Your document headline

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements presented by an entity in the current year would qualify as “first IFRS financial statements,” as explained in the Standard, if an entity presented<br />

its most recent previous financial statements:<br />

1. Under national generally accepted accounting principles or Standards that were inconsistent with IFRS in all respects<br />

2. In conformity with IFRS in all respects, however, these financial statements did not contain an explicit and unreserved statement that they complied with IFRS<br />

3. Categorically stating that the financial statements comply with certain IFRS but not all<br />

4. Under national GAAP or Standards that differ from IFRS but using some individual IFRS to account for items that are not addressed by its national GAAP or<br />

Standards<br />

5. Under national GAAP or Standards with a reconciliation of some items to amounts determined under IFRS<br />

Other examples of situations when an entity’s current year’s financial statements would qualify as “first IFRS financial statements” are when<br />

6. The entity prepared financial statements in the previous period under IFRS but the financial statements were meant for “internal use only” and were not made<br />

available to the entity’s owners or any other external users<br />

7. The entity prepared a reporting package in the previous period under IFRS for consolidation purposes without preparing a complete set of financial statements<br />

as mandated by IAS 1<br />

8. The entity did not present financial statements for the previous periods<br />

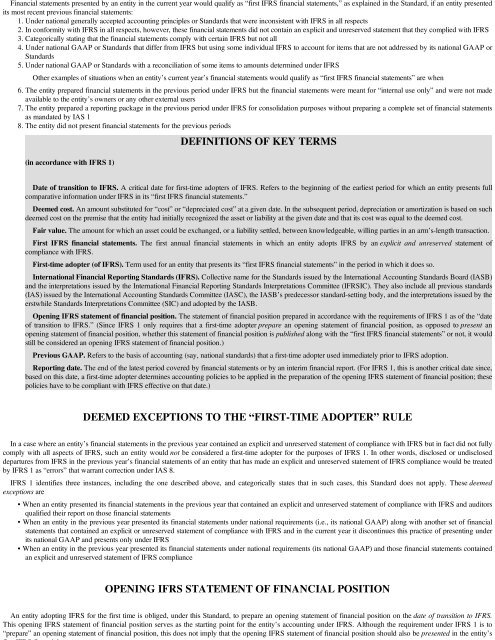

(in accordance with IFRS 1)<br />

DEFINITIONS OF KEY TERMS<br />

Date of transition to IFRS. A critical date for first-time adopters of IFRS. Refers to the beginning of the earliest period for which an entity presents full<br />

comparative information under IFRS in its “first IFRS financial statements.”<br />

Deemed cost. An amount substituted for “cost” or “depreciated cost” at a given date. In the subsequent period, depreciation or amortization is based on such<br />

deemed cost on the premise that the entity had initially recognized the asset or liability at the given date and that its cost was equal to the deemed cost.<br />

Fair value. The amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s-length transaction.<br />

First IFRS financial statements. The first annual financial statements in which an entity adopts IFRS by an explicit and unreserved statement of<br />

compliance with IFRS.<br />

First-time adopter (of IFRS). Term used for an entity that presents its “first IFRS financial statements” in the period in which it does so.<br />

International Financial Reporting Standards (IFRS). Collective name for the Standards issued by the International Accounting Standards Board (IASB)<br />

and the interpretations issued by the International Financial Reporting Standards Interpretations Committee (IFRSIC). They also include all previous standards<br />

(IAS) issued by the International Accounting Standards Committee (IASC), the IASB’s predecessor standard-setting body, and the interpretations issued by the<br />

erstwhile Standards Interpretations Committee (SIC) and adopted by the IASB.<br />

Opening IFRS statement of financial position. The statement of financial position prepared in accordance with the requirements of IFRS 1 as of the “date<br />

of transition to IFRS.” (Since IFRS 1 only requires that a first-time adopter prepare an opening statement of financial position, as opposed to present an<br />

opening statement of financial position, whether this statement of financial position is published along with the “first IFRS financial statements” or not, it would<br />

still be considered an opening IFRS statement of financial position.)<br />

Previous GAAP. Refers to the basis of accounting (say, national standards) that a first-time adopter used immediately prior to IFRS adoption.<br />

Reporting date. The end of the latest period covered by financial statements or by an interim financial report. (For IFRS 1, this is another critical date since,<br />

based on this date, a first-time adopter determines accounting policies to be applied in the preparation of the opening IFRS statement of financial position; these<br />

policies have to be compliant with IFRS effective on that date.)<br />

DEEMED EXCEPTIONS TO THE “FIRST-TIME ADOPTER” RULE<br />

In a case where an entity’s financial statements in the previous year contained an explicit and unreserved statement of compliance with IFRS but in fact did not fully<br />

comply with all aspects of IFRS, such an entity would not be considered a first-time adopter for the purposes of IFRS 1. In other words, disclosed or undisclosed<br />

departures from IFRS in the previous year’s financial statements of an entity that has made an explicit and unreserved statement of IFRS compliance would be treated<br />

by IFRS 1 as “errors” that warrant correction under IAS 8.<br />

IFRS 1 identifies three instances, including the one described above, and categorically states that in such cases, this Standard does not apply. These deemed<br />

exceptions are<br />

• When an entity presented its financial statements in the previous year that contained an explicit and unreserved statement of compliance with IFRS and auditors<br />

qualified their report on those financial statements<br />

• When an entity in the previous year presented its financial statements under national requirements (i.e., its national GAAP) along with another set of financial<br />

statements that contained an explicit or unreserved statement of compliance with IFRS and in the current year it discontinues this practice of presenting under<br />

its national GAAP and presents only under IFRS<br />

• When an entity in the previous year presented its financial statements under national requirements (its national GAAP) and those financial statements contained<br />

an explicit and unreserved statement of IFRS compliance<br />

OPENING IFRS STATEMENT OF FINANCIAL POSITION<br />

An entity adopting IFRS for the first time is obliged, under this Standard, to prepare an opening statement of financial position on the date of transition to IFRS.<br />

This opening IFRS statement of financial position serves as the starting point for the entity’s accounting under IFRS. Although the requirement under IFRS 1 is to<br />

“prepare” an opening statement of financial position, this does not imply that the opening IFRS statement of financial position should also be presented in the entity’s