Palatinose - Soft Drinks International

Palatinose - Soft Drinks International

Palatinose - Soft Drinks International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

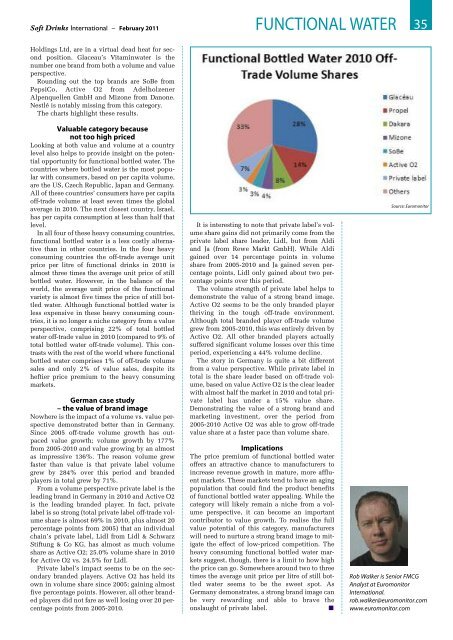

<strong>Soft</strong> <strong>Drinks</strong> <strong>International</strong> – February 2011<br />

Holdings Ltd, are in a virtual dead heat for second<br />

position. Glaceau’s Vitaminwater is the<br />

number one brand from both a volume and value<br />

perspective.<br />

Rounding out the top brands are SoBe from<br />

PepsiCo, Active O2 from Adelholzener<br />

Alpenquellen GmbH and Mizone from Danone.<br />

Nestlé is notably missing from this category.<br />

The charts highlight these results.<br />

Valuable category because<br />

not too high priced<br />

Looking at both value and volume at a country<br />

level also helps to provide insight on the potential<br />

opportunity for functional bottled water. The<br />

countries where bottled water is the most popular<br />

with consumers, based on per capita volume,<br />

are the US, Czech Republic, Japan and Germany.<br />

All of these countries’ consumers have per capita<br />

off-trade volume at least seven times the global<br />

average in 2010. The next closest country, Israel,<br />

has per capita consumption at less than half that<br />

level.<br />

In all four of these heavy consuming countries,<br />

functional bottled water is a less costly alternative<br />

than in other countries. In the four heavy<br />

consuming countries the off-trade average unit<br />

price per litre of functional drinks in 2010 is<br />

almost three times the average unit price of still<br />

bottled water. However, in the balance of the<br />

world, the average unit price of the functional<br />

variety is almost five times the price of still bottled<br />

water. Although functional bottled water is<br />

less expensive in these heavy consuming countries,<br />

it is no longer a niche category from a value<br />

perspective, comprising 22% of total bottled<br />

water off-trade value in 2010 (compared to 9% of<br />

total bottled water off-trade volume). This contrasts<br />

with the rest of the world where functional<br />

bottled water comprises 1% of off-trade volume<br />

sales and only 2% of value sales, despite its<br />

heftier price premium to the heavy consuming<br />

markets.<br />

German case study<br />

– the value of brand image<br />

Nowhere is the impact of a volume vs. value perspective<br />

demonstrated better than in Germany.<br />

Since 2005 off-trade volume growth has outpaced<br />

value growth; volume growth by 177%<br />

from 2005-2010 and value growing by an almost<br />

as impressive 136%. The reason volume grew<br />

faster than value is that private label volume<br />

grew by 284% over this period and branded<br />

players in total grew by 71%.<br />

From a volume perspective private label is the<br />

leading brand in Germany in 2010 and Active O2<br />

is the leading branded player. In fact, private<br />

label is so strong (total private label off-trade volume<br />

share is almost 69% in 2010, plus almost 20<br />

percentage points from 2005) that an individual<br />

chain’s private label, Lidl from Lidl & Schwarz<br />

Stiftung & Co KG, has almost as much volume<br />

share as Active O2; 25.0% volume share in 2010<br />

for Active O2 vs. 24.5% for Lidl.<br />

Private label’s impact seems to be on the secondary<br />

branded players. Active O2 has held its<br />

own in volume share since 2005; gaining almost<br />

five percentage points. However, all other branded<br />

players did not fare as well losing over 20 percentage<br />

points from 2005-2010.<br />

FUNCTIONAL WATER<br />

It is interesting to note that private label’s volume<br />

share gains did not primarily come from the<br />

private label share leader, Lidl, but from Aldi<br />

and Ja (from Rewe Markt GmbH). While Aldi<br />

gained over 14 percentage points in volume<br />

share from 2005-2010 and Ja gained seven percentage<br />

points, Lidl only gained about two percentage<br />

points over this period.<br />

The volume strength of private label helps to<br />

demonstrate the value of a strong brand image.<br />

Active O2 seems to be the only branded player<br />

thriving in the tough off-trade environment.<br />

Although total branded player off-trade volume<br />

grew from 2005-2010, this was entirely driven by<br />

Active O2. All other branded players actually<br />

suffered significant volume losses over this time<br />

period, experiencing a 44% volume decline.<br />

The story in Germany is quite a bit different<br />

from a value perspective. While private label in<br />

total is the share leader based on off-trade volume,<br />

based on value Active O2 is the clear leader<br />

with almost half the market in 2010 and total private<br />

label has under a 15% value share.<br />

Demonstrating the value of a strong brand and<br />

marketing investment, over the period from<br />

2005-2010 Active O2 was able to grow off-trade<br />

value share at a faster pace than volume share.<br />

Implications<br />

The price premium of functional bottled water<br />

offers an attractive chance to manufacturers to<br />

increase revenue growth in mature, more affluent<br />

markets. These markets tend to have an aging<br />

population that could find the product benefits<br />

of functional bottled water appealing. While the<br />

category will likely remain a niche from a volume<br />

perspective, it can become an important<br />

contributor to value growth. To realise the full<br />

value potential of this category, manufacturers<br />

will need to nurture a strong brand image to mitigate<br />

the effect of low-priced competition. The<br />

heavy consuming functional bottled water markets<br />

suggest, though, there is a limit to how high<br />

the price can go. Somewhere around two to three<br />

times the average unit price per litre of still bottled<br />

water seems to be the sweet spot. As<br />

Germany demonstrates, a strong brand image can<br />

be very rewarding and able to brave the<br />

onslaught of private label. ■<br />

35<br />

Source: Euromonitor<br />

Rob Walker is Senior FMCG<br />

Analyst at Euromonitor<br />

<strong>International</strong>.<br />

rob.walker@euromonitor.com<br />

www.euromonitor.com