FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

37. FINANCIAL RISk MANAGEMENT OBJECTIVES AND POLICIES (continued)<br />

(i) Interest rate risk<br />

Interest rate risk is the risk that the fair value of future cash flows of the Group’s and of the Company’s financial<br />

instruments will fluctuate because of changes in market interest rates.<br />

The Group’s exposure to changes in interest rates relates primarily to the Group’s deposits with banks and interest<br />

bearing debt obligations. The Group does not use derivative financial instruments to hedge its risk but regularly<br />

reviews its debt portfolio to enable it to source low interest funding. The Group’s deposits are placed at fixed rates and<br />

management endeavours to obtain the best rate available in the market.<br />

Sensitivity analysis for interest rate risk<br />

At 31 December 2010, if interest rates had been 50 basis points lower/higher, with all other variables held constant,<br />

the Group’s and the Company’s post-tax profit for the year would have been RM1,504,000 and RM626,000 higher/<br />

lower respectively, arising mainly as a result of lower/higher finance costs on floating rate borrowings and higher/<br />

lower finance income on deposits. The assumed movement in basis points for interest rate sensitivity analysis is based<br />

on a prudent estimate of the current market environment.<br />

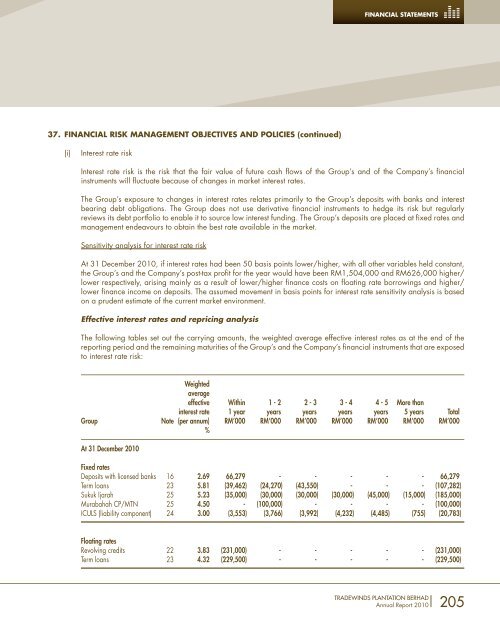

Effective interest rates and repricing analysis<br />

The following tables set out the carrying amounts, the weighted average effective interest rates as at the end of the<br />

reporting period and the remaining maturities of the Group’s and the Company’s financial instruments that are exposed<br />

to interest rate risk:<br />

Weighted<br />

average<br />

effective Within 1 - 2 2 - 3 3 - 4 4 - 5 More than<br />

interest rate 1 year years years years years 5 years Total<br />

Group Note (per annum) RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000<br />

%<br />

At 31 December 2010<br />

FINANCIAL STATEMENTS<br />

Fixed rates<br />

Deposits with licensed banks 16 2.69 66,279 - - - - - 66,279<br />

Term loans 23 5.81 (39,462) (24,270) (43,550) - - - (107,282)<br />

Sukuk Ijarah 25 5.23 (35,000) (30,000) (30,000) (30,000) (45,000) (15,000) (185,000)<br />

Murabahah CP/MTN 25 4.50 - (100,000) - - - - (100,000)<br />

ICULS (liability component) 24 3.00 (3,553) (3,766) (3,992) (4,232) (4,485) (755) (20,783)<br />

Floating rates<br />

Revolving credits 22 3.83 (231,000) - - - - - (231,000)<br />

Term loans 23 4.32 (229,500) - - - - - (229,500)<br />

TRADEWINDS PLANTATION BERHAD<br />

Annual Report 2010<br />

205