- Page 1 and 2:

�����������

- Page 3:

CONTENTS Chapter 1 Introduction 1 C

- Page 7 and 8:

Development; Child Welfare and Prot

- Page 9 and 10:

A number of programmes are being su

- Page 11 and 12:

and other social concerns. The main

- Page 13 and 14:

Promoting Gender Equality - GOI - U

- Page 15 and 16:

National Guidelines on Infant and Y

- Page 17 and 18:

Hoisting of the Women’s Empowerme

- Page 19 and 20:

— Child Protection — Girl Child

- Page 21:

at the same level i.e. Rs.4795.85 c

- Page 24 and 25:

(1997- 2002) laid emphasis on the p

- Page 26 and 27:

DIARY, a honorable activity for a h

- Page 28 and 29:

Hostels for Working Women 2.16 The

- Page 30 and 31:

Swadhar - A Scheme for Women in Dif

- Page 32 and 33:

exploitation is interlinked with tr

- Page 34 and 35:

— The ministry has requested the

- Page 36 and 37:

— Capacity building and training

- Page 38 and 39:

elationship does not exist such as

- Page 40 and 41:

— Equal participation of women an

- Page 42 and 43:

Hon’ble Vice president of India,

- Page 44 and 45:

Working Groups on Women Empowerment

- Page 46:

44 Annual Report 2006-07

- Page 49 and 50:

(iii) to reduce the incidence of mo

- Page 51 and 52:

3.5 The States have to necessarily

- Page 53 and 54:

Financial - Plan Allocation and Exp

- Page 55 and 56:

States, identified on the basis of

- Page 57 and 58:

70.00 60.00 50.00 40.00 30.00 20.00

- Page 59 and 60:

Table 1: Physical Status in Udisha

- Page 61 and 62:

Cooperation with UNICEF 3.34 UNICEF

- Page 63 and 64:

y Prime Minister’s Office and sen

- Page 65 and 66:

Rs. 1 lakh, a silver plaque and a c

- Page 67 and 68:

(ii) To provide a forum for network

- Page 69 and 70:

3.70 This scheme has been implement

- Page 71 and 72:

Voluntary Coordinating Agencies (VC

- Page 73 and 74:

Convention of the elimination of al

- Page 77 and 78:

Other Programmes Grant-in-aid for R

- Page 79 and 80:

of the Ministry is being constitute

- Page 81:

women and children belonging to Sch

- Page 85 and 86:

Food and Nutrition Board 5.1 The im

- Page 87 and 88:

Inaugural Session of the National W

- Page 89 and 90:

egularly to deliberate on the need

- Page 91 and 92:

Nutrition demonstration by C.F.N.E.

- Page 94 and 95:

Gender Budgeting - Budgeting for Ge

- Page 96 and 97:

Box -1: Mission statement- “Budge

- Page 98 and 99:

Box -3 The plan documents have over

- Page 100 and 101:

Box 5 : Checklist II for mainstream

- Page 102 and 103:

Complete Budget Macro Level Gender

- Page 104 and 105:

16. Deptt. of Food & Public Distrib

- Page 106 and 107:

