Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MARKET TRENDS<br />

MARKET TRENDS<br />

BUSINESS JET ADDITIONS & DEDUCTIONS<br />

MOVEMENTS<br />

<strong>2022</strong><br />

3,000<br />

2,500<br />

2,394 93<br />

210 -269<br />

2,428<br />

269<br />

2,000<br />

210<br />

1,500<br />

1,000<br />

93<br />

138<br />

500<br />

0<br />

<strong>Fleet</strong><br />

2021<br />

New<br />

Deliveries<br />

Pre-Owned<br />

Additions<br />

Deductions<br />

<strong>Fleet</strong><br />

<strong>2022</strong><br />

New Deliveries<br />

Pre-owned<br />

Additions<br />

Deductions<br />

Intra-<strong>Europe</strong><br />

Movements<br />

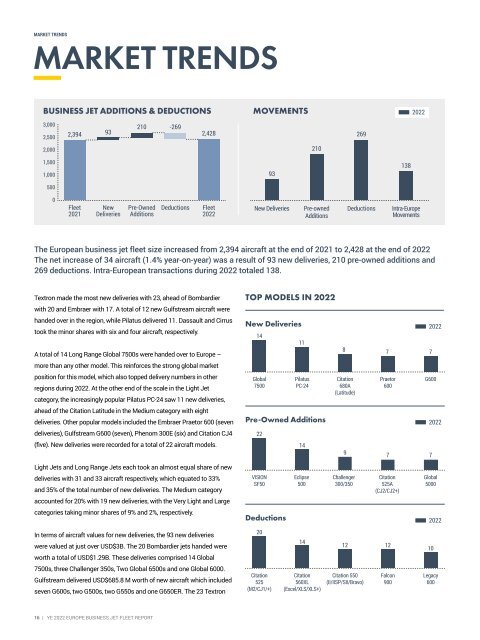

The <strong>Europe</strong>an business jet fleet size increased from 2,394 aircraft at the end of 2021 to 2,428 at the end of <strong>2022</strong><br />

The net increase of 34 aircraft (1.4% year-on-year) was a result of 93 new deliveries, 210 pre-owned additions and<br />

269 deductions. Intra-<strong>Europe</strong>an transactions during <strong>2022</strong> totaled 138.<br />

Textron made the most new deliveries with 23, ahead of Bombardier<br />

with 20 and Embraer with 17. A total of 12 new Gulfstream aircraft were<br />

handed over in the region, while Pilatus delivered 11. Dassault and Cirrus<br />

took the minor shares with six and four aircraft, respectively.<br />

A total of 14 Long Range Global 7500s were handed over to <strong>Europe</strong> –<br />

more than any other model. This reinforces the strong global market<br />

position for this model, which also topped delivery numbers in other<br />

regions during <strong>2022</strong>. At the other end of the scale in the Light Jet<br />

category, the increasingly popular Pilatus PC-24 saw 11 new deliveries,<br />

ahead of the Citation Latitude in the Medium category with eight<br />

deliveries. Other popular models included the Embraer Praetor 600 (seven<br />

deliveries), Gulfstream G600 (seven), Phenom 300E (six) and Citation CJ4<br />

(five). New deliveries were recorded for a total of 22 aircraft models.<br />

TOP MODELS IN <strong>2022</strong><br />

New Deliveries<br />

14<br />

Global<br />

7500<br />

11<br />

Pilatus<br />

PC-24<br />

Pre-Owned Additions<br />

22<br />

14<br />

8<br />

Citation<br />

680A<br />

(Latitude)<br />

7<br />

Praetor<br />

600<br />

<strong>2022</strong><br />

7<br />

G600<br />

9 7 7<br />

<strong>2022</strong><br />

Light Jets and Long Range Jets each took an almost equal share of new<br />

deliveries with 31 and 33 aircraft respectively, which equated to 33%<br />

and 35% of the total number of new deliveries. The Medium category<br />

accounted for 20% with 19 new deliveries, with the Very Light and Large<br />

categories taking minor shares of 9% and 2%, respectively.<br />

In terms of aircraft values for new deliveries, the 93 new deliveries<br />

were valued at just over USD$3B. The 20 Bombardier jets handed were<br />

worth a total of USD$1.29B. These deliveries comprised 14 Global<br />

7500s, three Challenger 350s, Two Global 6500s and one Global 6000.<br />

Gulfstream delivered USD$685.8 M worth of new aircraft which included<br />

seven G600s, two G500s, two G550s and one G650ER. The 23 Textron<br />

VISION<br />

SF50<br />

Deductions<br />

20<br />

Citation<br />

525<br />

(M2/CJ1/+)<br />

Eclipse<br />

500<br />

14<br />

Citation<br />

560XL<br />

(Excel/XLS/XLS+)<br />

Challenger<br />

300/350<br />

Citation<br />

525A<br />

(CJ2/CJ2+)<br />

12 12<br />

Citation 550<br />

(II/IISP/SII/Bravo)<br />

Falcon<br />

900<br />

Global<br />

5000<br />

<strong>2022</strong><br />

10<br />

Legacy<br />

600<br />

16 | <strong>YE</strong> <strong>2022</strong> EUROPE BUSINESS JET FLEET REPORT