Markedsrapport – Desember 2007 - NRP AS

Markedsrapport – Desember 2007 - NRP AS

Markedsrapport – Desember 2007 - NRP AS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Side 41 <strong>Markedsrapport</strong> <strong>–</strong> <strong>Desember</strong> <strong>2007</strong><br />

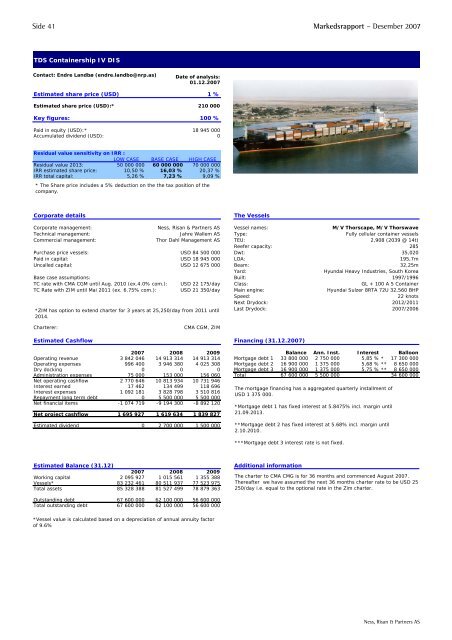

TDS Containership IV DIS<br />

Contact: Endre Landbø (endre.landbo@nrp.as)<br />

Date of analysis:<br />

01.12.<strong>2007</strong><br />

Estimated share price (USD) 1 %<br />

Estimated share price (USD):* 210 000<br />

Key figures: 100 %<br />

Paid in equity (USD):* 18 945 000<br />

Accumulated dividend (USD): 0<br />

Residual value sensitivity on IRR :<br />

LOW C<strong>AS</strong>E B<strong>AS</strong>E C<strong>AS</strong>E HIGH C<strong>AS</strong>E<br />

Residual value 2013: 50 000 000 60 000 000 70 000 000<br />

IRR estimated share price: 10,50 % 16,03 % 20,37 %<br />

IRR total capital: 5,26 % 7,23 % 9,09 %<br />

* The Share price includes a 5% deduction on the the tax position of the<br />

company.<br />

Corporate details The Vessels<br />

Corporate management: Ness, Risan & Partners <strong>AS</strong> Vessel names: M/V Thorscape, M/V Thorswave<br />

Technical management: Jahre Wallem <strong>AS</strong> Type: Fully cellular container vessels<br />

Commercial management: Thor Dahl Management <strong>AS</strong> TEU: 2,908 (2039 @ 14t)<br />

Reefer capacity: 285<br />

Purchase price vessels: USD 84 500 000 Dwt: 35,020<br />

Paid in capital: USD 18 945 000 LOA: 195,7m<br />

Uncalled capital: USD 12 675 000 Beam: 32,25m<br />

Yard: Hyundai Heavy Industries, South Korea<br />

Base case assumptions: Built: 1997/1996<br />

TC rate with CMA CGM until Aug. 2010 (ex.4.0% com.): USD 22 175/day Class: GL + 100 A 5 Container<br />

TC Rate with ZIM until Mai 2011 (ex. 6.75% com.): USD 21 350/day Main engine: Hyundai Sulzer 8RTA 72U 32,560 BHP<br />

Speed: 22 knots<br />

Next Drydock: 2012/2011<br />

*ZIM has option to extend charter for 3 years at 25,250/day from 2011 until<br />

2014.<br />

Last Drydock: <strong>2007</strong>/2006<br />

Charterer: CMA CGM, ZIM<br />

Estimated Cashflow Financing (31.12.<strong>2007</strong>)<br />

<strong>2007</strong> 2008 2009 Balance Ann. Inst. Interest Balloon<br />

Operating revenue 3 842 046 14 913 314 14 913 314 Mortgage debt 1 33 800 000 2 750 000 5,85 % * 17 300 000<br />

Operating expenses 996 400 3 946 380 4 025 308 Mortgage debt 2 16 900 000 1 375 000 5,68 % ** 8 650 000<br />

Dry docking 0 0 0 Mortgage debt 3 16 900 000 1 375 000 5,75 % ** 8 650 000<br />

Administration expenses 75 000 153 000 156 060 Total 67 600 000 5 500 000 34 600 000<br />

Net operating cashflow 2 770 646 10 813 934 10 731 946<br />

Interest earned 17 462 134 499 118 696<br />

Interest expenses 1 092 181 3 828 798 3 510 816<br />

Repayment long term debt 0 5 500 000 5 500 000<br />

Net financial items -1 074 719 -9 194 300 -8 892 120<br />

Net project cashflow 1 695 927 1 619 634 1 839 827<br />

Estimated dividend 0 2 700 000 1 500 000<br />

Estimated Balance (31.12) Additional information<br />

<strong>2007</strong> 2008 2009<br />

Working capital 2 095 927 1 015 561 1 355 388<br />

Vessels* 83 232 461 80 511 937 77 523 975<br />

Total assets 85 328 388 81 527 499 78 879 363<br />

Outstanding debt 67 600 000 62 100 000 56 600 000<br />

Total outstanding debt 67 600 000 62 100 000 56 600 000<br />

Net asset value pre dividend #REF! 12 483 954 13 113 756<br />

*Vessel value is calculated based on a depreciation of annual annuity factor<br />

of 9.6%<br />

The mortgage financing has a aggregated quarterly installment of<br />

USD 1 375 000.<br />

*Mortgage debt 1 has fixed interest at 5.8475% incl. margin until<br />

21.09.2013.<br />

**Mortgage debt 2 has fixed interest at 5.68% incl. margin until<br />

2.10.2010.<br />

***Mortgage debt 3 interest rate is not fixed.<br />

The charter to CMA CMG is for 36 months and commenced August <strong>2007</strong>.<br />

Thereafter we have assumed the next 36 months charter rate to be USD 25<br />

250/day i.e. equal to the optional rate in the Zim charter.<br />

Ness, Risan & Partners <strong>AS</strong>