A Guide to Investing in Trinidad and Tobago (2011) - Ministry of ...

A Guide to Investing in Trinidad and Tobago (2011) - Ministry of ...

A Guide to Investing in Trinidad and Tobago (2011) - Ministry of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

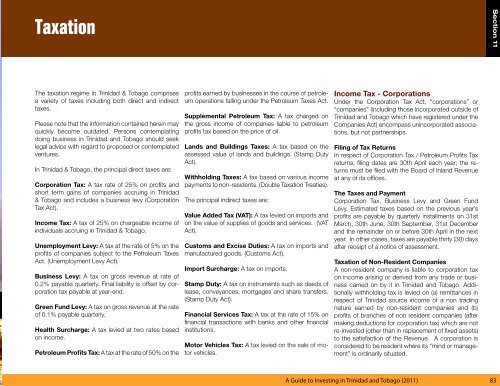

Taxation<br />

The taxation regime <strong>in</strong> Tr<strong>in</strong>idad & <strong>Tobago</strong> comprises<br />

a variety <strong>of</strong> taxes <strong>in</strong>clud<strong>in</strong>g both direct <strong>and</strong> <strong>in</strong>direct<br />

taxes.<br />

Please note that the <strong>in</strong>formation conta<strong>in</strong>ed here<strong>in</strong> may<br />

quickly become outdated. Persons contemplat<strong>in</strong>g<br />

do<strong>in</strong>g bus<strong>in</strong>ess <strong>in</strong> Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong> should seek<br />

legal advice with regard <strong>to</strong> proposed or contemplated<br />

ventures.<br />

In Tr<strong>in</strong>idad & <strong>Tobago</strong>, the pr<strong>in</strong>cipal direct taxes are:<br />

Corporation Tax: A tax rate <strong>of</strong> 25% on pr<strong>of</strong>its <strong>and</strong><br />

short term ga<strong>in</strong>s <strong>of</strong> companies accru<strong>in</strong>g <strong>in</strong> Tr<strong>in</strong>idad<br />

& <strong>Tobago</strong> <strong>and</strong> <strong>in</strong>cludes a bus<strong>in</strong>ess levy (Corporation<br />

Tax Act).<br />

Income Tax: A tax <strong>of</strong> 25% on chargeable <strong>in</strong>come <strong>of</strong><br />

<strong>in</strong>dividuals accru<strong>in</strong>g <strong>in</strong> Tr<strong>in</strong>idad & <strong>Tobago</strong>.<br />

Unemployment Levy: A tax at the rate <strong>of</strong> 5% on the<br />

pr<strong>of</strong>its <strong>of</strong> companies subject <strong>to</strong> the Petroleum Taxes<br />

Act. (Unemployment Levy Act).<br />

Bus<strong>in</strong>ess Levy: A tax on gross revenue at rate <strong>of</strong><br />

0.2% payable quarterly. F<strong>in</strong>al liability is <strong>of</strong>fset by corporation<br />

tax payable at year-end.<br />

Green Fund Levy: A tax on gross revenue at the rate<br />

<strong>of</strong> 0.1% payable quarterly.<br />

Health Surcharge: A tax levied at two rates based<br />

on <strong>in</strong>come.<br />

Petroleum Pr<strong>of</strong>its Tax: A tax at the rate <strong>of</strong> 50% on the<br />

pr<strong>of</strong>its earned by bus<strong>in</strong>esses <strong>in</strong> the course <strong>of</strong> petroleum<br />

operations fall<strong>in</strong>g under the Petroleum Taxes Act.<br />

Supplemental Petroleum Tax: A tax charged on<br />

the gross <strong>in</strong>come <strong>of</strong> companies liable <strong>to</strong> petroleum<br />

pr<strong>of</strong>its tax based on the price <strong>of</strong> oil.<br />

L<strong>and</strong>s <strong>and</strong> Build<strong>in</strong>gs Taxes: A tax based on the<br />

assessed value <strong>of</strong> l<strong>and</strong>s <strong>and</strong> build<strong>in</strong>gs. (Stamp Duty<br />