Ministry of Urban Development All U

- Page 108 and 109: — MEA is also looking into a poss

- Page 110 and 111: 6.31 The representative of the Mini

- Page 112 and 113: drudgery of women, facilitating her

- Page 114: 5. Case studies will have to be dev

- Page 117 and 118: 7.4 One of the major concerns of po

- Page 119 and 120: 7.9 Hence, there is a strong case f

- Page 121 and 122: a lot of time and other resources b

- Page 123 and 124: 7.25 Budget outlays for Child Devel

- Page 126 and 127: CHAPTER-8 National Institute of Pub

- Page 128 and 129: violence and gender budgeting. The

- Page 130 and 131: Workshop on Child Marriage in India

- Page 132 and 133: (ICDS) Programme. It has been entru

- Page 134: Emphasis on Hygiene during Menstrua

- Page 137 and 138: Central Social Welfare Board 9.1 Th

- Page 139 and 140: creches sanctioned during 2004-05 w

- Page 141 and 142: 9.22 State-wise amount sanctioned/r

- Page 143 and 144: subsistence and have no social prot

- Page 145 and 146: Board in collaboration with volunta

- Page 148 and 149: 154 Annual Report 2006-07

- Page 150 and 151: violence, harassment, dowry, tortur

- Page 152 and 153: Important Meetings/Workshops/Semina

- Page 154 and 155: Meeting of the Chairpersons of Stat

- Page 156 and 157: hailing from sections of Indian soc

- Page 158: — Research Study on “Socio Econ

- Page 163 and 164: designed for medium and large NGOs

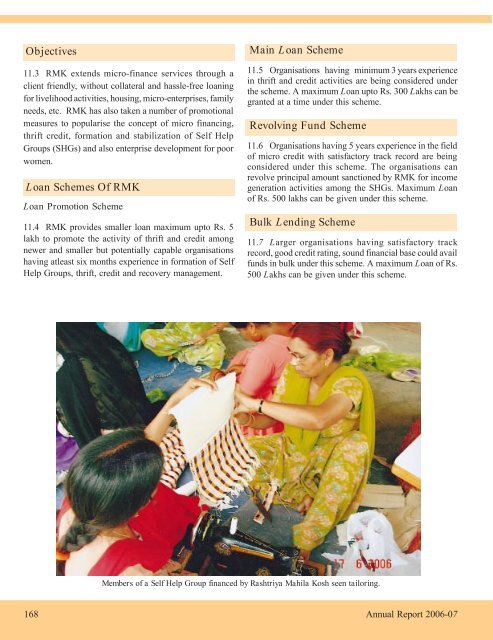

- Page 165 and 166: Members of a Self Help Group financ

- Page 167 and 168: Members of a Self Help Group financ

- Page 169 and 170: 176 Annual Report 2006-07

- Page 171 and 172: Annexure - II 178 Annual Report 200

- Page 173 and 174: Committee on Empowerment of Women A

- Page 175 and 176: Annexure - VI State wise fund relea

- Page 177 and 178: Statewise funds released, number of

- Page 179 and 180: Statewise Amount Released under Swa

- Page 181 and 182: Annexure - XII Statement indicating

- Page 183 and 184: Annexure - XIV State-wise Position

- Page 185 and 186: State-wise number of blocks sanctio

- Page 187 and 188: Annexure - XVIII State-wise fund re

- Page 189 and 190: Annexure - XX Statewise grant-in-ai

- Page 191 and 192: Annexure - XXII List of National Ch

- Page 193 and 194: 13 100 Master Liju K.V., Arts- draw

- Page 195 and 196: Annexure - XXIII List of National A

- Page 197 and 198: List of Children Honoured with Nati

- Page 199 and 200: Composition of the Child Delegation

- Page 201 and 202: 39 Wayanad September 2002 Kerala 40

- Page 203 and 204: List of new Research / Workshop Pro

- Page 205 and 206: 14. Development Organization of Vil

- Page 207 and 208: 47. SC/ST Backward Women and Childr

- Page 209 and 210:

82. Managing Director, Uttar Prdesh

- Page 211 and 212:

6. Member Secretary, Himalayan Regi

- Page 213 and 214:

2. The Principal, Vidyasagar School

- Page 215 and 216:

Nagaland 24. Thujo Multipurpose Coo

- Page 217 and 218:

26. Leather & Fur Emb. Works ICS, J

- Page 219 and 220:

67. Debniwas Sindhubala Nari Kalyan

- Page 221 and 222:

Sl.No. Name of the organisations &

- Page 223 and 224:

Sl.No. Name of the organisations &

- Page 225 and 226:

Sl.No. Name of the organisations &

- Page 227 and 228:

13. Praja Seva Samithi 2.50 Off. Na

- Page 229 and 230:

37. Nandi Youth & Educational & Eco

- Page 231 and 232:

63. Social Organisation for Communi

- Page 233 and 234:

84. Sachetanata 2.50 Plot No. 457D/

- Page 235 and 236:

114. Women and Child Development So

- Page 237 and 238:

ANDHRA PRADESH SHORT STAY HOMES (CS

- Page 239 and 240:

Sl. Name & Address Of The Instituti

- Page 241 and 242:

Sl. Name & Address of The Instituti

- Page 243 and 244:

Sl. Name & Address Of The Instituti

- Page 245 and 246:

Sl. Name & Address Of The Instituti

- Page 247 and 248:

Sl. Name & Address Of The Instituti

- Page 249 and 250:

Sl. Name & Address Of The Instituti

- Page 251 and 252:

Sl. Name & Address Of The Instituti

- Page 253 and 254:

Sl. Name & Address of The Instituti

- Page 255 and 256:

21 Inovative Work on Women & Childr

- Page 257 and 258:

Summary of Programmes Organised by

- Page 259 and 260:

13. Orientation Course on Procedure

- Page 261 and 262:

41. Orientation Course on Participa

- Page 263 and 264:

69. Workshop on Learning and Behavi

- Page 265 and 266:

97. Training on Micro Enterprises a

- Page 267 and 268:

122. Orientation Programme for Youn

- Page 269 and 270:

152. Job Training Course for CDPOs

- Page 271 and 272:

Annexur e - XXXV Statement showing

- Page 273 and 274:

Annexure - XXXVII Statement showing

- Page 275 and 276:

Annexur e - XXXIX Statement showing

- Page 277 and 278:

Statement showing the amount sancti

- Page 279 and 280:

Statement showing the amount sancti

- Page 281 and 282:

Annexure - XLV Statement showing Sa

- Page 283 and 284:

Annexure - XLVII Workshops/Training