Pallet-Management-Services - AFM

Pallet-Management-Services - AFM

Pallet-Management-Services - AFM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

| ANNUAL REPORT 2006 | IFCO SYSTEMS N.V. |<br />

amount of the Senior Secured Notes plus accrued and unpaid<br />

interest. A change of control, as defined, does not include a<br />

change in ownership if the sale of voting stock to an acquirer is<br />

made by holders who received this stock in connection with the<br />

conversion of the former Senior Subordinated Notes.<br />

The indenture governing the Senior Secured Notes contains<br />

a number of covenants that, among other things, limit the<br />

Company and its subsidiaries’ ability to incur additional debt,<br />

make certain restricted payments, create certain liens, dispose<br />

of assets and subsidiary capital stock, merge or consolidate,<br />

issue guarantees, pay dividends, and otherwise restrict certain<br />

corporate activities. The Senior Secured Notes also limit the<br />

Company’s obligations under finance leases to €25.0 million.<br />

The Senior Secured Notes also contain customary events of<br />

default, including non-payment of principal, interest or fees,<br />

material inaccuracy of certain representations and warranties,<br />

violation of covenants, cross-default to certain other debt,<br />

certain events of bankruptcy and insolvency, material judgments,<br />

and a change of control in certain circumstances.<br />

The Senior Secured Notes are not listed on a public market. The<br />

fair value of the Senior Secured Notes has been determined<br />

by using the fair values of comparable notes of comparable<br />

companies. These comparisons support Company’s assessment<br />

that fair value is nearly equal to nominal value.<br />

Working Capital Facility<br />

During 2004, one of the Company’s indirect European<br />

subsidiaries entered into a €20.0 million working capital<br />

facility (the Facility). The purpose of the Facility was to provide<br />

a mechanism to secure certain letters of credit which the<br />

Company had issued and to provide for liquidity as necessary<br />

for capital or working capital requirements. During 2005, the<br />

Facility was increased to €35.0 million. During 2006, the Facility<br />

was increased to €40.0 million and then to €44.0 million,<br />

respectively.<br />

Outstanding cash borrowings, which are limited to €24.0 million<br />

(US $31.7 million based on exchange rates as of December 31,<br />

2006), accrue interest at a variable rate of interest based on the<br />

Euro Over Night Index Average (Eonia), with interest payable<br />

quarterly. Due to the variability of this interest rate basis, the<br />

Company is exposed to interest rate fluctuations in that respect.<br />

No principal payments are due under the Facility, which is<br />

secured by certain assets of our European operations, until its<br />

86<br />

maturity in July 2007. The carrying amount of assets pledged<br />

is US $82.6 million.<br />

The working capital facility agreement contains financial<br />

covenants as EBITDA leverage, interest coverage and<br />

magnitude of EBIT and refundable deposit.<br />

As of December 31, 2006, there were US $3.5 million<br />

outstanding cash borrowings and approximately US $13.7<br />

million in outstanding letters of credit under the Facility.<br />

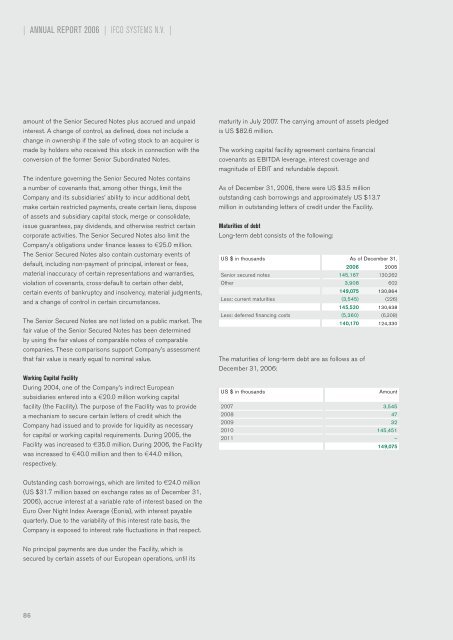

Maturities of debt<br />

Long-term debt consists of the following:<br />

US $ in thousands As of December 31,<br />

2006 2005<br />

Senior secured notes 145,167 130,262<br />

Other 3,908 602<br />

149,075 130,864<br />

Less: current maturities (3,545) (226)<br />

145,530 130,638<br />

Less: deferred financing costs (5,360) (6,308)<br />

The maturities of long-term debt are as follows as of<br />

December 31, 2006:<br />

140,170 124,330<br />

US $ in thousands Amount<br />

2007 3,545<br />

2008 47<br />

2009 32<br />

2010 145,451<br />

2011 –<br />

149,075