Pallet-Management-Services - AFM

Pallet-Management-Services - AFM

Pallet-Management-Services - AFM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Receivable factoring<br />

In 2006, a subsidiary of IFCO SYSTEMS Europe entered into<br />

non-recourse factoring agreement under which this European<br />

subsidiary may offer all of their trade receivables to third-party<br />

factoring companies. Under the factoring agreement, the sales<br />

price is the nominal value of the receivable less a factoring<br />

fee. The third-party factoring companies have the right to<br />

collect the receivables and bear the collection risk. Under these<br />

agreements, there is a factoring fee ranging from 0.10% to<br />

0.25% of the nominal value of the factored receivables and the<br />

interest rate on cash advances relating to factored receivables<br />

at rates ranging from 4.73% to 5.23% as of December 31,<br />

2006. The Company’s European subsidiaries incurred factoring<br />

charges and factoring-related interest charges of<br />

US $0.4 million and US $0.3 million during 2006 and 2005,<br />

respectively, which are shown as factoring charges in the<br />

accompanying consolidated statements of income.<br />

Finance lease obligations<br />

The Company has entered into leases with unaffiliated third<br />

parties principally for RPCs in Europe that are accounted for as<br />

finance leases. The RPC finance leases are part of<br />

sale-leaseback transactions in which the Company has sold<br />

the RPCs to third parties, which then leases them back to the<br />

Company. The RPC finance leases cover approximately 10.2<br />

million RPCs as of December 31, 2006. Upon termination<br />

of certain of these leases, the Company has the option to<br />

repurchase the RPCs. All of these lease agreements require<br />

the Company to repurchase the leased RPCs on the lessor’s<br />

demand.<br />

The Company has also entered in finance leases covering<br />

certain operating equipment. These contracts have bargain<br />

purchase options at the end of the lease period, which the<br />

Company intends to exercise.<br />

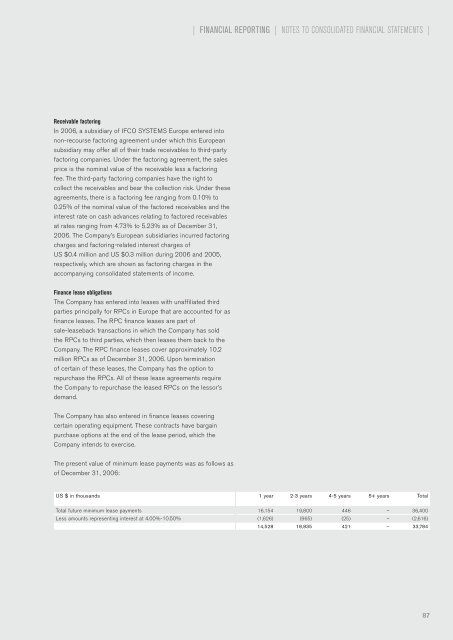

The present value of minimum lease payments was as follows as<br />

of December 31, 2006:<br />

| FINANCIAL REPORTING | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |<br />

US $ in thousands 1 year 2-3 years 4-5 years 5+ years Total<br />

Total future minimum lease payments 16,154 19,800 446 – 36,400<br />

Less amounts representing interest at 4.00%-10.50% (1,626) (965) (25) – (2,616)<br />

14,528 18,835 421 – 33,784<br />

87