March 2009 - Indocement Tunggal Prakarsa, PT.

March 2009 - Indocement Tunggal Prakarsa, PT.

March 2009 - Indocement Tunggal Prakarsa, PT.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

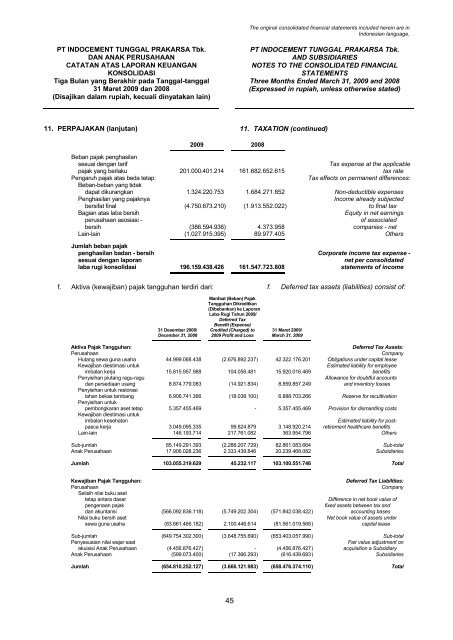

The original consolidated financial statements included herein are inIndonesian language.<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.DAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASITiga Bulan yang Berakhir pada Tanggal-tanggal31 Maret <strong>2009</strong> dan 2008(Disajikan dalam rupiah, kecuali dinyatakan lain)<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.AND SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIALSTATEMENTSThree Months Ended <strong>March</strong> 31, <strong>2009</strong> and 2008(Expressed in rupiah, unless otherwise stated)11. PERPAJAKAN (lanjutan) 11. TAXATION (continued)<strong>2009</strong> 2008Beban pajak penghasilansesuai dengan tarifTax expense at the applicablepajak yang berlaku 201.000.401.214 161.682.652.615 tax ratePengaruh pajak atas beda tetap:Tax effects on permanent differences:Beban-beban yang tidakdapat dikurangkan 1.324.220.753 1.684.271.852 Non-deductible expensesPenghasilan yang pajaknyaIncome already subjectedbersifat final (4.750.673.210) (1.913.552.022) to final taxBagian atas laba bersihEquity in net earningsperusahaan asosiasi -of associatedbersih (386.594.936) 4.373.958 companies - netLain-lain (1.027.915.395) 89.977.405 OthersJumlah beban pajakpenghasilan badan - bersih Corporate income tax expense -sesuai dengan laporannet per consolidatedlaba rugi konsolidasi 196.159.438.426 161.547.723.808 statements of incomef. Aktiva (kewajiban) pajak tangguhan terdiri dari: f. Deferred tax assets (liabilities) consist of:Manfaat (Beban) PajakTangguhan Dikreditkan(Dibebankan) ke LaporanLaba Rugi Tahun <strong>2009</strong>/Deferred TaxBenefit (Expense)31 Desember 2008/ Credited (Charged) to 31 Maret <strong>2009</strong>/December 31, 2008 <strong>2009</strong> Profit and Loss <strong>March</strong> 31, <strong>2009</strong>Aktiva Pajak Tangguhan:Deferred Tax Assets:PerusahaanCompanyHutang sewa guna usaha 44.999.068.438 (2.676.892.237 ) 42.322.176.201 Obligations under capital leaseKewajiban diestimasi untukEstimated liability for employeeimbalan kerja 15.815.957.988 104.058.481 15.920.016.469 benefitsPenyisihan piutang ragu-raguAllowance for doubtful accountsdan persediaan usang 8.874.779.083 (14.921.834 ) 8.859.857.249 and inventory lossesPenyisihan untuk restorasilahan bekas tambang 6.906.741.366 (18.038.100 ) 6.888.703.266 Reserve for recultivationPenyisihan untukpembongkaran aset tetap 5.357.455.469 - 5.357.455.469 Provision for dismantling costsKewajiban diestimasi untukimbalan kesehatanEstimated liability for postpascakerja 3.049.095.335 99.824.879 3.148.920.214 retirement healthcare benefitsLain-lain 146.193.714 217.761.082 363.954.796 OthersSub-jumlah 85.149.291.393 (2.288.207.729 ) 82.861.083.664 Sub-totalAnak Perusahaan 17.906.028.236 2.333.439.846 20.239.468.082 SubsidiariesJumlah 103.055.319.629 45.232.117 103.100.551.746 TotalKewajiban Pajak Tangguhan:Deferred Tax Liabilities:PerusahaanCompanySelisih nilai buku asettetap antara dasarDifference in net book value ofpengenaan pajakfixed assets between tax anddan akuntansi (566.092.836.118 ) (5.749.202.304 ) (571.842.038.422 ) accounting basesNilai buku bersih asetNet book value of assets undersewa guna usaha (83.661.466.182 ) 2.100.446.614 (81.561.019.568 ) capital leaseSub-jumlah (649.754.302.300 ) (3.648.755.690 ) (653.403.057.990 ) Sub-totalPenyesuaian nilai wajar saatFair value adjustment onakuisisi Anak Perusahaan (4.456.876.427 ) - (4.456.876.427 ) acquisition a SubsidiaryAnak Perusahaan (599.073.400 ) (17.366.293 ) (616.439.693 ) SubsidiariesJumlah (654.810.252.127 ) (3.666.121.983 ) (658.476.374.110 ) Total45