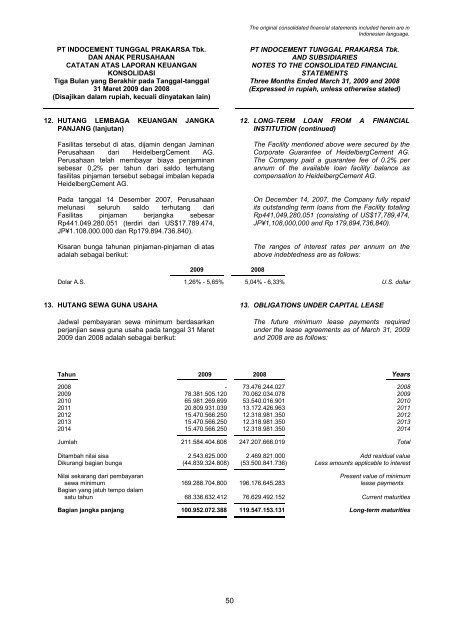

The original consolidated financial statements included herein are inIndonesian language.<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.DAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASITiga Bulan yang Berakhir pada Tanggal-tanggal31 Maret <strong>2009</strong> dan 2008(Disajikan dalam rupiah, kecuali dinyatakan lain)<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.AND SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIALSTATEMENTSThree Months Ended <strong>March</strong> 31, <strong>2009</strong> and 2008(Expressed in rupiah, unless otherwise stated)12. HUTANG LEMBAGA KEUANGAN JANGKAPANJANG (lanjutan)Fasilitas tersebut di atas, dijamin dengan JaminanPerusahaan dari HeidelbergCement AG.Perusahaan telah membayar biaya penjaminansebesar 0,2% per tahun dari saldo terhutangfasilitas pinjaman tersebut sebagai imbalan kepadaHeidelbergCement AG.Pada tanggal 14 Desember 2007, Perusahaanmelunasi seluruh saldo terhutang dariFasilitas pinjaman berjangka sebesarRp441.049.280.051 (terdiri dari US$17.789.474,JP¥1.108.000.000 dan Rp179.894.736.840).Kisaran bunga tahunan pinjaman-pinjaman di atasadalah sebagai berikut:12. LONG-TERM LOAN FROM A FINANCIALINSTITUTION (continued)The Facility mentioned above were secured by theCorporate Guarantee of HeidelbergCement AG.The Company paid a guarantee fee of 0.2% perannum of the available loan facility balance ascompensation to HeidelbergCement AG.On December 14, 2007, the Company fully repaidits outstanding term loans from the Facility totalingRp441,049,280,051 (consisting of US$17,789,474,JP¥1,108,000,000 and Rp 179,894,736,840).The ranges of interest rates per annum on theabove indebtedness are as follows:<strong>2009</strong> 2008Dolar A.S. 1,26% - 5,65% 5,04% - 6,33% U.S. dollar13. HUTANG SEWA GUNA USAHA 13. OBLIGATIONS UNDER CAPITAL LEASEJadwal pembayaran sewa minimum berdasarkanperjanjian sewa guna usaha pada tanggal 31 Maret<strong>2009</strong> dan 2008 adalah sebagai berikut:The future minimum lease payments requiredunder the lease agreements as of <strong>March</strong> 31, <strong>2009</strong>and 2008 are as follows:Tahun <strong>2009</strong> 2008 Years2008 - 73.476.244.027 2008<strong>2009</strong> 78.381.505.120 70.062.034.078 <strong>2009</strong>2010 65.981.269.699 53.540.016.901 20102011 20.809.931.039 13.172.426.963 20112012 15.470.566.250 12.318.981.350 20122013 15.470.566.250 12.318.981.350 20132014 15.470.566.250 12.318.981.350 2014Jumlah 211.584.404.608 247.207.666.019 TotalDitambah nilai sisa 2.543.625.000 2.469.821.000 Add residual valueDikurangi bagian bunga (44.839.324.808) (53.500.841.736) Less amounts applicable to interestNilai sekarang dari pembayaranPresent value of minimumsewa minimum 169.288.704.800 196.176.645.283 lease paymentsBagian yang jatuh tempo dalamsatu tahun 68.336.632.412 76.629.492.152 Current maturitiesBagian jangka panjang 100.952.072.388 119.547.153.131 Long-term maturities50

The original consolidated financial statements included herein are inIndonesian language.