- Page 1 and 2:

RepoRt to the CongRess Medicare Pay

- Page 3:

RepoRt to tHe CongRess Medicare Pay

- Page 6 and 7:

with the structure of the payment s

- Page 9 and 10:

table of contents Acknowledgments .

- Page 11:

executive summary

- Page 14 and 15:

of services—and pressure on feder

- Page 16 and 17:

current Medicare payments are adequ

- Page 18 and 19:

outpatient dialysis services Outpat

- Page 20 and 21:

some facilities are willing to acce

- Page 22 and 23:

coverage for conventional treatment

- Page 24 and 25:

of care for these conditions should

- Page 27:

Context for Medicare payment policy

- Page 30 and 31:

4 Context for Medicare payment poli

- Page 32 and 33:

FIguRe FIGURE 1-2 1-2 12% Out of po

- Page 34 and 35:

the level of health care spending a

- Page 36 and 37:

1-4 FIguRe 1-4 140 120 100 80 60 Do

- Page 38 and 39:

FIguRe 1-6 1-6 Growth rate (in perc

- Page 40 and 41:

FIGURE FIguRe Share of GDP (in perc

- Page 42 and 43:

Share of GDP (in percent) FIGURE 1-

- Page 44 and 45:

FIGURE FIguRe 1-10 1-10 8% African

- Page 46 and 47:

FIguRe 1-12 1-11 1800 1600 1400 120

- Page 48 and 49:

Americans than for other racial and

- Page 50 and 51:

References Agency for Healthcare Re

- Page 52 and 53:

Medicare Payment Advisory Commissio

- Page 55 and 56:

Assessing payment adequacy and upda

- Page 57 and 58:

The goal of Medicare payment policy

- Page 59 and 60:

may go up when payment rates go dow

- Page 61 and 62:

hospitals and that hospitals shift

- Page 63 and 64:

individual payment systems but also

- Page 65 and 66:

Hospital inpatient and outpatient s

- Page 67 and 68:

Hospital inpatient and outpatient s

- Page 69:

covered the fully allocated costs o

- Page 72 and 73:

3-1 3-1 FIguRe 100 80 60 40 Number

- Page 74 and 75:

Visits or claims per 1,000 benefici

- Page 76 and 77:

3-4 3-4 FIguRe 2012 dollars (in bil

- Page 78 and 79:

of physicians employed directly by

- Page 80 and 81:

FIguRe FIGURE Annual percent change

- Page 82 and 83:

FIGURE FIguRe Margin (in percent) 3

- Page 84 and 85:

FIGURE FIguRe Margin (in percent) 3

- Page 86 and 87:

tABLe 3-5 performance of efficient

- Page 88 and 89:

Act, the EHR Incentive Program also

- Page 90 and 91:

as Medicaid expands, the new insura

- Page 92 and 93:

ates for separately paid drugs resu

- Page 94 and 95:

endnotes 1 From 2002 to 2011, 479 h

- Page 96 and 97:

References Agency for Healthcare Re

- Page 99 and 100:

C H A p t e R4 physician and other

- Page 101 and 102:

physician and other health professi

- Page 103:

from the SGR system in its October

- Page 106 and 107:

4-1 4-1 FIguRe 40 35 30 25 20 15 10

- Page 108 and 109:

tABLe 4-1 Most aged Medicare benefi

- Page 110 and 111:

tABLe 4-2 Medicare beneficiaries ha

- Page 112 and 113:

payment adjustments for health prof

- Page 114 and 115:

tABLe 4-3 Year physicians primary c

- Page 116 and 117:

provider’s characteristics, geogr

- Page 118 and 119:

tABLe 4-4 type of service Change in

- Page 120 and 121:

tABLe 4-5 type of imaging Change in

- Page 122 and 123:

the patient-centered medical home T

- Page 124 and 125:

FIguRe FIGURE Cumulative percent ch

- Page 126 and 127:

References ABIM Foundation. 2012. C

- Page 129 and 130:

Ambulatory surgical center services

- Page 131 and 132:

Ambulatory surgical center services

- Page 133 and 134:

Background An ambulatory surgical c

- Page 135 and 136:

Differences in types of patients tr

- Page 137 and 138:

Differences in types of patients tr

- Page 139 and 140:

number of services grew from 2006 t

- Page 141 and 142:

tABLe 5-7 rapidly than nonowning ph

- Page 143 and 144:

Creating a value-based purchasing p

- Page 145 and 146:

Revisiting the ambulatory surgical

- Page 147 and 148:

endnotes 1 Because CMS updates paym

- Page 149:

Medicare Payment Advisory Commissio

- Page 152 and 153:

R e C o M M e n D A t I o n 6 The C

- Page 154 and 155:

