<br />

26%<br />

2% 9%<br />

6%<br />

2%<br />

5%<br />

ITALY<br />

112<br />

67%<br />

7%<br />

17%<br />

9%<br />

SPAIN<br />

78<br />

76%<br />

3%<br />

8%<br />

14%<br />

BELGIUM<br />

65<br />

69% 5% 5%<br />

22%<br />

NOTE:<br />

1. Offshore Registrations include: Aruba, Bermuda, Cayman Islands, Guernsey, Isle of Man, Malta and San Marino.<br />

2. Others indicates any registration besides Local, US and Offshore.<br />

OFFSHORE REGISTRY<br />

OFFSHORE REGISTRY MARKET SHARE<br />

By Country/Region<br />

By Size Category<br />

Cayman Islands VP-C, 16 (4%)<br />

Aruba P4-, 11 (3%)<br />

Very Light 36 (8%)<br />

Corp. Airliner 22 (5%)<br />

Bermuda<br />

VP-B/VQ-B, 29 (7%)<br />

Guernsey 2-, 36 (8%)<br />

San Marino<br />

T7-, 49 (11%)<br />

Isle of Man<br />

M-, 97 (22%)<br />

431<br />

Malta 9H-, 193 (45%)<br />

Medium 61 (14%)<br />

Light 71 (17%)<br />

431<br />

Long Range 164 (38%)<br />

Large 77 (18%)<br />

Offshore registries offer numerous benefits to business jet<br />

owners and operators. The first is ease of flight operations<br />

– offshore registered aircraft are much less restricted when<br />

operating into certain countries or regions. This is not so relevant<br />

for most <strong>Europe</strong>an operators, especially when flying within the<br />

<strong>Europe</strong>an Union; although it does bring more convenience if<br />

flying to some overseas locations. The advantages of a flexible<br />

tax structure is perhaps most attractive reason for an offshore<br />

registry to be selected, which means that high end jets in the<br />

Large, Long Range and Corporate Airliner categories are most<br />

commonly registered offshore. Among all offshore registered jets<br />

in <strong>Europe</strong>, some 61% are in these three categories. In addition,<br />

the level of privacy offered by offshore registries is also preferred<br />

by owners.<br />

Malta has become an increasingly popular offshore registry. The<br />

number of Malta registered jets (9H-) increased by 30% since the<br />

end of 2020 and reached 193 by the end of <strong>2022</strong>. Malta has also<br />

become a preferred location as an operator base and company<br />

headquarters, led by fast expanding operators such as VistaJet.<br />

The clear advantage of a flexible tax structure is highlighted by the<br />

fact that the 67% of the <strong>Europe</strong>an business jets registered in Malta<br />

are in the Large, Long Range and Corporate Airliner categories.<br />

<strong>YE</strong> <strong>2022</strong> EUROPE BUSINESS JET FLEET REPORT | 23