QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

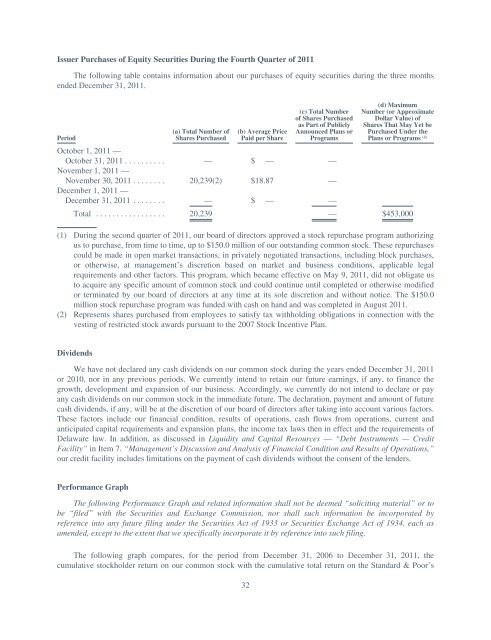

Issuer Purchases of Equity Securities During the Fourth Quarter of 2011<br />

The following table contains information about our purchases of equity securities during the three months<br />

ended December 31, 2011.<br />

Period<br />

(a) Total Number of<br />

Shares Purchased<br />

(b) Average Price<br />

Paid per Share<br />

(c) Total Number<br />

of Shares Purchased<br />

as Part of Publicly<br />

Announced Plans or<br />

Programs<br />

October 1, 2011 —<br />

October 31, 2011 .......... — $ — —<br />

November 1, 2011 —<br />

November 30, 2011 ........ 20,239(2) $18.87 —<br />

December 1, 2011 —<br />

December 31, 2011 ........ — $ — —<br />

(d) Maximum<br />

Number (or Approximate<br />

Dollar Value) of<br />

Shares That May Yet be<br />

Purchased Under the<br />

Plans or Programs (1)<br />

Total ................. 20,239 — $453,000<br />

(1) During the second quarter of 2011, our board of directors approved a stock repurchase program authorizing<br />

us to purchase, from time to time, up to $150.0 million of our outstanding common stock. These repurchases<br />

could be made in open market transactions, in privately negotiated transactions, including block purchases,<br />

or otherwise, at management’s discretion based on market and business conditions, applicable legal<br />

requirements and other factors. This program, which became effective on May 9, 2011, did not obligate us<br />

to acquire any specific amount of common stock and could continue until completed or otherwise modified<br />

or terminated by our board of directors at any time at its sole discretion and without notice. The $150.0<br />

million stock repurchase program was funded with cash on hand and was completed in August 2011.<br />

(2) Represents shares purchased from employees to satisfy tax withholding obligations in connection with the<br />

vesting of restricted stock awards pursuant to the 2007 Stock Incentive Plan.<br />

Dividends<br />

We have not declared any cash dividends on our common stock during the years ended December 31, 2011<br />

or 2010, nor in any previous periods. We currently intend to retain our future earnings, if any, to finance the<br />

growth, development and expansion of our business. Accordingly, we currently do not intend to declare or pay<br />

any cash dividends on our common stock in the immediate future. The declaration, payment and amount of future<br />

cash dividends, if any, will be at the discretion of our board of directors after taking into account various factors.<br />

These factors include our financial condition, results of operations, cash flows from operations, current and<br />

anticipated capital requirements and expansion plans, the income tax laws then in effect and the requirements of<br />

Delaware law. In addition, as discussed in Liquidity and Capital Resources — “Debt Instruments — Credit<br />

Facility” in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”<br />

our credit facility includes limitations on the payment of cash dividends without the consent of the lenders.<br />

Performance Graph<br />

The following Performance Graph and related information shall not be deemed “soliciting material” or to<br />

be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by<br />

reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as<br />

amended, except to the extent that we specifically incorporate it by reference into such filing.<br />

The following graph compares, for the period from December 31, 2006 to December 31, 2011, the<br />

cumulative stockholder return on our common stock with the cumulative total return on the Standard & Poor’s<br />

32