MEAT Sector Analyse

MEAT Sector Analyse

MEAT Sector Analyse

- TAGS

- sector

- analyse

- mbumk.gov.al

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

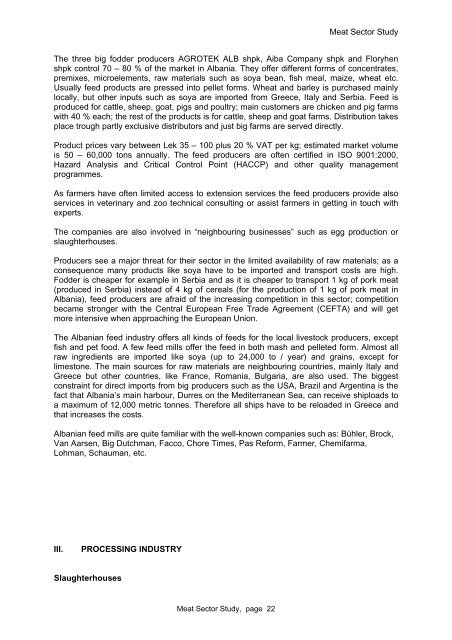

Meat <strong>Sector</strong> Study<br />

The three big fodder producers AGROTEK ALB shpk, Aiba Company shpk and Floryhen<br />

shpk control 70 – 80 % of the market in Albania. They offer different forms of concentrates,<br />

premixes, microelements, raw materials such as soya bean, fish meal, maize, wheat etc.<br />

Usually feed products are pressed into pellet forms. Wheat and barley is purchased mainly<br />

locally, but other inputs such as soya are imported from Greece, Italy and Serbia. Feed is<br />

produced for cattle, sheep, goat, pigs and poultry; main customers are chicken and pig farms<br />

with 40 % each; the rest of the products is for cattle, sheep and goat farms. Distribution takes<br />

place trough partly exclusive distributors and just big farms are served directly.<br />

Product prices vary between Lek 35 – 100 plus 20 % VAT per kg; estimated market volume<br />

is 50 – 60,000 tons annually. The feed producers are often certified in ISO 9001:2000,<br />

Hazard Analysis and Critical Control Point (HACCP) and other quality management<br />

programmes.<br />

As farmers have often limited access to extension services the feed producers provide also<br />

services in veterinary and zoo technical consulting or assist farmers in getting in touch with<br />

experts.<br />

The companies are also involved in “neighbouring businesses” such as egg production or<br />

slaughterhouses.<br />

Producers see a major threat for their sector in the limited availability of raw materials; as a<br />

consequence many products like soya have to be imported and transport costs are high.<br />

Fodder is cheaper for example in Serbia and as it is cheaper to transport 1 kg of pork meat<br />

(produced in Serbia) instead of 4 kg of cereals (for the production of 1 kg of pork meat in<br />

Albania), feed producers are afraid of the increasing competition in this sector; competition<br />

became stronger with the Central European Free Trade Agreement (CEFTA) and will get<br />

more intensive when approaching the European Union.<br />

The Albanian feed industry offers all kinds of feeds for the local livestock producers, except<br />

fish and pet food. A few feed mills offer the feed in both mash and pelleted form. Almost all<br />

raw ingredients are imported like soya (up to 24,000 to / year) and grains, except for<br />

limestone. The main sources for raw materials are neighbouring countries, mainly Italy and<br />

Greece but other countries, like France, Romania, Bulgaria, are also used. The biggest<br />

constraint for direct imports from big producers such as the USA, Brazil and Argentina is the<br />

fact that Albania’s main harbour, Durres on the Mediterranean Sea, can receive shiploads to<br />

a maximum of 12,000 metric tonnes. Therefore all ships have to be reloaded in Greece and<br />

that increases the costs.<br />

Albanian feed mills are quite familiar with the well-known companies such as: Bühler, Brock,<br />

Van Aarsen, Big Dutchman, Facco, Chore Times, Pas Reform, Farmer, Chemifarma,<br />

Lohman, Schauman, etc.<br />

III. PROCESSING INDUSTRY<br />

Slaughterhouses<br />

Meat <strong>Sector</strong> Study, page 22