128 Outpatient dialysis services: A

- Page 156 and 157:

tABLe 6-1 Characteristics of FFs di

- Page 158 and 159:

Physicians Association has publishe

- Page 160 and 161:

tABLe 6-3 Increasing number and cap

- Page 162 and 163:

Number of FFS dialysis beneficiarie

- Page 164 and 165:

FIguRe 6-3 Percent of dialysis bene

- Page 166 and 167:

and 2011, the proportion of adult h

- Page 168 and 169:

anticipated under the modernized pa

- Page 170 and 171:

endnotes 1 In this chapter, we use

- Page 172 and 173:

References ABIM Foundation. 2012. C

- Page 175: C H A p t e R7 post-acute care prov

- Page 178 and 179: encourages more 60-day episodes. Fu

- Page 181 and 182: C H A p t e R8 skilled nursing faci

- Page 183 and 184: skilled nursing facility services C

- Page 185: adjust for differences in patients

- Page 188 and 189: Description of beneficiaries who us

- Page 190 and 191: snF prospective payment system and

- Page 192 and 193: Number of SNFs FIguRe FIGURE 8-1 7-

- Page 194 and 195: FIGURE FIguRe Percent 7-2 8-2 30 25

- Page 196 and 197: and other SNF users were essentiall

- Page 198 and 199: FIguRe FIGURE Program spending (in

- Page 200 and 201: 7-8 8-6 FIguRe 30 25 20 15 10 Medic

- Page 202 and 203: (e.g., whether there is a requireme

- Page 204 and 205: the Commission’s 2012 update reco

- Page 206 and 207: tABLe 8-9 non-Medicare margins were

- Page 208 and 209: found to be associated with one or

- Page 210 and 211: Smith, V. K., K. Gifford, E. Ellis,

- Page 212 and 213: R e C o M M e n D A t I o n s (The

- Page 214 and 215: 188 Home health care services: Asse

- Page 216 and 217: tABLe 9-1 use and growth of home he

- Page 218 and 219: FIGURE FIguRe Number of new agencie

- Page 220 and 221: tABLe 9-2 of services. The review a

- Page 222 and 223: tABLe 9-4 Community-admitted home h

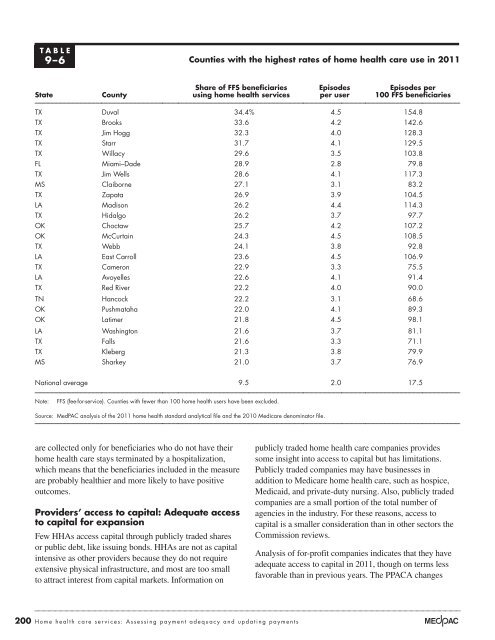

- Page 224 and 225: tABLe 9-5 type of county Claims dat

- Page 228 and 229: tABLe 9-8 Medicare margins for free

- Page 230 and 231: tABLe 9-11 provider characteristics

- Page 232 and 233: tABLe 9-12 Medicare visits per full

- Page 234 and 235: strengthening incentives for effect

- Page 236 and 237: endnotes 1 The exceptions pertain t

- Page 239 and 240: C H A p t e R10 Inpatient rehabilit

- Page 241 and 242: Inpatient rehabilitation facility s

- Page 243 and 244: FIguRe FIGURE 10-1 9-1 Note: IRF (i

- Page 245 and 246: Medicare IRF classification require

- Page 247 and 248: tABLe 10-2 type of IRF 2004 2005 20

- Page 249 and 250: tABLe 10-4 number of IRF beds decre

- Page 251 and 252: weight for compliant cases was 1.39

- Page 253 and 254: unobserved factors regarding patien

- Page 255 and 256: freestanding IRFs were about $4,340

- Page 257 and 258: increase for changes in the outlier

- Page 259: References Centers for Medicare & M

- Page 262 and 263: R e C o M M e n D A t I o n 11 The

- Page 264 and 265: Quality of care—LTCHs only recent

- Page 266 and 267: FIguRe FIGURE 11-1 10-1 Source: Med

- Page 268 and 269: short-stay outlier cases in long-te

- Page 270 and 271: tABLe 11-1 growth in the number of

- Page 272 and 273: Chronically critically ill benefici

- Page 274 and 275: Quality measures for long-term care

- Page 276 and 277:

tABLe 11-4 type of LtCH per case pa

- Page 278 and 279:

temporary legislative relief from s

- Page 280 and 281:

