Your document headline

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

d. In the near future.<br />

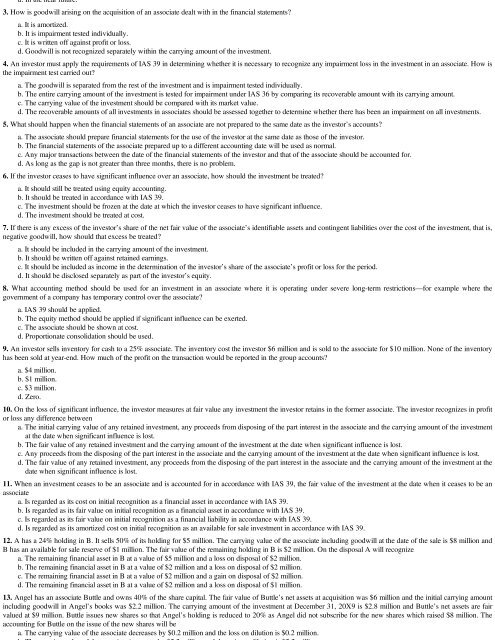

3. How is goodwill arising on the acquisition of an associate dealt with in the financial statements?<br />

a. It is amortized.<br />

b. It is impairment tested individually.<br />

c. It is written off against profit or loss.<br />

d. Goodwill is not recognized separately within the carrying amount of the investment.<br />

4. An investor must apply the requirements of IAS 39 in determining whether it is necessary to recognize any impairment loss in the investment in an associate. How is<br />

the impairment test carried out?<br />

a. The goodwill is separated from the rest of the investment and is impairment tested individually.<br />

b. The entire carrying amount of the investment is tested for impairment under IAS 36 by comparing its recoverable amount with its carrying amount.<br />

c. The carrying value of the investment should be compared with its market value.<br />

d. The recoverable amounts of all investments in associates should be assessed together to determine whether there has been an impairment on all investments.<br />

5. What should happen when the financial statements of an associate are not prepared to the same date as the investor’s accounts?<br />

a. The associate should prepare financial statements for the use of the investor at the same date as those of the investor.<br />

b. The financial statements of the associate prepared up to a different accounting date will be used as normal.<br />

c. Any major transactions between the date of the financial statements of the investor and that of the associate should be accounted for.<br />

d. As long as the gap is not greater than three months, there is no problem.<br />

6. If the investor ceases to have significant influence over an associate, how should the investment be treated?<br />

a. It should still be treated using equity accounting.<br />

b. It should be treated in accordance with IAS 39.<br />

c. The investment should be frozen at the date at which the investor ceases to have significant influence.<br />

d. The investment should be treated at cost.<br />

7. If there is any excess of the investor’s share of the net fair value of the associate’s identifiable assets and contingent liabilities over the cost of the investment, that is,<br />

negative goodwill, how should that excess be treated?<br />

a. It should be included in the carrying amount of the investment.<br />

b. It should be written off against retained earnings.<br />

c. It should be included as income in the determination of the investor’s share of the associate’s profit or loss for the period.<br />

d. It should be disclosed separately as part of the investor’s equity.<br />

8. What accounting method should be used for an investment in an associate where it is operating under severe long-term restrictions—for example where the<br />

government of a company has temporary control over the associate?<br />

a. IAS 39 should be applied.<br />

b. The equity method should be applied if significant influence can be exerted.<br />

c. The associate should be shown at cost.<br />

d. Proportionate consolidation should be used.<br />

9. An investor sells inventory for cash to a 25% associate. The inventory cost the investor $6 million and is sold to the associate for $10 million. None of the inventory<br />

has been sold at year-end. How much of the profit on the transaction would be reported in the group accounts?<br />

a. $4 million.<br />

b. $1 million.<br />

c. $3 million.<br />

d. Zero.<br />

10. On the loss of significant influence, the investor measures at fair value any investment the investor retains in the former associate. The investor recognizes in profit<br />

or loss any difference between<br />

a. The initial carrying value of any retained investment, any proceeds from disposing of the part interest in the associate and the carrying amount of the investment<br />

at the date when significant influence is lost.<br />

b. The fair value of any retained investment and the carrying amount of the investment at the date when significant influence is lost.<br />

c. Any proceeds from the disposing of the part interest in the associate and the carrying amount of the investment at the date when significant influence is lost.<br />

d. The fair value of any retained investment, any proceeds from the disposing of the part interest in the associate and the carrying amount of the investment at the<br />

date when significant influence is lost.<br />

11. When an investment ceases to be an associate and is accounted for in accordance with IAS 39, the fair value of the investment at the date when it ceases to be an<br />

associate<br />

a. Is regarded as its cost on initial recognition as a financial asset in accordance with IAS 39.<br />

b. Is regarded as its fair value on initial recognition as a financial asset in accordance with IAS 39.<br />

c. Is regarded as its fair value on initial recognition as a financial liability in accordance with IAS 39.<br />

d. Is regarded as its amortized cost on initial recognition as an available for sale investment in accordance with IAS 39.<br />

12. A has a 24% holding in B. It sells 50% of its holding for $5 million. The carrying value of the associate including goodwill at the date of the sale is $8 million and<br />

B has an available for sale reserve of $1 million. The fair value of the remaining holding in B is $2 million. On the disposal A will recognize<br />

a. The remaining financial asset in B at a value of $5 million and a loss on disposal of $2 million.<br />

b. The remaining financial asset in B at a value of $2 million and a loss on disposal of $2 million.<br />

c. The remaining financial asset in B at a value of $2 million and a gain on disposal of $2 million.<br />

d. The remaining financial asset in B at a value of $2 million and a loss on disposal of $1 million.<br />

13. Angel has an associate Buttle and owns 40% of the share capital. The fair value of Buttle’s net assets at acquisition was $6 million and the initial carrying amount<br />

including goodwill in Angel’s books was $2.2 million. The carrying amount of the investment at December 31, 20X9 is $2.8 million and Buttle’s net assets are fair<br />

valued at $9 million. Buttle issues new shares so that Angel’s holding is reduced to 20% as Angel did not subscribe for the new shares which raised $8 million. The<br />

accounting for Buttle on the issue of the new shares will be<br />

a. The carrying value of the associate decreases by $0.2 million and the loss on dilution is $0.2 million.