a quarterly report by - Technopak

a quarterly report by - Technopak

a quarterly report by - Technopak

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

perspective<br />

a quar terly repor t <strong>by</strong><br />

Volume 02 / 2009<br />

| Volume 02<br />

• Table 1: Suppose a firm currently does a stock transfer from State A to State B, before selling in State<br />

B to avoid paying CST. It thus gets a margin of US$ 0.50 per unit and incurs local VAT only when it sells<br />

in State B to its distributor through its depot. The distributor charges a margin of US$ 0.14 per unit and<br />

charges the final price <strong>by</strong> adjusting the input credit (which is available since the sale from depot was<br />

intra-state). In this case,<br />

Price to Retailer = (Distributor Landed Cost + Distributor Margin – Distributor Input Credit) * (1 + VAT<br />

Rate).<br />

Similarly the MRP comes out to US$ 3.13/unit after accounting for input credit at retail level as well as<br />

retailers’ US$ 0.28 /unit margin.<br />

• Table 2: In today’s 2% CST scenario, the firm incurs US$ 0.08/unit loss in margin if it were to do a crossborder<br />

sale to the distributor, without going through a stock transfer at the depot. The calculations are<br />

based on the premise that the US$/unit retailer margin, distributor margin and MRP are maintained at the<br />

same level.<br />

•Table 3: If CST rates were to become zero then the firm can do cross-border sale (at 0% rate) directly to<br />

the distributor without any loss of margin to itself, the distributor or the retailer and yet charge the same<br />

MRP to the consumer.<br />

•Table 4: If CST is abolished and inter-state sales or stock transfers are taxed with input credit allowed at<br />

the destination, then also the margins and MRP remain intact for everyone.<br />

Thus, we see that when tax barriers on cross-border<br />

sales are removed whether through the route shown<br />

in Table 3 or 4, it becomes unnecessary to have<br />

a depot in the destination state. The supply chain<br />

can then be designed not on tax considerations<br />

but purely on logistics cost and customer service<br />

considerations.<br />

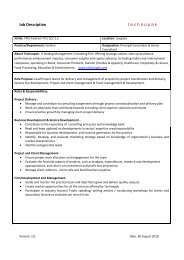

Exhibit 5<br />

Approximate Number of Warehouses Needed<br />

in the GST Scenario<br />

Delivery Lead Time for 80% Urban<br />

Customers<br />

Annual Turnover (US$ Mn ) 24 Hrs 48 Hrs<br />

< 600 24 - 28 20 - 24<br />

600 - 1500 22 - 26 18 - 22<br />

Hence, a key feature of post GST supply chain<br />

networks would be fewer warehouses or distribution > 1500 20 - 24 16 - 20<br />

centres than before. This means simpler and leaner<br />

Source: <strong>Technopak</strong> analysis<br />

networks which could incur lower costs of operation as explained below. Exhibit 5 provides an approximate<br />

guide on the number of warehouses for a distribution company dealing in fast moving goods can have in<br />

a GST scenario. The specific business realities of the company will also have a great bearing on the actual<br />

number of warehouses required.<br />

Network Re-engineering for GST<br />

We have already established that an optimum network design post GST would be different from an optimum<br />

network design in today’s taxation scenario. The re-organised network will in fact be significantly different.<br />

•The<br />

move towards fewer warehouses would require many warehouses to combine, close and re-locate.<br />

•Required<br />

capacity of many warehouses will undergo changes. With fewer warehouses, the average size<br />

of the warehouse will go up.<br />

•Hubs<br />

are not directly impacted <strong>by</strong> CST considerations. However, fewer & larger warehouses may make<br />

it feasible to route plant production directly to warehouses rather than through hubs, due to larger<br />

throughputs. Thus, the size and number of hubs could get affected.<br />

•The<br />

linkages between factories-hubs-warehouses-customers for various products will get re-aligned.<br />

GST : Impact on the Supply Chain |<br />

26