a quarterly report by - Technopak

a quarterly report by - Technopak

a quarterly report by - Technopak

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Bangladesh Offers Low Cost Production.<br />

•The<br />

cumulative FDI in Bangladesh from 1998 to 2008 amounts to UD$ 6.5 Bn<br />

•16%<br />

of FDI is in the textile sector, amounting to ~US$ 1 Bn<br />

•75%<br />

of the country’s export earnings come from textiles and apparel<br />

perspective<br />

a quar terly repor t <strong>by</strong><br />

•Readymade<br />

garment exports increased from US$ 643 Mn in 1990, to US$ 12 Bn in 2008<br />

•This<br />

has been possible due to the proactive role of the government and trade associations<br />

India’s case is similar to that of China. India is in a unique position to offer both a substantial and fast<br />

growing domestic market and a country rich of resources required for low cost production. In sum, investing<br />

companies have been motivated to enter into collaborations with host country firms due to increasing gains<br />

that can be made <strong>by</strong> producing brands in the host country and selling them into the host country market.<br />

Host country companies have been motivated <strong>by</strong> the scope for gaining technical and marketing expertise<br />

from foreign partners.<br />

FDI in India: Current Scenario<br />

Due to India’s recent liberalization of its foreign investment regulations, the country has become one of the<br />

fastest growing destinations for FDI inflows. India offers many advantages for foreign investors like strong<br />

economic growth leading to increased buying power <strong>by</strong> the middle class, low wages, and an educated<br />

work force. India’s Special Economic Zones (SEZs) attract foreign investment <strong>by</strong> providing tax incentives,<br />

assistance with bureaucratic and administrative problems, and access to reliable infrastructure.<br />

Indian economy is growing at the rate of in excess of 6% per annum since last 10 years. Even in times<br />

of recession / slowdown in most of the developed economies, India is expected to maintain this level of<br />

growth. From 1990 to 2007, India’s GDP has grown at an annualized rate of 8% which is second only to<br />

China among present trillion dollar economies.<br />

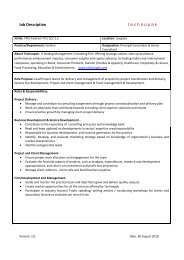

Exhibit 3<br />

US$ Mn<br />

30000<br />

25000<br />

20000<br />

15000<br />

10000<br />

5000<br />

0<br />

1991-1992<br />

(Aug-March)<br />

1992-1993<br />

1993-1994<br />

1994-1995<br />

1995-1996<br />

FDI Inflows in India (1991 to present)<br />

1996-1997<br />

1997-1998<br />

1998-1999<br />

1999-2000<br />

From August 1991 to March 2009, India has attracted a total FDI of US$ 106 Bn, of which approximately<br />

US$ 90 Bn was invested during Apr ’00 to Mar ’09.<br />

Extending its liberalization policies to other industries, India also raised the level of foreign equity ownership<br />

permitted in civil aviation, refineries, some mineral mining, construction, industrial parks and commodity<br />

exchanges in January 2008.<br />

In the textile and apparel sector, 100% FDI is allowed under the automatic route. FDI in sectors to the extent<br />

permitted under automatic route does not require any prior approval either <strong>by</strong> the Government of India<br />

2000-2001<br />

2001-2002<br />

2002-2003<br />

2003-2004<br />

2004-2005<br />

2005-2006<br />

2006-2007<br />

2007-2008<br />

Volume 02 / 2009<br />

2008-2009<br />

| Volume 02<br />

FDI : A Catalyst for Growth of the Textile & Apparel Industry |<br />

34