SURF LIFE SAVING AUSTRALIA ANNUAL REPORT 2007–08

SURF LIFE SAVING AUSTRALIA ANNUAL REPORT 2007–08

SURF LIFE SAVING AUSTRALIA ANNUAL REPORT 2007–08

- TAGS

- surf

- australia

- annual

- sls.com.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

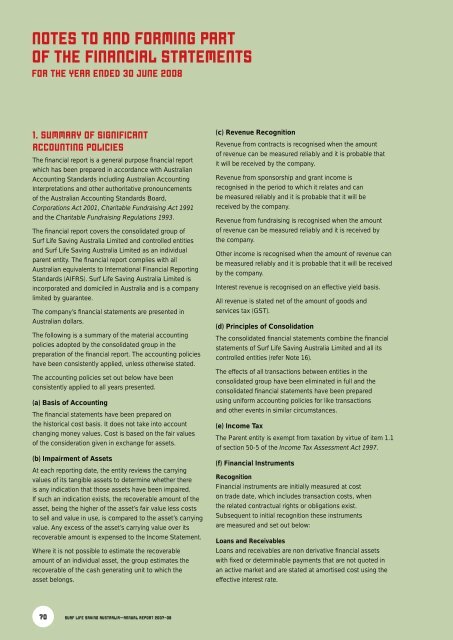

NOTES TO AND FORMING PART<br />

OF THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2008<br />

1. SUMMARY OF SIGNIFICANT<br />

ACCOUNTING POLICIES<br />

The fi nancial report is a general purpose fi nancial report<br />

which has been prepared in accordance with Australian<br />

Accounting Standards including Australian Accounting<br />

Interpretations and other authoritative pronouncements<br />

of the Australian Accounting Standards Board,<br />

Corporations Act 2001, Charitable Fundraising Act 1991<br />

and the Charitable Fundraising Regulations 1993.<br />

The fi nancial report covers the consolidated group of<br />

Surf Life Saving Australia Limited and controlled entities<br />

and Surf Life Saving Australia Limited as an individual<br />

parent entity. The fi nancial report complies with all<br />

Australian equivalents to International Financial Reporting<br />

Standards (AIFRS). Surf Life Saving Australia Limited is<br />

incorporated and domiciled in Australia and is a company<br />

limited by guarantee.<br />

The company’s fi nancial statements are presented in<br />

Australian dollars.<br />

The following is a summary of the material accounting<br />

policies adopted by the consolidated group in the<br />

preparation of the fi nancial report. The accounting policies<br />

have been consistently applied, unless otherwise stated.<br />

The accounting policies set out below have been<br />

consistently applied to all years presented.<br />

(a) Basis of Accounting<br />

The fi nancial statements have been prepared on<br />

the historical cost basis. It does not take into account<br />

changing money values. Cost is based on the fair values<br />

of the consideration given in exchange for assets.<br />

(b) Impairment of Assets<br />

At each reporting date, the entity reviews the carrying<br />

values of its tangible assets to determine whether there<br />

is any indication that those assets have been impaired.<br />

If such an indication exists, the recoverable amount of the<br />

asset, being the higher of the asset’s fair value less costs<br />

to sell and value in use, is compared to the asset’s carrying<br />

value. Any excess of the asset’s carrying value over its<br />

recoverable amount is expensed to the Income Statement.<br />

Where it is not possible to estimate the recoverable<br />

amount of an individual asset, the group estimates the<br />

recoverable of the cash generating unit to which the<br />

asset belongs.<br />

70 <strong>SURF</strong> <strong>LIFE</strong> <strong>SAVING</strong> <strong>AUSTRALIA</strong>—<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2007–08</strong><br />

(c) Revenue Recognition<br />

Revenue from contracts is recognised when the amount<br />

of revenue can be measured reliably and it is probable that<br />

it will be received by the company.<br />

Revenue from sponsorship and grant income is<br />

recognised in the period to which it relates and can<br />

be measured reliably and it is probable that it will be<br />

received by the company.<br />

Revenue from fundraising is recognised when the amount<br />

of revenue can be measured reliably and it is received by<br />

the company.<br />

Other income is recognised when the amount of revenue can<br />

be measured reliably and it is probable that it will be received<br />

by the company.<br />

Interest revenue is recognised on an effective yield basis.<br />

All revenue is stated net of the amount of goods and<br />

services tax (GST).<br />

(d) Principles of Consolidation<br />

The consolidated fi nancial statements combine the fi nancial<br />

statements of Surf Life Saving Australia Limited and all its<br />

controlled entities (refer Note 16).<br />

The effects of all transactions between entities in the<br />

consolidated group have been eliminated in full and the<br />

consolidated fi nancial statements have been prepared<br />

using uniform accounting policies for like transactions<br />

and other events in similar circumstances.<br />

(e) Income Tax<br />

The Parent entity is exempt from taxation by virtue of item 1.1<br />

of section 50-5 of the Income Tax Assessment Act 1997.<br />

(f) Financial Instruments<br />

Recognition<br />

Financial instruments are initially measured at cost<br />

on trade date, which includes transaction costs, when<br />

the related contractual rights or obligations exist.<br />

Subsequent to initial recognition these instruments<br />

are measured and set out below:<br />

Loans and Receivables<br />

Loans and receivables are non derivative fi nancial assets<br />

with fi xed or determinable payments that are not quoted in<br />

an active market and are stated at amortised cost using the<br />

effective interest rate.