QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

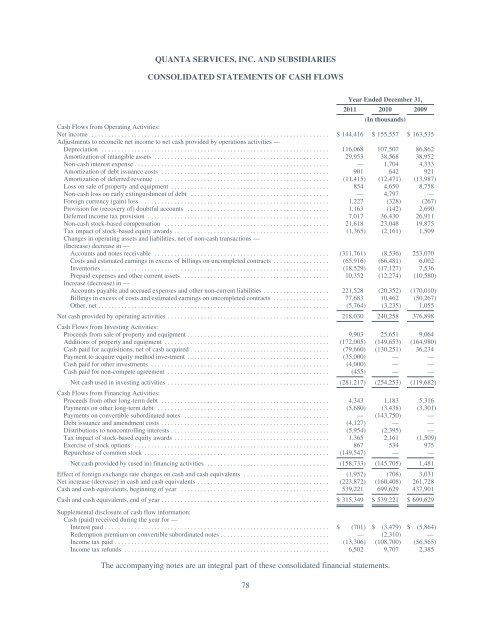

<strong>QUANTA</strong> <strong>SERVICES</strong>, <strong>INC</strong>. AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

Year Ended December 31,<br />

2011 2010<br />

(In thousands)<br />

2009<br />

Cash Flows from Operating Activities:<br />

Net income ........................................................................<br />

Adjustments to reconcile net income to net cash provided by operations activities —<br />

$144,416 $ 155,557 $ 163,535<br />

Depreciation ..................................................................... 116,068 107,507 86,862<br />

Amortization of intangible assets ..................................................... 29,953 38,568 38,952<br />

Non-cash interest expense ........................................................... — 1,704 4,333<br />

Amortization of debt issuance costs ................................................... 901 642 921<br />

Amortization of deferred revenue ..................................................... (11,415) (12,471) (13,987)<br />

Loss on sale of property and equipment ................................................ 854 4,650 8,758<br />

Non-cash loss on early extinguishment of debt .......................................... — 4,797 —<br />

Foreign currency (gain) loss ......................................................... 1,227 (328) (267)<br />

Provision for (recovery of) doubtful accounts ........................................... 1,163 (142) 2,690<br />

Deferred income tax provision ....................................................... 7,017 36,430 26,911<br />

Non-cash stock-based compensation .................................................. 21,618 23,048 19,875<br />

Tax impact of stock-based equity awards ...............................................<br />

Changes in operating assets and liabilities, net of non-cash transactions —<br />

(Increase) decrease in —<br />

(1,365) (2,161) 1,509<br />

Accounts and notes receivable ..................................................... (311,761) (8,536) 253,070<br />

Costs and estimated earnings in excess of billings on uncompleted contracts ................. (65,916) (66,481) 6,002<br />

Inventories ..................................................................... (18,529) (17,127) 7,536<br />

Prepaid expenses and other current assets ............................................<br />

Increase (decrease) in —<br />

10,352 (12,274) (10,580)<br />

Accounts payable and accrued expenses and other non-current liabilities .................... 221,528 (20,352) (170,010)<br />

Billings in excess of costs and estimated earnings on uncompleted contracts ................. 77,683 10,462 (50,267)<br />

Other, net ...................................................................... (5,764) (3,235) 1,055<br />

Net cash provided by operating activities ................................................. 218,030 240,258 376,898<br />

Cash Flows from Investing Activities:<br />

Proceeds from sale of property and equipment ........................................... 9,903 25,651 9,064<br />

Additions of property and equipment .................................................. (172,005) (149,653) (164,980)<br />

Cash paid for acquisitions, net of cash acquired .......................................... (79,660) (130,251) 36,234<br />

Payment to acquire equity method investment ........................................... (35,000) — —<br />

Cash paid for other investments ...................................................... (4,000) — —<br />

Cash paid for non-compete agreement ................................................. (455) — —<br />

Net cash used in investing activities ................................................. (281,217) (254,253) (119,682)<br />

Cash Flows from Financing Activities:<br />

Proceeds from other long-term debt ................................................... 4,343 1,183 5,316<br />

Payments on other long-term debt .................................................... (5,680) (3,438) (3,301)<br />

Payments on convertible subordinated notes ............................................ — (143,750) —<br />

Debt issuance and amendment costs ................................................... (4,127) — —<br />

Distributions to noncontrolling interests ................................................ (5,954) (2,395) —<br />

Tax impact of stock-based equity awards ............................................... 1,365 2,161 (1,509)<br />

Exercise of stock options ........................................................... 867 534 975<br />

Repurchase of common stock ........................................................ (149,547) — —<br />

Net cash provided by (used in) financing activities ..................................... (158,733) (145,705) 1,481<br />

Effect of foreign exchange rate changes on cash and cash equivalents .......................... (1,952) (708) 3,031<br />

Net increase (decrease) in cash and cash equivalents ........................................ (223,872) (160,408) 261,728<br />

Cash and cash equivalents, beginning of year ............................................. 539,221 699,629 437,901<br />

Cash and cash equivalents, end of year ................................................... $315,349 $ 539,221 $ 699,629<br />

Supplemental disclosure of cash flow information:<br />

Cash (paid) received during the year for —<br />

Interest paid .................................................................... $ (701) $ (3,479) $ (5,864)<br />

Redemption premium on convertible subordinated notes ................................. — (2,310) —<br />

Income tax paid ................................................................. (13,306) (108,700) (56,565)<br />

Income tax refunds .............................................................. 6,502 9,707 2,385<br />

The accompanying notes are an integral part of these consolidated financial statements.<br />

78