Pallet-Management-Services - AFM

Pallet-Management-Services - AFM

Pallet-Management-Services - AFM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The corporate loss carryforwards attributable to German<br />

operations, together with additional trade tax carryforwards<br />

(approximately US $166.5 million available as of December<br />

31, 2006), do not expire. The loss carryforwards attributable to<br />

United States operations expire between 2021 and 2024. The<br />

loss carryforwards attributable to other European countries’<br />

operations expire as follows; approximately US $0.4 million<br />

expire between 2007 and 2009, approximately US $6.9 million<br />

expire between 2010 and 2015 and the remainder does not<br />

expire. All loss carryforwards are available to offset future<br />

taxable income in their respective tax jurisdiction; however, loss<br />

carryforwards attributable to the United States are subject to<br />

a limitation of use under Internal Revenue Code Section 382<br />

and loss carryforwards attributable to Germany are subject<br />

to a limitation under German Income Tax Code Section 10d.<br />

The Company has developed certain tax planning strategies<br />

to reduce the effects of loss carryforward limitations in future<br />

years. All loss carryforwards still require final validation from<br />

the respective local taxing authorities and may be adjusted upon<br />

further review.<br />

During 2005 and 2006, the Company capitalized certain<br />

deferred tax assets in the United States and Germany, as the<br />

Company’s operating results have increased the likelihood that<br />

these deferred tax assets will be utilized over the next three<br />

(2005: two) years. The Company has a capitalized deferred tax<br />

asset based on the projected use of loss carry forwards over the<br />

next three years in amount of US $9.8 million in Germany and<br />

US $18.8 million in the United States. A positive taxable income<br />

over the next three years and the increase of the projection<br />

period from two up to three years is probable due to positive<br />

operating results already achieved in 2006 in the United States<br />

and Germany and due to the tax planning strategy in regard of<br />

the depreciation volume for RPCs in Germany. No deferred tax<br />

assets are capitalized for loss carry forwards in the total amount<br />

of US $188 million, thereof approximately US $94 million in<br />

Germany, approximately US $47 million in the United States, and<br />

approximately US $45 million in the European countries.<br />

Deferred taxes have not been recognized for temporary<br />

differences of US $18 million relating to earnings from foreign<br />

subsidiaries, either because these profits are not subject to<br />

taxation or because they are to be reinvested for an indefinite<br />

period. If deferred taxes were recognized for these temporary<br />

differences, the liability would be based on the respective<br />

withholding tax rates only, taking into account the German tax<br />

rate of 5% on corporate dividends where applicable. The amount<br />

of these unrecognized deferred tax liabilities could not be<br />

derived with reasonable effort.<br />

| FINANCIAL REPORTING | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |<br />

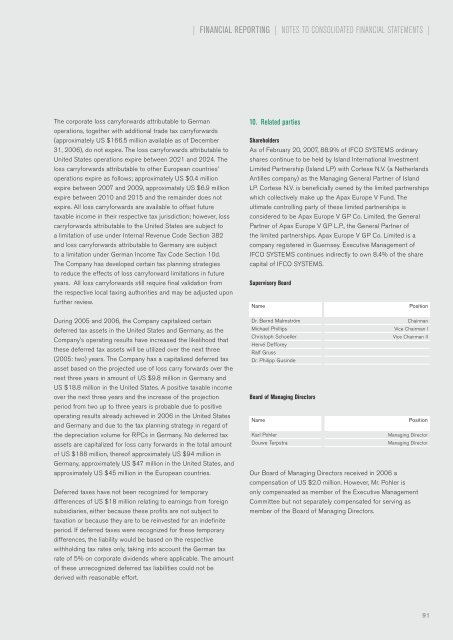

10. Related parties<br />

Shareholders<br />

As of February 20, 2007, 88.9% of IFCO SYSTEMS ordinary<br />

shares continue to be held by Island International Investment<br />

Limited Partnership (Island LP) with Cortese N.V. (a Netherlands<br />

Antilles company) as the Managing General Partner of Island<br />

LP. Cortese N.V. is beneficially owned by the limited partnerships<br />

which collectively make up the Apax Europe V Fund. The<br />

ultimate controlling party of these limited partnerships is<br />

considered to be Apax Europe V GP Co. Limited, the General<br />

Partner of Apax Europe V GP L.P., the General Partner of<br />

the limited partnerships. Apax Europe V GP Co. Limited is a<br />

company registered in Guernsey. Executive <strong>Management</strong> of<br />

IFCO SYSTEMS continues indirectly to own 8.4% of the share<br />

capital of IFCO SYSTEMS.<br />

Supervisory Board<br />

Name Position<br />

Dr. Bernd Malmström Chairman<br />

Michael Phillips Vice Chairman I<br />

Christoph Schoeller Vice Chairman II<br />

Hervé Defforey<br />

Ralf Gruss<br />

Dr. Philipp Gusinde<br />

Board of Managing Directors<br />

Name Position<br />

Karl Pohler Managing Director<br />

Douwe Terpstra Managing Director<br />

Our Board of Managing Directors received in 2006 a<br />

compensation of US $2.0 million. However, Mr. Pohler is<br />

only compensated as member of the Executive <strong>Management</strong><br />

Committee but not separately compensated for serving as<br />

member of the Board of Managing Directors.<br />

91