16 We observed growth over time in

- Page 282 and 283:

Durairaj, L., J. C. Torner, E. A. C

- Page 285 and 286:

Hospice services C H A p t e R12

- Page 287 and 288:

Hospice services Chapter summary Th

- Page 289 and 290:

Background Medicare began offering

- Page 291 and 292:

March 2009 Commission recommendatio

- Page 293 and 294:

March 2009 Commission recommendatio

- Page 295 and 296:

number peaking in 2009). With rapid

- Page 297 and 298:

tABLe 12-4 Hospice use has increase

- Page 299 and 300:

tABLe 12-5 Characteristic insurers

- Page 301 and 302:

three settings, respectively) (Tabl

- Page 303 and 304:

measures, it is likely that the vas

- Page 305 and 306:

tABLe 12-10 Category percentage poi

- Page 307 and 308:

• additional wage index changes,

- Page 309 and 310:

elieve the cost report data provide

- Page 311:

C H A p t e R13 the Medicare Advant

- Page 314 and 315:

288 The Medicare Advantage program:

- Page 317 and 318:

The Medicare Advantage (MA) program

- Page 319 and 320:

enchmark. If a plan’s bid is abov

- Page 321 and 322:

tABLe 13-3 projected payments excee

- Page 323 and 324:

We broke the fourth quartile into t

- Page 325 and 326:

tABLe 13-5 Distribution of enrollme

- Page 327 and 328:

tABLe 13-6 examples of measures inc

- Page 329 and 330:

tABLe 13-7 Between 2011 and 2012, l

- Page 331 and 332:

tABLe 13-9 admission-weighted ratio

- Page 333 and 334:

ecommended that payments be brought

- Page 335 and 336:

eport HEDIS measures based on admin

- Page 337 and 338:

C H A p t e R14 Medicare Advantage

- Page 339 and 340:

Medicare Advantage special needs pl

- Page 341:

integrating Medicaid benefits. We f

- Page 344 and 345:

tABLe 14-1 Distribution of snp enro

- Page 346 and 347:

previous Commission recommendations

- Page 348 and 349:

tABLe 14-4 Readmission rates by typ

- Page 350 and 351:

There has been recent movement in t

- Page 352 and 353:

of the quality measures that only S

- Page 354 and 355:

Separate appeals and grievances pro

- Page 356 and 357:

References Government Accountabilit

- Page 359 and 360:

status report on part D Chapter sum

- Page 361:

controlling growth in drug spending

- Page 364 and 365:

tABLe 15-2 and pharmacists who part

- Page 366 and 367:

Characteristics of Medicare benefic

- Page 368 and 369:

tABLe 15-6 Distribution of enrollme

- Page 370 and 371:

FIGURE FIguRe Percent of all Part D

- Page 372 and 373:

3). Most regions continue to have m

- Page 374 and 375:

tABLe 15-9 • Reinsurance—Medica

- Page 376 and 377:

tABLe 15-11 toward the OOP threshol

- Page 378 and 379:

tABLe 15-12 Cost-sharing amounts fo

- Page 380 and 381:

tABLe 15-14 enrollees—by about $9

- Page 382 and 383:

Drug price index equal to 1.0 at th

- Page 384 and 385:

Voluntary switchers Each year, Part

- Page 386 and 387:

endnotes 1 PPACA eliminates the cov

- Page 388 and 389:

References Boards of Trustees, Fede

- Page 391 and 392:

Commissioners’ voting on recommen

- Page 393 and 394:

Chapter 12: Hospice services The Co

- Page 395:

A p p e n D I X Moving forward from

- Page 398 and 399:

well as the cost of temporary repri

- Page 400 and 401:

payments rates be frozen at their c

- Page 402 and 403:

than primary care physicians (class

- Page 404 and 405:

achieving a total estimated 10-year

- Page 406 and 407:

would be costly, too, and they are

- Page 408 and 409:

payment accuracy. For example, such

- Page 410 and 411:

Final regulations on the ACO progra

- Page 412 and 413:

statemen nt of MedPAC’s position

- Page 414 and 415:

Cumulative percent change 70 7 60 6

- Page 416 and 417:

390 Moving forward from the sustain

- Page 418 and 419:

Note: The availability and scoring

- Page 421 and 422:

Acronyms AAgR average annual growth

- Page 423:

op outpatient opD hospital outpatie

- Page 427:

Commission members glenn M. Hackbar

- Page 430 and 431:

a state society of the National Med

- Page 432 and 433:

on the Advocate Physician Partners

- Page 435:

425 eye street, nW • suite 701