FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

200<br />

FINANCIAL STATEMENTS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2010<br />

36. FINANCIAL INSTRUMENTS<br />

(a) Capital management<br />

The primary objective of the Group’s capital management is to ensure that the Group maintains healthy capital ratios<br />

in order to support its business operations and maximises shareholders value.<br />

The Group manages its capital structure and makes adjustments to it, in light of changes in economic conditions. To<br />

maintain or adjust the capital structure, the Group may adjust the dividend payment to shareholders, return capital to<br />

shareholders or issue new shares. No changes were made in the objectives, policies or processes during the financial<br />

years ended 31 December 2010 and 31 December 2009.<br />

The Group monitors capital using a gearing ratio which is the amount of borrowings (Note 21 to the financial<br />

statements) divided by equity attributable to owners of the parent. The Group’s policy is to keep the gearing ratio within<br />

manageable levels. At the end of the reporting period, the Group’s gearing ratio is 0.57 times (2009: 0.68 times).<br />

With respect to the banking facilities with certain financial institutions and the Sukuk Ijarah and Murabahah CP/MTN<br />

facilities, the Group is committed to maintain a gearing ratio of not more than 1.75 times calculated by dividing the<br />

amount of borrowings (Note 21 to the financial statements) over equity attributable to owners of the parent.<br />

(b) Financial instruments<br />

Certain comparative figures have not been presented for the financial year ended 31 December 2009 by virtue of the<br />

exemption given in paragraph 44AA of FRS 7.<br />

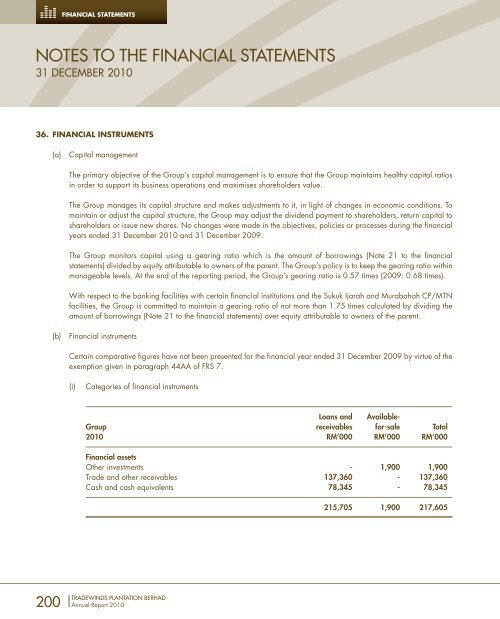

(i) Categories of financial instruments<br />

Loans and Available-<br />

Group receivables for-sale Total<br />

2010 RM’000 RM’000 RM’000<br />

Financial assets<br />

Other investments - 1,900 1,900<br />

Trade and other receivables 137,360 - 137,360<br />

Cash and cash equivalents 78,345 - 78,345<br />

TRADEWINDS PLANTATION BERHAD<br />

Annual Report 2010<br />

215,705 1,900 217,605