The original consolidated financial statements included herein are inIndonesian language.<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.DAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASITiga Bulan yang Berakhir pada Tanggal-tanggal31 Maret <strong>2009</strong> dan 2008(Disajikan dalam rupiah, kecuali dinyatakan lain)<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.AND SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIALSTATEMENTSThree Months Ended <strong>March</strong> 31, <strong>2009</strong> and 2008(Expressed in rupiah, unless otherwise stated)12. HUTANG LEMBAGA KEUANGAN JANGKAPANJANG (lanjutan)Pinjaman dari HC Finance B.V. mempunyai jangkawaktu empat (4) tahun dan akan dibayarkan secarapenuh pada akhir tahun keempat (<strong>2009</strong>). Pinjamanini dikenakan suku bunga sebesar 1,8% di atasLIBOR 3 bulan dan jatuh tempo triwulanan. Sejaktanggal 1 Juli 2006, suku bunga tahunan untukpinjaman diturunkan dari LIBOR 3 bulan + 1,80%per tahun menjadi LIBOR 3 bulan + 1,15% pertahun.Untuk mengurangi risiko fluktuasi nilai tukar (kurs),terkait dengan transaksi pembiayaan kembalidengan HC Finance B.V. tersebut di atas,Perusahaan melakukan transaksi “Cross CurrencyInterest Rate Swap” (CCIRS) dengan nilai pokoksebesar US$150 juta dengan Standard CharteredBank, Cabang Jakarta. Kontrak CCIRS tersebutmempunyai jangka waktu yang sama denganjangka waktu pinjaman dari HC Finance B.V.(Catatan 25).Pada tanggal 16 September 2008 dan17 September 2008, Perusahaan melunasisebagian saldo terhutang dari pinjaman HCFinance B.V. dengan jumlah keseluruhan sebesarUS$100.000.000, dan sisanya sebesarUS$50.000.000 akan jatuh tempo pada tanggal10 Maret <strong>2009</strong>. Pada tanggal yang sama,Perusahaan mengakhiri sebagian kontrak CCIRSdengan Standard Chartered Bank, Cabang Jakartadengan nilai pokok sebesar US$100.000.000sehubungan dengan pinjaman HC Finance B.V.tersebut diatas (Catatan 25).Pada tanggal 10 Maret <strong>2009</strong>, Perusahaan melunasisisa saldo terhutang daripinjaman HC Finance B.V. yang jatuh temposebesar US$50.000.000. Pada tanggal yang sama,Perusahaan juga telah mengakhiri kontrak CCIRSdengan Standard Chartered Bank, Cabang Jakartadengan nilai pokok sebesar US$50.000.000sehubungan dengan pinjaman HC Finance B.V.tersebut (Catatan 25).Perusahaan juga menarik pinjaman darifasilitas pinjaman sindikasi yang diperoleh padatanggal 7 April 2006, dimana Perusahaan(sebagai Peminjam) bersama denganHeidelbergCement AG (sebagai Penjamin),menandatangani perjanjian fasilitas pinjamansindikasi (Fasilitas) dengan Standard CharteredBank (sebagai “Coordinating Lead Arranger danFacility Agent”), dan dengan ABN-AMRO BankN.V., Cabang Jakarta, <strong>PT</strong> Bank Central Asia Tbkdan Calyon Deutschland bertindak sebagai “LeadArrangers” dengan jumlah keseluruhan setaradengan US$158 juta. Fasilitas tersebut terdiri darisebagai berikut:12. LONG-TERM LOAN FROM A FINANCIALINSTITUTION (continued)The HC Finance B.V. loan has a term of four (4)years and will be fully repaid at the end of thefourth year (<strong>2009</strong>). This loan bears interest at therate of 1.8% above the 3 Months’ LIBOR with thesame interest payment schedule and are duequarterly. Starting July 1, 2006, the interest ratewas reduced from 3 Months’ LIBOR + 1.80% perannum to 3 Months’ LIBOR + 1.15% per annum.To reduce the exposure to exchange ratefluctuations relating to the above-mentionedrefinancing transaction with HC Finance B.V., theCompany entered into a Cross Currency InterestRate Swap (CCIRS) transaction with a notionalamount of US$150 million with Standard CharteredBank, Jakarta Branch. The CCIRS contract has thesame period as the HC Finance B.V. loan(Note 25).On September 16, 2008 and September 17, 2008,the Company made partial repayment of theoutstanding balance of the HC Finance B.V. loanfor a total amount of US$100,000,000, and theremaining balance of US$50,000,000 will be dueon <strong>March</strong> 10, <strong>2009</strong>. On the same dates, theCompany had partially unwinded the CCIRScontract with Standard Chartered Bank, JakartaBranch with a notional amount of US$100,000,000relating to the above-mentioned HC Finance B.V.loan (Note 25).On <strong>March</strong> 10, <strong>2009</strong>, the Company fully repaid itsremaining balance of the HC Finance B.V. loan ofUS$50,000,000 which is due on <strong>March</strong> 10, <strong>2009</strong>.On the same dates, the Company has completelysettled the CCIRS contract with StandardChartered Bank, Jakarta Branch with a notionalamount of US$50,000,000 relating to the HCFinance B.V. loan (Note 25).The Company also had drawn loans from asyndicated loan facility obtained on April 7, 2006,whereby the Company (as the Borrower) togetherwith HeidelbergCement AG (as the Guarantor),signed the syndicated loan facility (“the Facility”)agreement with Standard Chartered Bank (as theCoordinating Lead Arranger and Facility Agent),and with ABN-AMRO Bank N.V., Jakarta Branch,<strong>PT</strong> Bank Central Asia Tbk and Calyon Deutschlandacting as the Lead Arrangers with a total amountequivalent to US$158 million. The Facility consistsof the following:48

