a quarterly report by - Technopak

a quarterly report by - Technopak

a quarterly report by - Technopak

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

perspective<br />

a quar terly repor t <strong>by</strong><br />

The single largest category is woven apparel followed <strong>by</strong> knitted apparel, made-ups and cotton based<br />

textiles.<br />

Growth Prospects<br />

India’s current domestic consumption of US$<br />

40 Bn is expected to grow to ~US$ 200 Bn over<br />

the next 25 years (growing at over 7% per year).<br />

India’s exports are expected to grow to ~US$ 125<br />

Bn from the current level of US$ 22 Bn <strong>by</strong> 2035.<br />

Volume 02 / 2009<br />

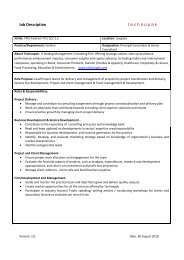

Exhibit 2<br />

Investment in Textile and Apparel Manufacturing<br />

Sector Investment Required (US$ Mn)<br />

1. Spinning 55,000<br />

2. Weaving 25,000<br />

3. Knitting 10,000<br />

| Volume 02<br />

However, the visible bottleneck to the above 4. Fabric Processing 40,000<br />

growth is the shortfall in the supply to meet 5. Home textiles 4,200<br />

the aforementioned demand. The current<br />

manufacturing capacities cannot meet the unprecedented growth in the demand and therefore, we<br />

would need mega investments to the tune of US$ 130 - 135 Bn over next 25 years in textile and apparel<br />

manufacturing.<br />

If the required demand is not met <strong>by</strong> indigenous manufacturing then it would be met <strong>by</strong> imports from Asian<br />

countries like China, Bangladesh, Vietnam, Korea etc.; Eastern European countries like Romania, Bulgaria,<br />

Tunisia etc.; and African countries like Kenya, Nigeria, Egypt etc.<br />

One of the biggest questions to be answered here is - who will invest? We firmly believe that FDI can act as<br />

a catalyst to trigger this investment. One of the most commonly known benefits of FDI is the “Crowding-in”<br />

effect. With entry of foreign firms in the sector, the confidence level of investing in the sector increases and<br />

it has been usually seen that more and more domestic manufacturers follow suite.<br />

Considering the above logic, we believe that approximately 75% to 80% of the investment would still be<br />

done <strong>by</strong> the domestic business houses, but the balance 20% to 25% investment required as FDI will give<br />

the required confidence to invest in the sector.<br />

A prime example of the same would be what US auto sector underwent in the 1980s.<br />

•Companies<br />

invest in the US because it is single largest economy in the world and its labor pool is one<br />

of the best educated, most productive and innovative, and it provides world class infrastructure.<br />

•The<br />

US auto sector in the 1980s had several features that made it an attractive setting for FDI. Both<br />

the end-product automobile sector, where there were only ‘The Big Three’ US assemblers (General<br />

Motors, Ford, and Chrysler), and the large number of firms in the auto component supply sector<br />

provided such an opportunity.<br />

•There<br />

was substantial inward FDI that originated predominantly from a single country, Japan. This<br />

investment likely increased the competition that then led to productivity changes. In addition, the<br />

Japanese entrants possessed superior production techniques and management practices, which<br />

created the potential for technology transfer.<br />

•They<br />

began to produce vehicles in North America and began to purchase inputs from US autocomponent<br />

manufacturers.<br />

•The<br />

results suggest that increased competitive pressure in the auto sector was the main cause of<br />

overall productivity improvement, at least during the initial stages of foreign direct investment of<br />

the 1980s.<br />

FDI : A Catalyst for Growth of the Textile & Apparel Industry |<br />

32