Markedsrapport – Desember 2007 - NRP AS

Markedsrapport – Desember 2007 - NRP AS

Markedsrapport – Desember 2007 - NRP AS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Markedsrapport</strong> <strong>–</strong> <strong>Desember</strong> <strong>2007</strong> Side 74<br />

Ness, Risan & Partners <strong>AS</strong><br />

<strong>NRP</strong> Fleetfinance IV DIS<br />

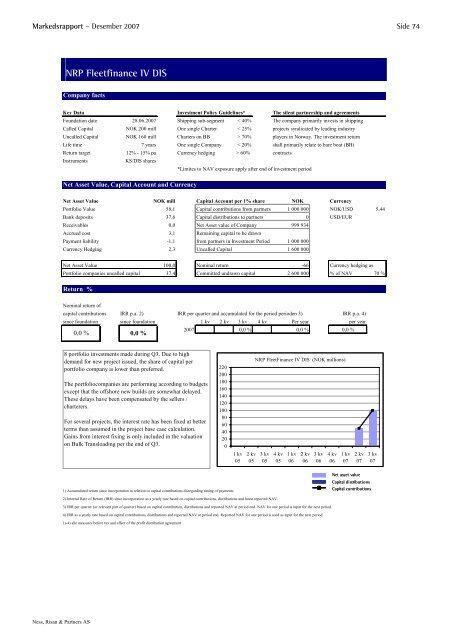

Company facts<br />

Key Data Investment Policy Guidelines* The silent partnership and agreements<br />

Foundation date 28.06.<strong>2007</strong> Shipping sub-segment < 40% The company primarily invests in shipping<br />

Called Capital NOK 200 mill One single Charter < 25% projects syndicated by leading industry<br />

Uncalled Capital NOK 160 mill Charters on BB > 70% players in Norway. The investment return<br />

Life time 7 years One single Company < 20% shall primarily relate to bare boat (BB)<br />

Return target 12% - 15% pa Currency hedging > 60% contracts<br />

Instruments KS/DIS shares<br />

*Limites to NAV exposure apply after end of investment period<br />

Net Asset Value, Capital Account and Currency<br />

Net Asset Value NOK mill Capital Account per 1% share NOK Currency<br />

Portfolio Value 58,1 Capital contributions from partners 1 000 000 NOK/USD 5,44<br />

Bank deposits 37,6 Capital distributions to partners 0 USD/EUR<br />

Receivables 0,0 Net Asset value of Company<br />

999 934<br />

Accrued cost 3,1 Remaining capital to be drawn<br />

Payment liability -1,1 from partners in Investment Period 1 000 000<br />

Currency Hedging 2,3 Uncalled Capital<br />

1 600 000<br />

Net Asset Value 100,0 Nominal return -66 Currency hedging as<br />

Portfolio companies uncalled capital 37,4 Committed undrawn capital 2 600 000 % of NAV 70 %<br />

Return %<br />

Nominal return of<br />

capital contributions IRR p.a. 2) IRR per quarter and accumulated for the period perioden 3)<br />

IRR p.a. 4)<br />

since foundation since foundation 1 kv 2 kv 3 kv 4 kv Per year<br />

per year<br />

0,0 % 0,0 %<br />

<strong>2007</strong> 0,0 %<br />

0,0 % 0,0 %<br />

8 portfolio investments made during Q3. Due to high<br />

demand for new project issued, the share of capital per<br />

portfolio company is lower than preferred.<br />

The portfoliocompanies are performing according to budgets<br />

except that the offshore new builds are somewhat delayed.<br />

These delays have been compensated by the sellers /<br />

charterers.<br />

For several projects, the interest rate has been fixed at better<br />

terms than assumed in the project base case calculation.<br />

Gains from interest fixing is only included in the valuation<br />

on Bulk Transloading per the end of Q3.<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

<strong>NRP</strong> FleetFinance IV DIS (NOK millions)<br />

Net asset value<br />

Capital distributions<br />

1) Accumulated return since incorporation in relation to capital contributions disregarding timing of payments<br />

Capital contr ibutions<br />

2) Internal Rate of Return (IRR) since incorporation as a yearly rate based on capital contributions, distributions and latest reported NAV.<br />

3) IRR per quarter (or relevant part of quarter) based on capital contribution, distributions and reported NAV at period end. NAV for one period is input for the next period.<br />

4) IRR as a yearly rate based on capital contributions, distributions and reported NAV at period end. Reported NAV for one period is used as input for the next period.<br />

1)-4) alle measures before tax and effect of the profit distribution agreement<br />

1 kv<br />

05<br />

2 kv<br />

05<br />

3 kv<br />

05<br />

4 kv<br />

05<br />

1 kv<br />

06<br />

2 kv<br />

06<br />

3 kv<br />

06<br />

4 kv<br />

06<br />

1 kv<br />

07<br />

2 kv<br />

07<br />

3 kv<br />

07