FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

204<br />

FINANCIAL STATEMENTS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2010<br />

36. FINANCIAL INSTRUMENTS (continued)<br />

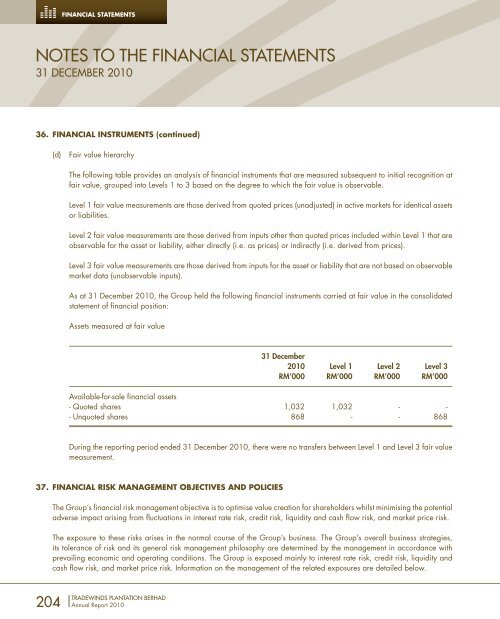

(d) Fair value hierarchy<br />

The following table provides an analysis of financial instruments that are measured subsequent to initial recognition at<br />

fair value, grouped into Levels 1 to 3 based on the degree to which the fair value is observable.<br />

Level 1 fair value measurements are those derived from quoted prices (unadjusted) in active markets for identical assets<br />

or liabilities.<br />

Level 2 fair value measurements are those derived from inputs other than quoted prices included within Level 1 that are<br />

observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).<br />

Level 3 fair value measurements are those derived from inputs for the asset or liability that are not based on observable<br />

market data (unobservable inputs).<br />

As at 31 December 2010, the Group held the following financial instruments carried at fair value in the consolidated<br />

statement of financial position:<br />

Assets measured at fair value<br />

TRADEWINDS PLANTATION BERHAD<br />

Annual Report 2010<br />

31 December<br />

2010 Level 1 Level 2 Level 3<br />

RM’000 RM’000 RM’000 RM’000<br />

Available-for-sale financial assets<br />

- Quoted shares 1,032 1,032 - -<br />

- Unquoted shares 868 - - 868<br />

During the reporting period ended 31 December 2010, there were no transfers between Level 1 and Level 3 fair value<br />

measurement.<br />

37. FINANCIAL RISk MANAGEMENT OBJECTIVES AND POLICIES<br />

The Group’s financial risk management objective is to optimise value creation for shareholders whilst minimising the potential<br />

adverse impact arising from fluctuations in interest rate risk, credit risk, liquidity and cash flow risk, and market price risk.<br />

The exposure to these risks arises in the normal course of the Group’s business. The Group’s overall business strategies,<br />

its tolerance of risk and its general risk management philosophy are determined by the management in accordance with<br />

prevailing economic and operating conditions. The Group is exposed mainly to interest rate risk, credit risk, liquidity and<br />

cash flow risk, and market price risk. Information on the management of the related exposures are detailed below.