A Guide to Investing in Trinidad and Tobago (2011) - Ministry of ...

A Guide to Investing in Trinidad and Tobago (2011) - Ministry of ...

A Guide to Investing in Trinidad and Tobago (2011) - Ministry of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

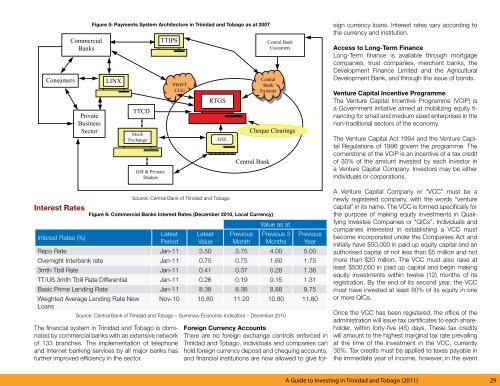

Interest Rates<br />

Figure 5: Payments System Architecture <strong>in</strong> Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong> as at 2007<br />

Source: Central Bank <strong>of</strong> Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong><br />

Figure 6: Commercial Banks Interest Rates (December 2010, Local Currency)<br />

Interest Rates (%)<br />

Latest<br />

Period<br />

Latest<br />

Value<br />

Previous<br />

Month<br />

Value as at<br />

Previous 3<br />

Months<br />

Previous<br />

Year<br />

Repo Rate Jan-11 3.50 3.75 4.00 5.00<br />

Overnight Interbank rate Jan-11 0.75 0.75 1.60 1.75<br />

3mth Tbill Rate Jan-11 0.41 0.37 0.28 1.36<br />

TT/US 3mth Tbill Rate Differential Jan-11 0.26 0.19 0.15 1.31<br />

Basic Prime Lend<strong>in</strong>g Rate Jan-11 8.38 8.38 8.88 9.75<br />

Weighted Average Lend<strong>in</strong>g Rate New<br />

Loans<br />

Nov-10 10.80 11.20 10.80 11.80<br />

Source: Central Bank <strong>of</strong> Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong> – Summary Economic Indica<strong>to</strong>rs – December 2010<br />

The f<strong>in</strong>ancial system <strong>in</strong> Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong> is dom<strong>in</strong>ated<br />

by commercial banks with an extensive network<br />

<strong>of</strong> 133 branches. The implementation <strong>of</strong> telephone<br />

<strong>and</strong> Internet bank<strong>in</strong>g services by all major banks has<br />

further improved efficiency <strong>in</strong> the sec<strong>to</strong>r.<br />

Foreign Currency Accounts<br />

There are no foreign exchange controls enforced <strong>in</strong><br />

Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong>. Individuals <strong>and</strong> companies can<br />

hold foreign currency deposit <strong>and</strong> chequ<strong>in</strong>g accounts,<br />

<strong>and</strong> f<strong>in</strong>ancial <strong>in</strong>stitutions are now allowed <strong>to</strong> give for-<br />

eign currency loans. Interest rates vary accord<strong>in</strong>g <strong>to</strong><br />

the currency <strong>and</strong> <strong>in</strong>stitution.<br />

Access <strong>to</strong> Long-Term F<strong>in</strong>ance<br />

Long-Term f<strong>in</strong>ance is available through mortgage<br />

companies, trust companies, merchant banks, the<br />

Development F<strong>in</strong>ance Limited <strong>and</strong> the Agricultural<br />

Development Bank, <strong>and</strong> through the issue <strong>of</strong> bonds.<br />

Venture Capital Incentive Programme<br />

The Venture Capital Incentive Programme (VCIP) is<br />

a Government <strong>in</strong>itiative aimed at mobiliz<strong>in</strong>g equity f<strong>in</strong>anc<strong>in</strong>g<br />

for small <strong>and</strong> medium sized enterprises <strong>in</strong> the<br />

non-traditional sec<strong>to</strong>rs <strong>of</strong> the economy.<br />

The Venture Capital Act 1994 <strong>and</strong> the Venture Capital<br />

Regulations <strong>of</strong> 1996 govern the programme. The<br />

corners<strong>to</strong>ne <strong>of</strong> the VCIP is an <strong>in</strong>centive <strong>of</strong> a tax credit<br />

<strong>of</strong> 30% <strong>of</strong> the amount <strong>in</strong>vested by each <strong>in</strong>ves<strong>to</strong>r <strong>in</strong><br />

a Venture Capital Company. Inves<strong>to</strong>rs may be either<br />

<strong>in</strong>dividuals or corporations.<br />

A Venture Capital Company or “VCC” must be a<br />

newly registered company, with the words “venture<br />

capital” <strong>in</strong> its name. The VCC is formed specifically for<br />

the purpose <strong>of</strong> mak<strong>in</strong>g equity <strong>in</strong>vestments <strong>in</strong> Qualify<strong>in</strong>g<br />

Investee Companies or “QICs”. Individuals <strong>and</strong><br />

companies <strong>in</strong>terested <strong>in</strong> establish<strong>in</strong>g a VCC must<br />

become <strong>in</strong>corporated under the Companies Act <strong>and</strong><br />

<strong>in</strong>itially have $50,000 <strong>in</strong> paid up equity capital <strong>and</strong> an<br />

authorised capital <strong>of</strong> not less than $5 million <strong>and</strong> not<br />

more than $20 million. The VCC must also raise at<br />

least $500,000 <strong>in</strong> paid up capital <strong>and</strong> beg<strong>in</strong> mak<strong>in</strong>g<br />

equity <strong>in</strong>vestments with<strong>in</strong> twelve (12) months <strong>of</strong> its<br />

registration. By the end <strong>of</strong> its second year, the VCC<br />

must have <strong>in</strong>vested at least 80% <strong>of</strong> its equity <strong>in</strong> one<br />

or more QICs.<br />

Once the VCC has been registered, the <strong>of</strong>fice <strong>of</strong> the<br />

adm<strong>in</strong>istration will issue tax certificates <strong>to</strong> each shareholder,<br />

with<strong>in</strong> forty-five (45) days. These tax credits<br />

will amount <strong>to</strong> the highest marg<strong>in</strong>al tax rate prevail<strong>in</strong>g<br />

at the time <strong>of</strong> the <strong>in</strong>vestment <strong>in</strong> the VCC, currently<br />

30%. Tax credits must be applied <strong>to</strong> taxes payable <strong>in</strong><br />

the immediate year <strong>of</strong> <strong>in</strong>come, however, <strong>in</strong> the event<br />

A <strong>Guide</strong> <strong>to</strong> <strong>Invest<strong>in</strong>g</strong> <strong>in</strong> Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong> (<strong>2011</strong>) 29