BEAST Magazine #1 2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8<br />

#Business | FinTech<br />

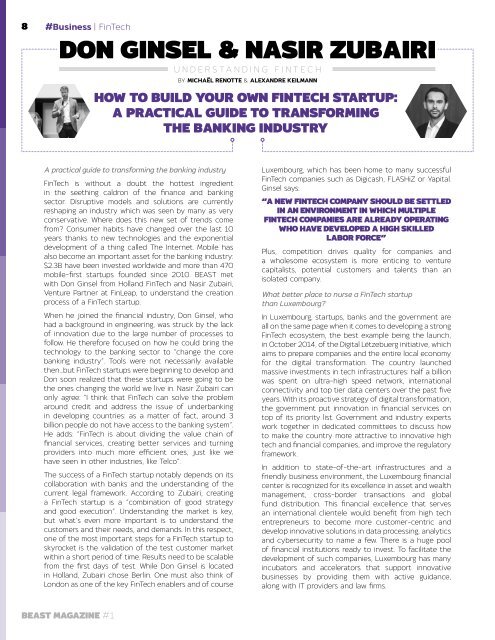

DON GINSEL & NASIR ZUBAIRI<br />

UNDERSTANDING FINTECH<br />

BY MICHAËL RENOTTE & ALEXANDRE KEILMANN<br />

HOW TO BUILD YOUR OWN FINTECH STARTUP:<br />

A PRACTICAL GUIDE TO TRANSFORMING<br />

THE BANKING INDUSTRY<br />

A practical guide to transforming the banking industry<br />

FinTech is without a doubt the hottest ingredient<br />

in the seething caldron of the finance and banking<br />

sector. Disruptive models and solutions are currently<br />

reshaping an industry which was seen by many as very<br />

conservative. Where does this new set of trends come<br />

from? Consumer habits have changed over the last 10<br />

years thanks to new technologies and the exponential<br />

development of a thing called The Internet. Mobile has<br />

also become an important asset for the banking industry:<br />

$2.3B have been invested worldwide and more than 470<br />

mobile-first startups founded since 2010. <strong>BEAST</strong> met<br />

with Don Ginsel from Holland FinTech and Nasir Zubairi,<br />

Venture Partner at FinLeap, to understand the creation<br />

process of a FinTech startup.<br />

When he joined the financial industry, Don Ginsel, who<br />

had a background in engineering, was struck by the lack<br />

of innovation due to the large number of processes to<br />

follow. He therefore focused on how he could bring the<br />

technology to the banking sector to “change the core<br />

banking industry”. Tools were not necessarily available<br />

then…but FinTech startups were beginning to develop and<br />

Don soon realized that these startups were going to be<br />

the ones changing the world we live in. Nasir Zubairi can<br />

only agree: “I think that FinTech can solve the problem<br />

around credit and address the issue of underbanking<br />

in developing countries: as a matter of fact, around 3<br />

billion people do not have access to the banking system”.<br />

He adds: “FinTech is about dividing the value chain of<br />

financial services, creating better services and turning<br />

providers into much more efficient ones, just like we<br />

have seen in other industries, like Telco”.<br />

The success of a FinTech startup notably depends on its<br />

collaboration with banks and the understanding of the<br />

current legal framework. According to Zubairi, creating<br />

a FinTech startup is a “combination of good strategy<br />

and good execution”. Understanding the market is key,<br />

but what’s even more important is to understand the<br />

customers and their needs, and demands. In this respect,<br />

one of the most important steps for a FinTech startup to<br />

skyrocket is the validation of the test customer market<br />

within a short period of time. Results need to be scalable<br />

from the first days of test. While Don Ginsel is located<br />

in Holland, Zubairi chose Berlin. One must also think of<br />

London as one of the key FinTech enablers and of course<br />

Luxembourg, which has been home to many successful<br />

FinTech companies such as Digicash, FLASHiZ or Yapital.<br />

Ginsel says:<br />

“A NEW FINTECH COMPANY SHOULD BE SETTLED<br />

IN AN ENVIRONMENT IN WHICH MULTIPLE<br />

FINTECH COMPANIES ARE ALREADY OPERATING<br />

WHO HAVE DEVELOPED A HIGH SKILLED<br />

LABOR FORCE”<br />

Plus, competition drives quality for companies and<br />

a wholesome ecosystem is more enticing to venture<br />

capitalists, potential customers and talents than an<br />

isolated company.<br />

What better place to nurse a FinTech startup<br />

than Luxembourg?<br />

In Luxembourg, startups, banks and the government are<br />

all on the same page when it comes to developing a strong<br />

FinTech ecosystem, the best example being the launch,<br />

in October 2014, of the Digital Lëtzebuerg initiative, which<br />

aims to prepare companies and the entire local economy<br />

for the digital transformation. The country launched<br />

massive investments in tech infrastructures: half a billion<br />

was spent on ultra-high speed network, international<br />

connectivity and top tier data centers over the past five<br />

years. With its proactive strategy of digital transformation,<br />

the government put innovation in financial services on<br />

top of its priority list. Government and industry experts<br />

work together in dedicated committees to discuss how<br />

to make the country more attractive to innovative high<br />

tech and financial companies, and improve the regulatory<br />

framework.<br />

In addition to state-of-the-art infrastructures and a<br />

friendly business environment, the Luxembourg financial<br />

center is recognized for its excellence in asset and wealth<br />

management, cross-border transactions and global<br />

fund distribution. This financial excellence that serves<br />

an international clientele would benefit from high tech<br />

entrepreneurs to become more customer-centric and<br />

develop innovative solutions in data processing, analytics<br />

and cybersecurity to name a few. There is a huge pool<br />

of financial institutions ready to invest. To facilitate the<br />

development of such companies, Luxembourg has many<br />

incubators and accelerators that support innovative<br />

businesses by providing them with active guidance,<br />

along with IT providers and law firms.<br />

<strong>BEAST</strong> MAGAZINE <strong>#1</strong>