March 2009 - Indocement Tunggal Prakarsa, PT.

March 2009 - Indocement Tunggal Prakarsa, PT.

March 2009 - Indocement Tunggal Prakarsa, PT.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

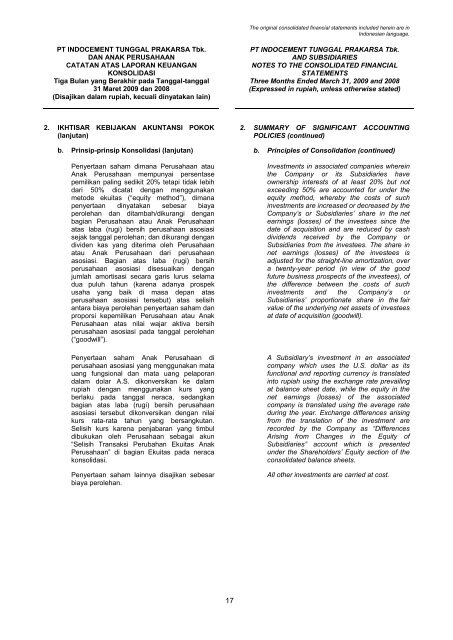

The original consolidated financial statements included herein are inIndonesian language.<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.DAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASITiga Bulan yang Berakhir pada Tanggal-tanggal31 Maret <strong>2009</strong> dan 2008(Disajikan dalam rupiah, kecuali dinyatakan lain)<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.AND SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIALSTATEMENTSThree Months Ended <strong>March</strong> 31, <strong>2009</strong> and 2008(Expressed in rupiah, unless otherwise stated)2. IKHTISAR KEBIJAKAN AKUNTANSI POKOK(lanjutan)2. SUMMARY OF SIGNIFICANT ACCOUNTINGPOLICIES (continued)b. Prinsip-prinsip Konsolidasi (lanjutan) b. Principles of Consolidation (continued)Penyertaan saham dimana Perusahaan atauAnak Perusahaan mempunyai persentasepemilikan paling sedikit 20% tetapi tidak lebihdari 50% dicatat dengan menggunakanmetode ekuitas (“equity method”), dimanapenyertaan dinyatakan sebesar biayaperolehan dan ditambah/dikurangi denganbagian Perusahaan atau Anak Perusahaanatas laba (rugi) bersih perusahaan asosiasisejak tanggal perolehan; dan dikurangi dengandividen kas yang diterima oleh Perusahaanatau Anak Perusahaan dari perusahaanasosiasi. Bagian atas laba (rugi) bersihperusahaan asosiasi disesuaikan denganjumlah amortisasi secara garis lurus selamadua puluh tahun (karena adanya prospekusaha yang baik di masa depan atasperusahaan asosiasi tersebut) atas selisihantara biaya perolehan penyertaan saham danproporsi kepemilikan Perusahaan atau AnakPerusahaan atas nilai wajar aktiva bersihperusahaan asosiasi pada tanggal perolehan(“goodwill”).Penyertaan saham Anak Perusahaan diperusahaan asosiasi yang menggunakan matauang fungsional dan mata uang pelaporandalam dolar A.S. dikonversikan ke dalamrupiah dengan menggunakan kurs yangberlaku pada tanggal neraca, sedangkanbagian atas laba (rugi) bersih perusahaanasosiasi tersebut dikonversikan dengan nilaikurs rata-rata tahun yang bersangkutan.Selisih kurs karena penjabaran yang timbuldibukukan oleh Perusahaan sebagai akun“Selisih Transaksi Perubahan Ekuitas AnakPerusahaan” di bagian Ekuitas pada neracakonsolidasi.Penyertaan saham lainnya disajikan sebesarbiaya perolehan.Investments in associated companies whereinthe Company or its Subsidiaries haveownership interests of at least 20% but notexceeding 50% are accounted for under theequity method, whereby the costs of suchinvestments are increased or decreased by theCompany’s or Subsidiaries’ share in the netearnings (losses) of the investees since thedate of acquisition and are reduced by cashdividends received by the Company orSubsidiaries from the investees. The share innet earnings (losses) of the investees isadjusted for the straight-line amortization, overa twenty-year period (in view of the goodfuture business prospects of the investees), ofthe difference between the costs of suchinvestments and the Company’s orSubsidiaries’ proportionate share in the fairvalue of the underlying net assets of investeesat date of acquisition (goodwill).A Subsidiary’s investment in an associatedcompany which uses the U.S. dollar as itsfunctional and reporting currency is translatedinto rupiah using the exchange rate prevailingat balance sheet date, while the equity in thenet earnings (losses) of the associatedcompany is translated using the average rateduring the year. Exchange differences arisingfrom the translation of the investment arerecorded by the Company as “DifferencesArising from Changes in the Equity ofSubsidiaries” account which is presentedunder the Shareholders’ Equity section of theconsolidated balance sheets.All other investments are carried at cost.17