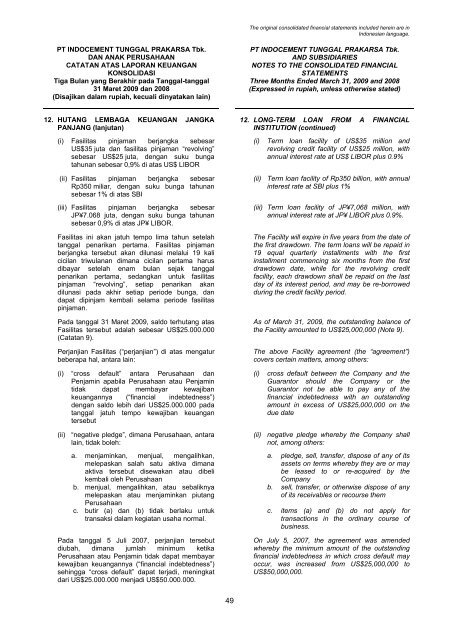

The original consolidated financial statements included herein are inIndonesian language.<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.DAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASITiga Bulan yang Berakhir pada Tanggal-tanggal31 Maret <strong>2009</strong> dan 2008(Disajikan dalam rupiah, kecuali dinyatakan lain)<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.AND SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIALSTATEMENTSThree Months Ended <strong>March</strong> 31, <strong>2009</strong> and 2008(Expressed in rupiah, unless otherwise stated)12. HUTANG LEMBAGA KEUANGAN JANGKAPANJANG (lanjutan)(i) Fasilitas pinjaman berjangka sebesarUS$35 juta dan fasilitas pinjaman “revolving”sebesar US$25 juta, dengan suku bungatahunan sebesar 0,9% di atas US$ LIBOR(ii) Fasilitas pinjaman berjangka sebesarRp350 miliar, dengan suku bunga tahunansebesar 1% di atas SBI(iii) Fasilitas pinjaman berjangka sebesarJP¥7.068 juta, dengan suku bunga tahunansebesar 0,9% di atas JP¥ LIBOR.Fasilitas ini akan jatuh tempo lima tahun setelahtanggal penarikan pertama. Fasilitas pinjamanberjangka tersebut akan dilunasi melalui 19 kalicicilan triwulanan dimana cicilan pertama harusdibayar setelah enam bulan sejak tanggalpenarikan pertama, sedangkan untuk fasilitaspinjaman “revolving”, setiap penarikan akandilunasi pada akhir setiap periode bunga, dandapat dipinjam kembali selama periode fasilitaspinjaman.Pada tanggal 31 Maret <strong>2009</strong>, saldo terhutang atasFasilitas tersebut adalah sebesar US$25.000.000(Catatan 9).Perjanjian Fasilitas (“perjanjian”) di atas mengaturbeberapa hal, antara lain:12. LONG-TERM LOAN FROM A FINANCIALINSTITUTION (continued)(i)Term loan facility of US$35 million andrevolving credit facility of US$25 million, withannual interest rate at US$ LIBOR plus 0.9%(ii) Term loan facility of Rp350 billion, with annualinterest rate at SBI plus 1%(iii) Term loan facility of JP¥7,068 million, withannual interest rate at JP¥ LIBOR plus 0.9%.The Facility will expire in five years from the date ofthe first drawdown. The term loans will be repaid in19 equal quarterly installments with the firstinstallment commencing six months from the firstdrawdown date, while for the revolving creditfacility, each drawdown shall be repaid on the lastday of its interest period, and may be re-borrowedduring the credit facility period.As of <strong>March</strong> 31, <strong>2009</strong>, the outstanding balance ofthe Facility amounted to US$25,000,000 (Note 9).The above Facility agreement (the “agreement”)covers certain matters, among others:(i) “cross default” antara Perusahaan danPenjamin apabila Perusahaan atau Penjamintidak dapat membayar kewajibankeuangannya (“financial indebtedness”)dengan saldo lebih dari US$25.000.000 padatanggal jatuh tempo kewajiban keuangantersebut(i)cross default between the Company and theGuarantor should the Company or theGuarantor not be able to pay any of thefinancial indebtedness with an outstandingamount in excess of US$25,000,000 on thedue date(ii) “negative pledge”, dimana Perusahaan, antaralain, tidak boleh:a. menjaminkan, menjual, mengalihkan,melepaskan salah satu aktiva dimanaaktiva tersebut disewakan atau dibelikembali oleh Perusahaanb. menjual, mengalihkan, atau sebaliknyamelepaskan atau menjaminkan piutangPerusahaanc. butir (a) dan (b) tidak berlaku untuktransaksi dalam kegiatan usaha normal.Pada tanggal 5 Juli 2007, perjanjian tersebutdiubah, dimana jumlah minimum ketikaPerusahaan atau Penjamin tidak dapat membayarkewajiban keuangannya (“financial indebtedness”)sehingga “cross default” dapat terjadi, meningkatdari US$25.000.000 menjadi US$50.000.000.(ii) negative pledge whereby the Company shallnot, among others:a. pledge, sell, transfer, dispose of any of itsassets on terms whereby they are or maybe leased to or re-acquired by theCompanyb. sell, transfer, or otherwise dispose of anyof its receivables or recourse themc. items (a) and (b) do not apply fortransactions in the ordinary course ofbusiness.On July 5, 2007, the agreement was amendedwhereby the minimum amount of the outstandingfinancial indebtedness in which cross default mayoccur, was increased from US$25,000,000 toUS$50,000,000.49