<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.DAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASITiga Bulan yang Berakhir pada Tanggal-tanggal31 Maret <strong>2009</strong> dan 2008(Disajikan dalam rupiah, kecuali dinyatakan lain)<strong>PT</strong> INDOCEMENT TUNGGAL PRAKARSA Tbk.AND SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIALSTATEMENTSThree Months Ended <strong>March</strong> 31, <strong>2009</strong> and 2008(Expressed in rupiah, unless otherwise stated)13. HUTANG SEWA GUNA USAHA (lanjutan) 13. OBLIGATIONS UNDER CAPITAL LEASE(continued)a. Perusahaan a. The Companyi. <strong>PT</strong> ABN-AMRO Finance Indonesia i. <strong>PT</strong> ABN-AMRO Finance IndonesiaPada bulan November 2006, Perusahaanmengadakan transaksi sewa guna usahadengan <strong>PT</strong> ABN-AMRO Finance Indonesia(AAFI) untuk alat pengangkutan tertentudengan jumlah keseluruhan sebesarRp15.180.159.620. Periode sewa gunausaha untuk transaksi tersebut adalah36 bulan dan Perusahaan memiliki opsiuntuk membeli aset sewa guna usahatersebut dengan membayar nilai sisasebesar Rp10 juta untuk setiap unitperalatan pada akhir periode sewa.Pada bulan Desember 2006, Perusahaanmengadakan perjanjian sewa guna usahadengan AAFI untuk penjualan danpenyewaan kembali alat pengangkutandengan jumlah nilai penyewaan kembalisebesar Rp3.650.660.000. Periode sewaguna usaha untuk transaksi tersebutadalah 36 bulan dan Perusahaan memilikiopsi untuk membeli aset sewa guna usahatersebut dengan membayar nilai sisasebesar Rp10 juta untuk setiap unitperalatan pada akhir periode sewa.Pada bulan Juli 2007, Perusahaanmengadakan transaksi sewa guna usahadengan AAFI untuk alat pengangkutantertentu dengan jumlah keseluruhansebesar US$1.580.923 (setara denganRp14.761.401.186). Periode sewa gunausaha untuk transaksi tersebut adalah36 bulan dan Perusahaan memiliki opsiuntuk membeli aset sewa guna usahatersebut dengan membayar nilai sisasebesar US$1.000 untuk setiap unitperalatan pada akhir periode sewa.Pada bulan Juli 2007, Perusahaanmengadakan perjanjian sewa guna usahadengan AAFI untuk penjualan danpenyewaan kembali mesin dan alatpengangkutan tertentu dengan jumlah nilaipenyewaan kembali sebesar US$5.213.754(setara dengan Rp48.222.913.116).Periode sewa guna usaha untuk transaksitersebut adalah 36 bulan dan Perusahaanmemiliki opsi untuk membeli aset sewaguna usaha tersebut dengan membayarnilai sisa sebesar US$1.000 untuk setiapunit mesin dan alat pengangkutan padaakhir periode sewa.In November 2006, the Company enteredinto a finance lease transaction with<strong>PT</strong> ABN-AMRO Finance Indonesia (AAFI)covering certain transportation equipmentunits for a total amount ofRp15,180,159,620. The lease period is for36 months and the Company has an optionto purchase the leased assets by paymentof the residual value of Rp10 million foreach equipment unit at the end of the leaseperiod.In December 2006, the Company enteredinto a sale-and-leaseback transaction withAAFI for the sale and leaseback oftransportation equipment units for a totalleaseback value of Rp3,650,660,000. Thelease period is for 36 months and theCompany has an option to purchase theleased assets by payment of the residualvalue of Rp10 million for each equipmentunit at the end of the lease period.In July 2007, the Company entered into afinance lease transaction with AAFIcovering certain transportation equipmentunits for a total amount of US$1,580,923(equivalent to Rp14,761,401,186). Thelease period is for 36 months and theCompany has an option to purchase theleased assets by payment of the residualvalue of US$1,000 for each equipment unitat the end of the lease period.In July 2007, the Company entered into asale-and-leaseback transaction with AAFIfor the sale and leaseback of certainmachinery and transportation equipmentunits for a total leaseback valueof US$5,213,754 (equivalent toRp48,222,913,116). The lease period is for36 months and the Company has an optionto purchase the leased assets by paymentof the residual value of US$1,000 for eachequipment unit at the end of the leaseperiod.51