FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

194<br />

FINANCIAL STATEMENTS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2010<br />

34. ACQUISITION OF SUBSIDIARIES (continued)<br />

2009<br />

(a) On 21 August 2009, the Company entered into a conditional Sale and Purchase Agreement with Gerak Mashyur<br />

(Malaysia) Sdn. Bhd. (‘GMSB’) for the acquisition of 700,000 ordinary shares of RM1 each, representing 70%<br />

equity interest of Northern Intergrated Agriculture Sdn. Bhd. (‘NIA’) for a total cash consideration of RM50,360,000.<br />

The purchase consideration was adjusted to RM49,315,000 upon the completion of assessment of the acquiree’s<br />

identifiable assets, liabilities, and contingent liabilities based on due diligence report.<br />

NIA is a property development company incorporated in Malaysia and was established as a joint venture vehicle<br />

between GMSB and Perbadanan Kemajuan Negeri Kedah to undertake the development of the second border town<br />

between Malaysia and Thailand known as ‘Bandar Sempadan Kota Putra’.<br />

NIA owns five (5) parcels of leasehold agriculture land located at Kota Putra, Mukim Batang Tunggang Kiri, Daerah<br />

Padang Terap, Negeri Kedah measuring in aggregate approximately 2,612.99 acres (‘NIA Lands’) of which 169.44<br />

acres had been surrendered to the Government following completion of their project in November 2008.<br />

1,115.02 acres of the NIA Lands had been planted with rubber trees whilst an approved master plan for the<br />

development of Bandar Sempadan Kota Putra had been obtained for the remaining land.<br />

The acquisition of NIA was completed on 23 October 2009.<br />

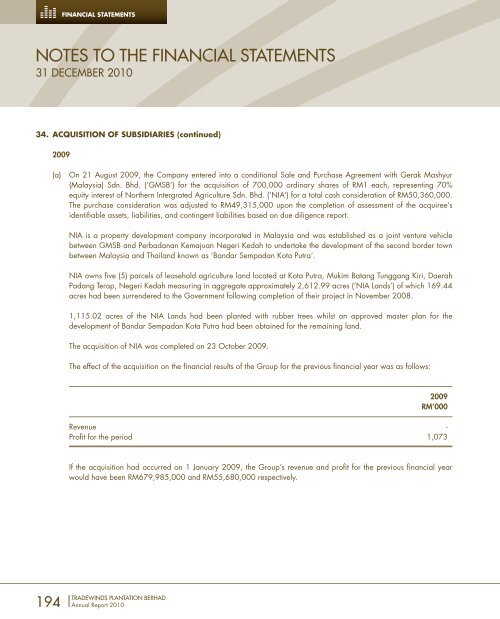

The effect of the acquisition on the financial results of the Group for the previous financial year was as follows:<br />

TRADEWINDS PLANTATION BERHAD<br />

Annual Report 2010<br />

2009<br />

RM’000<br />

Revenue -<br />

Profit for the period 1,073<br />

If the acquisition had occurred on 1 January 2009, the Group’s revenue and profit for the previous financial year<br />

would have been RM679,985,000 and RM55,680,000 respectively.