Act).<br />

Withhold<strong>in</strong>g Taxes: A tax based on various <strong>in</strong>come<br />

payments <strong>to</strong> non-residents. (Double Taxation Treaties).<br />

The pr<strong>in</strong>cipal <strong>in</strong>direct taxes are:<br />

Value Added Tax (VAT): A tax levied on imports <strong>and</strong><br />

on the value <strong>of</strong> supplies <strong>of</strong> goods <strong>and</strong> services. (VAT<br />

Act).<br />

Cus<strong>to</strong>ms <strong>and</strong> Excise Duties: A tax on imports <strong>and</strong><br />

manufactured goods. (Cus<strong>to</strong>ms Act).<br />

Import Surcharge: A tax on imports.<br />

Stamp Duty: A tax on <strong>in</strong>struments such as deeds <strong>of</strong><br />

lease, conveyances, mortgages <strong>and</strong> share transfers.<br />

(Stamp Duty Act).<br />

F<strong>in</strong>ancial Services Tax: A tax at the rate <strong>of</strong> 15% on<br />

f<strong>in</strong>ancial transactions with banks <strong>and</strong> other f<strong>in</strong>ancial<br />

<strong>in</strong>stitutions.<br />

Mo<strong>to</strong>r Vehicles Tax: A tax levied on the sale <strong>of</strong> mo<strong>to</strong>r<br />

vehicles.<br />

Income Tax - Corporations<br />

Under the Corporation Tax Act, “corporations” or<br />

“companies” (<strong>in</strong>clud<strong>in</strong>g those <strong>in</strong>corporated outside <strong>of</strong><br />

Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong> which have registered under the<br />

Companies Act) encompass un<strong>in</strong>corporated associations,<br />

but not partnerships.<br />

Fil<strong>in</strong>g <strong>of</strong> Tax Returns<br />

In respect <strong>of</strong> Corporation Tax / Petroleum Pr<strong>of</strong>its Tax<br />

returns, fil<strong>in</strong>g dates are 30th April each year; the returns<br />

must be filed with the Board <strong>of</strong> Inl<strong>and</strong> Revenue<br />

at any <strong>of</strong> its <strong>of</strong>fices.<br />

The Taxes <strong>and</strong> Payment<br />

Corporation Tax, Bus<strong>in</strong>ess Levy <strong>and</strong> Green Fund<br />

Levy. Estimated taxes based on the previous year’s<br />

pr<strong>of</strong>its are payable by quarterly <strong>in</strong>stallments on 31st<br />

March, 30th June, 30th September, 31st December<br />

<strong>and</strong> the rema<strong>in</strong>der on or before 30th April <strong>in</strong> the next<br />

year. In other cases, taxes are payable thirty (30) days<br />

after receipt <strong>of</strong> a notice <strong>of</strong> assessment.<br />

Taxation <strong>of</strong> Non-Resident Companies<br />

A non-resident company is liable <strong>to</strong> corporation tax<br />

on <strong>in</strong>come aris<strong>in</strong>g or derived from any trade or bus<strong>in</strong>ess<br />

carried on by it <strong>in</strong> Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong>. Additionally<br />

withhold<strong>in</strong>g tax is levied on (a) remittances <strong>in</strong><br />

respect <strong>of</strong> Tr<strong>in</strong>idad source <strong>in</strong>come <strong>of</strong> a non trad<strong>in</strong>g<br />

nature earned by non-resident companies <strong>and</strong> (b)<br />

pr<strong>of</strong>its <strong>of</strong> branches <strong>of</strong> non resident companies (after<br />

mak<strong>in</strong>g deductions for corporation tax) which are not<br />

re-<strong>in</strong>vested (other than <strong>in</strong> replacement <strong>of</strong> fixed assets)<br />

<strong>to</strong> the satisfaction <strong>of</strong> the Revenue. A corporation is<br />

considered <strong>to</strong> be resident where its “m<strong>in</strong>d or management”<br />

is ord<strong>in</strong>arily situated.<br />

A <strong>Guide</strong> <strong>to</strong> <strong>Invest<strong>in</strong>g</strong> <strong>in</strong> Tr<strong>in</strong>idad <strong>and</strong> <strong>Tobago</strong> (<strong>2011</strong>) 83<br />

Section 11