FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

190<br />

FINANCIAL STATEMENTS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2010<br />

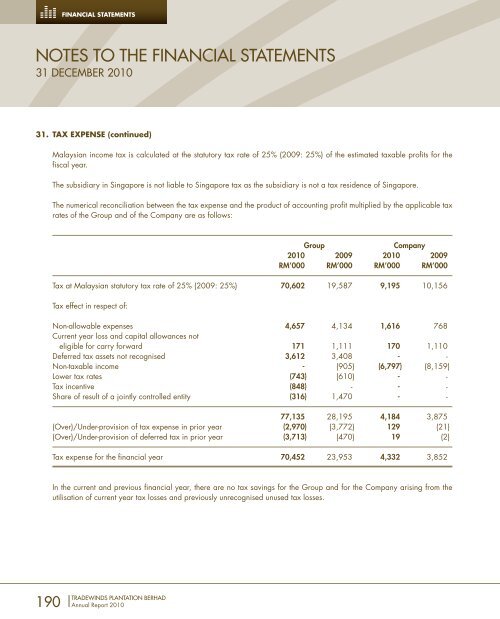

31. TAX EXPENSE (continued)<br />

Malaysian income tax is calculated at the statutory tax rate of 25% (2009: 25%) of the estimated taxable profits for the<br />

fiscal year.<br />

The subsidiary in Singapore is not liable to Singapore tax as the subsidiary is not a tax residence of Singapore.<br />

The numerical reconciliation between the tax expense and the product of accounting profit multiplied by the applicable tax<br />

rates of the Group and of the Company are as follows:<br />

TRADEWINDS PLANTATION BERHAD<br />

Annual Report 2010<br />

Group Company<br />

2010 2009 2010 2009<br />

RM’000 RM’000 RM’000 RM’000<br />

Tax at Malaysian statutory tax rate of 25% (2009: 25%) 70,602 19,587 9,195 10,156<br />

Tax effect in respect of:<br />

Non-allowable expenses 4,657 4,134 1,616 768<br />

Current year loss and capital allowances not<br />

eligible for carry forward 171 1,111 170 1,110<br />

Deferred tax assets not recognised 3,612 3,408 - -<br />

Non-taxable income - (905) (6,797) (8,159)<br />

Lower tax rates (743) (610) - -<br />

Tax incentive (848) - - -<br />

Share of result of a jointly controlled entity (316) 1,470 - -<br />

77,135 28,195 4,184 3,875<br />

(Over)/Under-provision of tax expense in prior year (2,970) (3,772) 129 (21)<br />

(Over)/Under-provision of deferred tax in prior year (3,713) (470) 19 (2)<br />

Tax expense for the financial year 70,452 23,953 4,332 3,852<br />

In the current and previous financial year, there are no tax savings for the Group and for the Company arising from the<br />

utilisation of current year tax losses and previously unrecognised unused tax losses.