This Issue - Icwai

This Issue - Icwai

This Issue - Icwai

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CAPITAL CAPITAL MARKET<br />

MARKET<br />

f. Redemption Process<br />

There are a few ways of redemption of ETF<br />

shares :<br />

● For redemption of ETF, investors may sell shares<br />

on the open market—the more common option for<br />

investors.<br />

● The second option is to hoard enough ETF shares<br />

to form a creation unit and then exchange the creation<br />

unit for an underlying security—the option more<br />

generally associated with institutional investors<br />

because of the large volume of shares required.<br />

● When investors redeem, the creation unit is no<br />

more and the securities are handed over to the<br />

redeemer.<br />

How do ETFs generate returns for investors?<br />

ETFs, as earlier mentioned, are like stocks and are<br />

traded like a stock. So the price of an ETF share<br />

depends on the forces of supply and demand in the<br />

market and on the performance of the underlying<br />

index.<br />

In order to understand ETFs better we tried to give<br />

a brief about couple of ETFs traded in different<br />

exchanges and are a replica of Indian index.<br />

Methodology<br />

The methodology used for was to study the<br />

difference of mutual fund and ETFs. <strong>This</strong> will help<br />

passive investor to make the investment decisions.<br />

Also, a comparative analysis of ETF and shares will<br />

help us know how well are ETFs for active investors.<br />

During the study a sample of two ETF iShares S&P<br />

India Nifty 50 Index Fund and PowerShares India<br />

Portfolio ETF is also taken to understand the<br />

composition of ETFs. The samples taken are the ETFs<br />

traded in US market but are fund based in Indian<br />

Index.<br />

Analysis<br />

Precisely, ETFs are like mutual fund which trades<br />

like a stock. It can be used for speculative trading like<br />

short selling and trading on margin. It has low expense<br />

ratio. Just like a stock it can be traded through<br />

brokerage firm. A commission charge is incurred in<br />

each trading. It gives the opportunity to an investor<br />

to diversify its portfolio.<br />

In mutual fund, whose pool of money is invested<br />

by the fund manager is based on the goals of the funds.<br />

The trading of the different positions is done throughout<br />

the year but the information is published quarterly<br />

i.e. the fund is not transparent but ETFs mention the<br />

details like the sector they have invested and the<br />

equity they are holding—this information is available<br />

at all times.<br />

Second major differencde between mutual fund<br />

and ETFs are that MF can be valued at that day’s<br />

closing price so it cannot be traded throughout the<br />

day unlike ETFs which are constantly valued on their<br />

underlying holdings and are traded on the real time<br />

basis. The last major difference between them is the<br />

annual fee charges. MF tends to charge tentatively<br />

between 1-2% but ETF’s annual charges may be as<br />

low as 0.1%.<br />

Comparative analysis of Shares, ETFs and<br />

traditional managed fund shows that Exchange traded<br />

Funds has the benefit of a stock and a traditional<br />

managed both :<br />

● It has high level of diversification which is<br />

lacking if an investment is done in shares and<br />

is dependable on the type of securities in case<br />

of traditional funds.<br />

● It can be traded on intra-day pricing like a<br />

share, unlike a traditional fund which is traded<br />

on the market close value.<br />

● Liquidity is comparatively high as compared<br />

to shares and funds.<br />

● The ETFs information is very transparent. At<br />

any given point of time an investor can know<br />

all the related information of the ETFs from the<br />

sectors it has invested into to the shares it is<br />

holding.<br />

● It can be used in short selling and limit order<br />

just like a share.<br />

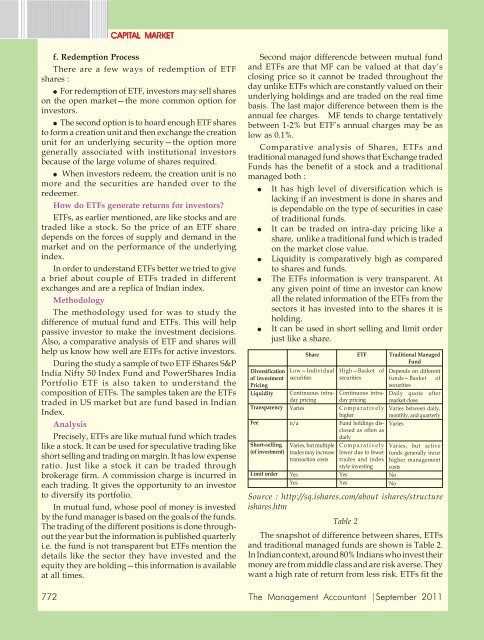

Diversification<br />

of investment<br />

Pricing<br />

Liquidity<br />

Transparency<br />

772 The Management Accountant |September 2011<br />

Fee<br />

Short-selling<br />

(of investment)<br />

Limit order<br />

Share<br />

Low—Individual<br />

securities<br />

Continuous intraday<br />

pricing<br />

Varies<br />

n/a<br />

Varies, but multiple<br />

trades may increase<br />

transaction costs<br />

Yes<br />

Yes<br />

ETF<br />

High—Basket of<br />

securities<br />

Continuous intraday<br />

pricing<br />

Comparatively<br />

higher<br />

Fund holdings disclosed<br />

as often as<br />

daily<br />

Comparatively<br />

lower due to fewer<br />

trades and index<br />

style investing<br />

Yes<br />

Yes<br />

Traditional Managed<br />

Fund<br />

Depends on different<br />

funds—Basket of<br />

securities<br />

Daily quote after<br />

market close<br />

Varies between daily,<br />

monthly, and quarterly<br />

Varies<br />

Varies, but active<br />

funds generally incur<br />

higher management<br />

costs<br />

No<br />

No<br />

Source : http://sq.ishares.com/about ishares/structure<br />

ishares.htm<br />

Table 2<br />

The snapshot of difference between shares, ETFs<br />

and traditional managed funds are shown is Table 2.<br />

In Indian context, around 80% Indians who invest their<br />

money are from middle class and are risk averse. They<br />

want a high rate of return from less risk. ETFs fit the