FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2010<br />

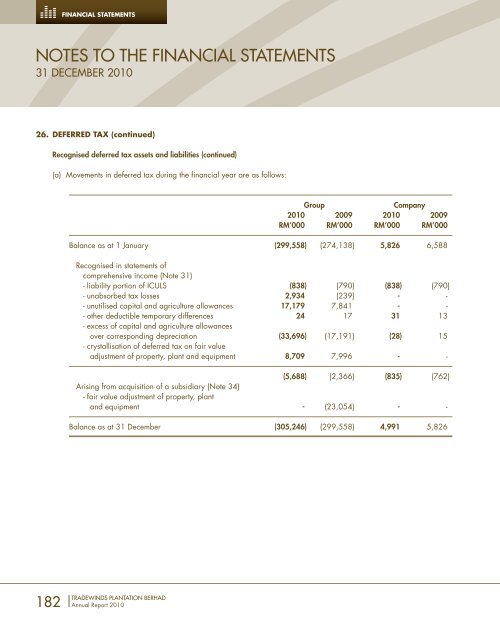

26. DEFERRED TAX (continued)<br />

182<br />

FINANCIAL STATEMENTS<br />

Recognised deferred tax assets and liabilities (continued)<br />

(a) Movements in deferred tax during the financial year are as follows:<br />

TRADEWINDS PLANTATION BERHAD<br />

Annual Report 2010<br />

Group Company<br />

2010 2009 2010 2009<br />

RM’000 RM’000 RM’000 RM’000<br />

Balance as at 1 January (299,558) (274,138) 5,826 6,588<br />

Recognised in statements of<br />

comprehensive income (Note 31)<br />

- liability portion of ICULS (838) (790) (838) (790)<br />

- unabsorbed tax losses 2,934 (239) - -<br />

- unutilised capital and agriculture allowances 17,179 7,841 - -<br />

- other deductible temporary differences 24 17 31 13<br />

- excess of capital and agriculture allowances<br />

over corresponding depreciation (33,696) (17,191) (28) 15<br />

- crystallisation of deferred tax on fair value<br />

adjustment of property, plant and equipment 8,709 7,996 - -<br />

(5,688) (2,366) (835) (762)<br />

Arising from acquisition of a subsidiary (Note 34)<br />

- fair value adjustment of property, plant<br />

and equipment - (23,054) - -<br />

Balance as at 31 December (305,246) (299,558) 4,991 5,826