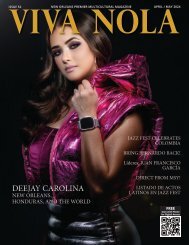

VIVA NOLA APRIL MAY 2023

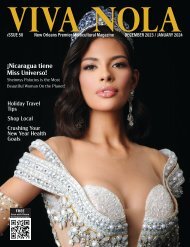

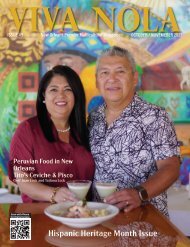

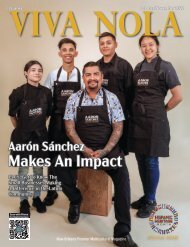

Bilingual variety magazine - Connecting the Latino community to New Orleans, Louisiana, and beyond. Learn about the unique culture of New Orleans and relevant topics.

Bilingual variety magazine - Connecting the Latino community to New Orleans, Louisiana, and beyond. Learn about the unique culture of New Orleans and relevant topics.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ECONOMIC Development<br />

9 Steps for Buying<br />

Your First Property<br />

By Carolina Loreto<br />

Realtor®<br />

Buying a home is an exciting process, but it can also be overwhelming. If you want to buy your first property, here are<br />

some steps to consider. In future issues, we will talk more in depth about each step.<br />

1. Decide what neighborhood you want to live in.<br />

Familiarize yourself with housing costs in the areas<br />

that interest you.<br />

2. Get your finances in order. Consider your<br />

income, debt, and savings. Check your credit score.<br />

A high credit score can help you get a low interest<br />

rate.<br />

3. Decide what type of loan is right for you.<br />

Different types of loans have advantages and<br />

disadvantages. They include conventional loans,<br />

FHA, VA, Jumbo, and others, which we will explain<br />

in upcoming issues. Talk to your mortgage lender<br />

for guidance in deciding which is best for you.<br />

4. Get pre-qualified and pre-approved for<br />

your mortgage. The ideal time to obtain these<br />

documents is when you’re ready to begin your<br />

search. Your lender will consider your income,<br />

expenses, assets, debts, and price range. A preapproval<br />

letter shows sellers and real estate agents<br />

that you are a serious buyer who can obtain<br />

financing.<br />

5. Get a Realtor® or Real Estate Agent to work<br />

with you. It is essential to find a trustworthy agent<br />

who will provide information on the neighborhoods<br />

that interest you and is knowledgeable about the<br />

buying process and negotiations.<br />

6. Make an offer. If you have found a house that<br />

meets your criteria, it’s time to make an offer.<br />

During these negotiations, your real estate agent is<br />

your best ally.<br />

7. Inspection. The inspector will check the home<br />

for any defects that need repair. The inspection is<br />

essential because it allows you to renegotiate the<br />

terms or withdraw your offer if the report reveals<br />

significant problems.<br />

8. Valuation of the house. The lender arranges for<br />

the home’s appraisal, which may affect the granting<br />

of the loan. An appraisal estimates a home’s worth<br />

based on a property’s condition, comparable sales<br />

in the area, and public records.<br />

9. Closing the sale. Your lender must provide the<br />

closing disclosure at least three days before the<br />

closing.<br />

After all the necessary documents are signed, you<br />

are ready to move into your new home!<br />

I’m ready to take you through these steps and help<br />

you buy your next home. Please call or text me at<br />

(504)232-0555.<br />

4 ~ <strong>VIVA</strong> <strong>NOLA</strong> April / May <strong>2023</strong>