Markedsrapport – Desember 2007 - NRP AS

Markedsrapport – Desember 2007 - NRP AS

Markedsrapport – Desember 2007 - NRP AS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Markedsrapport</strong> <strong>–</strong> <strong>Desember</strong> <strong>2007</strong> Side 16<br />

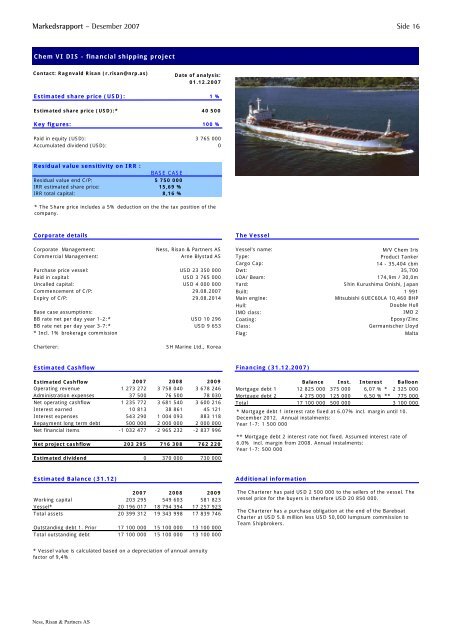

Chem VI DIS - financial shipping project<br />

Contact: Ragnvald Risan (r.risan@nrp.as)<br />

Ness, Risan & Partners <strong>AS</strong><br />

Date of analysis:<br />

01.12.<strong>2007</strong><br />

Estimated share price (USD): 1 %<br />

Estimated share price (USD):* 40 500<br />

Key figures: 100 %<br />

Paid in equity (USD): 3 765 000<br />

Accumulated dividend (USD): 0<br />

Residual value sensitivity on IRR :<br />

B<strong>AS</strong>E C<strong>AS</strong>E<br />

Residual value end C/P: 5 750 000<br />

IRR estimated share price: 15,69 %<br />

IRR total capital: 8,16 %<br />

* The Share price includes a 5% deduction on the the tax position of the<br />

company.<br />

Corporate details The Vessel<br />

Corporate Management: Ness, Risan & Partners <strong>AS</strong> Vessel's name: M/V Chem Iris<br />

Commercial Management: Arne Blystad <strong>AS</strong> Type: Product Tanker<br />

Cargo Cap: 14 - 35,404 cbm<br />

Purchase price vessel: USD 23 350 000 Dwt: 35,700<br />

Paid in capital: USD 3 765 000 LOA/ Beam: 174,9m / 30,0m<br />

Uncalled capital: USD 4 000 000 Yard: Shin Kurushima Onishi, Japan<br />

Commencement of C/P: 29.08.<strong>2007</strong> Built: 1 991<br />

Expiry of C/P: 29.08.2014 Main engine: Mitsubishi 6UEC60LA 10,460 BHP<br />

Hull: Double Hull<br />

Base case assumptions: IMO class: IMO 2<br />

BB rate net per day year 1-2:* USD 10 296 Coating: Epoxy/Zinc<br />

BB rate net per day year 3-7:* USD 9 653 Class: Germanischer Lloyd<br />

* Incl. 1% brokerage commission Flag: Malta<br />

Charterer: SH Marine Ltd., Korea<br />

Estimated Cashflow Financing (31.12.<strong>2007</strong>)<br />

Estimated Cashflow <strong>2007</strong> 2008 2009 Balance Inst. Interest Balloon<br />

Operating revenue 1 273 272 3 758 040 3 678 246 Mortgage debt 1 12 825 000 375 000 6,07 % * 2 325 000<br />

Administration expenses 37 500 76 500 78 030 Mortgage debt 2 4 275 000 125 000 6,50 % ** 775 000<br />

Net operating cashflow 1 235 772 3 681 540 3 600 216 Total 17 100 000 500 000 3 100 000<br />

Interest earned 10 813 38 861 45 121<br />

Interest expenses 543 290 1 004 093 883 118<br />

Repayment long term debt 500 000 2 000 000 2 000 000<br />

Net financial items -1 032 477 -2 965 232 -2 837 996<br />

Net project cashflow 203 295 716 308 762 220<br />

Estimated dividend 0 370 000 730 000<br />

Estimated Balance (31.12) Additional information<br />

<strong>2007</strong> 2008 2009<br />

Working capital 203 295 549 603 581 823<br />

Vessel* 20 196 017 18 794 394 17 257 923<br />

Total assets 20 399 312 19 343 998 17 839 746<br />

Outstanding debt 1. Prior 17 100 000 15 100 000 13 100 000<br />

Total outstanding debt 17 100 000 15 100 000 13 100 000<br />

* Vessel value is calculated based on a depreciation of annual annuity<br />

factor of 9,4%<br />

* Mortgage debt 1 interest rate fixed at 6.07% incl. margin until 10.<br />

December 2012. Annual instalments:<br />

Year 1-7: 1 500 000<br />

** Mortgage debt 2 interest rate not fixed. Assumed interest rate of<br />

6.0% incl. margin from 2008. Annual instalments:<br />

Year 1-7: 500 000<br />

The Charterer has paid USD 2 500 000 to the sellers of the vessel. The<br />

vessel price for the buyers is therefore USD 20 850 000.<br />

The Charterer has a purchase obligation at the end of the Bareboat<br />

Charter at USD 5.8 million less USD 50,000 lumpsum commission to<br />

Team Shipbrokers.