SURF LIFE SAVING AUSTRALIA ANNUAL REPORT 2007–08

SURF LIFE SAVING AUSTRALIA ANNUAL REPORT 2007–08

SURF LIFE SAVING AUSTRALIA ANNUAL REPORT 2007–08

- TAGS

- surf

- australia

- annual

- sls.com.au

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS (continued)<br />

FOR THE YEAR ENDED 30 JUNE 2008<br />

(m) Government Grants<br />

Government grants are recognized at fair value where there<br />

is reasonable assurance that the grant will be received and<br />

all grant conditions will be met. Grants relating to expense<br />

items are recognized as income over the periods necessary<br />

to match the grant to the costs they are compensating.<br />

Grants relating to assets are credited to deferred income<br />

at fair value and are credited to income over the expected<br />

useful life of the asset on a straight line basis.<br />

(n) Critical Accounting Estimates and Judgments<br />

Estimates and judgments are continually evaluated and<br />

are based on historical experience and other factors,<br />

including expectations of future events that are believed<br />

to be reasonable under the circumstances.<br />

The Directors evaluate estimates and judgments<br />

incorporated in the fi nancial report based on historical<br />

knowledge and best available current information.<br />

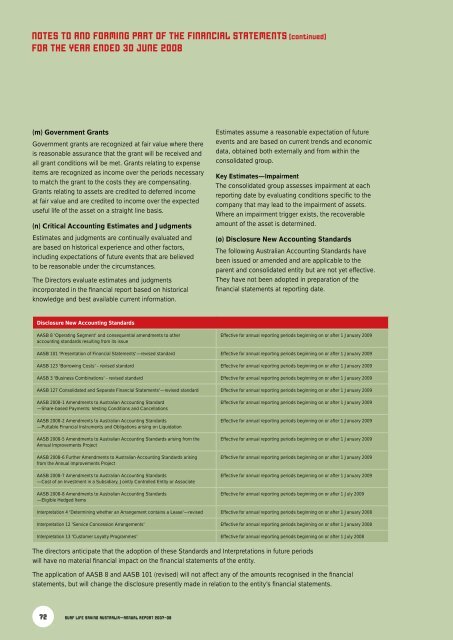

Disclosure New Accounting Standards<br />

AASB 8 'Operating Segment' and consequential amendments to other<br />

accounting standards resulting from its issue<br />

Estimates assume a reasonable expectation of future<br />

events and are based on current trends and economic<br />

data, obtained both externally and from within the<br />

consolidated group.<br />

Key Estimates—Impairment<br />

The consolidated group assesses impairment at each<br />

reporting date by evaluating conditions specifi c to the<br />

company that may lead to the impairment of assets.<br />

Where an impairment trigger exists, the recoverable<br />

amount of the asset is determined.<br />

(o) Disclosure New Accounting Standards<br />

The following Australian Accounting Standards have<br />

been issued or amended and are applicable to the<br />

parent and consolidated entity but are not yet effective.<br />

They have not been adopted in preparation of the<br />

fi nancial statements at reporting date.<br />

Effective for annual reporting periods beginning on or after 1 January 2009<br />

AASB 101 'Presentation of Financial Statements'—revised standard Effective for annual reporting periods beginning on or after 1 January 2009<br />

AASB 123 'Borrowing Costs' - revised standard Effective for annual reporting periods beginning on or after 1 January 2009<br />

AASB 3 'Business Combinations' - revised standard Effective for annual reporting periods beginning on or after 1 January 2009<br />

AASB 127 Consolidated and Separate Financial Statements'—revised standard Effective for annual reporting periods beginning on or after 1 January 2009<br />

AASB 2008-1 Amendments to Australian Accounting Standard<br />

—Share-based Payments: Vesting Conditions and Cancellations<br />

AASB 2008-2 Amendments to Australian Accounting Standards<br />

—Puttable Financial Instruments and Obligations arising on Liquidation<br />

AASB 2008-5 Amendments to Australian Accounting Standards arising from the<br />

Annual Improvements Project<br />

AASB 2008-6 Further Amendments to Australian Accounting Standards arising<br />

from the Annual Improvements Project<br />

AASB 2008-7 Amendments to Australian Accounting Standards<br />

—Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate<br />

AASB 2008-8 Amendments to Australian Accounting Standards<br />

—Eligible Hedged Items<br />

Effective for annual reporting periods beginning on or after 1 January 2009<br />

Effective for annual reporting periods beginning on or after 1 January 2009<br />

Effective for annual reporting periods beginning on or after 1 January 2009<br />

Effective for annual reporting periods beginning on or after 1 January 2009<br />

Effective for annual reporting periods beginning on or after 1 January 2009<br />

Effective for annual reporting periods beginning on or after 1 July 2009<br />

Interpretation 4 'Determining whether an Arrangement contains a Lease'—revised Effective for annual reporting periods beginning on or after 1 January 2008<br />

Interpretation 12 'Service Concession Arrangements' Effective for annual reporting periods beginning on or after 1 January 2008<br />

Interpretation 13 'Customer Loyalty Programmes' Effective for annual reporting periods beginning on or after 1 July 2008<br />

The directors anticipate that the adoption of these Standards and Interpretations in future periods<br />

will have no material fi nancial impact on the fi nancial statements of the entity.<br />

The application of AASB 8 and AASB 101 (revised) will not affect any of the amounts recognised in the fi nancial<br />

statements, but will change the disclosure presently made in relation to the entity’s fi nancial statements.<br />

72 <strong>SURF</strong> <strong>LIFE</strong> <strong>SAVING</strong> <strong>AUSTRALIA</strong>—<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2007–08</strong>