QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

QUANTA SERVICES INC, QUANTA SERVICES MANAGEMENT ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>QUANTA</strong> <strong>SERVICES</strong>, <strong>INC</strong>. AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)<br />

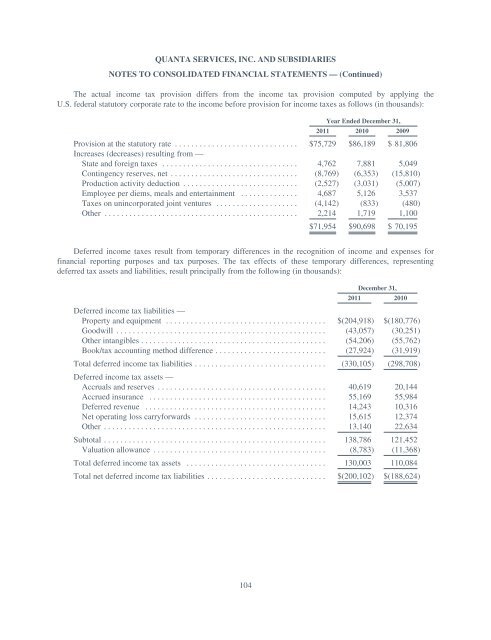

The actual income tax provision differs from the income tax provision computed by applying the<br />

U.S. federal statutory corporate rate to the income before provision for income taxes as follows (in thousands):<br />

Year Ended December 31,<br />

2011 2010 2009<br />

Provision at the statutory rate ..............................<br />

Increases (decreases) resulting from —<br />

$75,729 $86,189 $ 81,806<br />

State and foreign taxes ................................. 4,762 7,881 5,049<br />

Contingency reserves, net ............................... (8,769) (6,353) (15,810)<br />

Production activity deduction ............................ (2,527) (3,031) (5,007)<br />

Employee per diems, meals and entertainment .............. 4,687 5,126 3,537<br />

Taxes on unincorporated joint ventures .................... (4,142) (833) (480)<br />

Other ............................................... 2,214 1,719 1,100<br />

$71,954 $90,698 $ 70,195<br />

Deferred income taxes result from temporary differences in the recognition of income and expenses for<br />

financial reporting purposes and tax purposes. The tax effects of these temporary differences, representing<br />

deferred tax assets and liabilities, result principally from the following (in thousands):<br />

December 31,<br />

2011 2010<br />

Deferred income tax liabilities —<br />

Property and equipment ....................................... $(204,918) $(180,776)<br />

Goodwill ................................................... (43,057) (30,251)<br />

Other intangibles ............................................. (54,206) (55,762)<br />

Book/tax accounting method difference ........................... (27,924) (31,919)<br />

Total deferred income tax liabilities ................................ (330,105) (298,708)<br />

Deferred income tax assets —<br />

Accruals and reserves ......................................... 40,619 20,144<br />

Accrued insurance ........................................... 55,169 55,984<br />

Deferred revenue ............................................ 14,243 10,316<br />

Net operating loss carryforwards ................................ 15,615 12,374<br />

Other ...................................................... 13,140 22,634<br />

Subtotal ...................................................... 138,786 121,452<br />

Valuation allowance .......................................... (8,783) (11,368)<br />

Total deferred income tax assets .................................. 130,003 110,084<br />

Total net deferred income tax liabilities ............................. $(200,102) $(188,624)<br />

104