- Page 4 and 5:

Title Page Copyright Page Foreword

- Page 6 and 7:

DIVIDENDS DISCLOSURE: KEY ELEMENTS

- Page 8 and 9:

CONSOLIDATED FINANCIAL STATEMENTS A

- Page 10 and 11:

ELABORATION AND INTERPRETATION OF T

- Page 12 and 13:

MULTIPLE-CHOICE QUESTIONS Chapter 3

- Page 14 and 15:

FOREWORD TO THE FIRST EDITION by th

- Page 16 and 17:

PREFACE Achieving consistency in fi

- Page 18 and 19:

ABOUT THE AUTHORS Abbas Ali Mirza i

- Page 20 and 21:

ecognition and use of IFRS. A major

- Page 22 and 23:

SIC 12, Consolidation—Special-Pur

- Page 24 and 25:

The IFRS Advisory Council shall com

- Page 26 and 27:

Chapter 2 IASB FRAMEWORK INTRODUCTI

- Page 28 and 29:

ELEMENTS OF FINANCIAL STATEMENTS Th

- Page 30 and 31:

Chapter 3 PRESENTATION OF FINANCIAL

- Page 32 and 33:

XYZ Inc. is a manufacturer of telev

- Page 34 and 35:

Statement of Comprehensive Income I

- Page 36 and 37:

Available-for-sale financial assets

- Page 38 and 39:

Notes The notes should disclose the

- Page 40 and 41:

equired by the counterparty to sett

- Page 42 and 43:

The costs of purchase constitute al

- Page 44 and 45:

Based on the FIFO cost flow assumpt

- Page 46 and 47:

• Accounting policies adopted for

- Page 48 and 49:

f. Choices a and c. g. Choices a, b

- Page 50 and 51:

1. They should be “short term”

- Page 52 and 53:

2. Proceeds from disposal of debt i

- Page 54 and 55:

1. Cash collections from customers

- Page 56 and 57:

3. Placements and withdrawals of de

- Page 58 and 59:

Additional Information Retained ear

- Page 60 and 61:

c. Indirect Method Cash paid to sup

- Page 62 and 63:

Notes to the Consolidated Cash Flow

- Page 64 and 65:

Chapter 6 ACCOUNTING POLICIES, CHAN

- Page 66 and 67:

een applied. The impact of the new

- Page 68 and 69:

• For current and each prior peri

- Page 70 and 71:

An entity should disclose amounts a

- Page 72 and 73:

Notes to the Financial Statements (

- Page 74 and 75:

d. The entity would find the determ

- Page 76 and 77:

Given these facts, what is the “a

- Page 78 and 79:

existed at the end of the reporting

- Page 80 and 81:

Chapter 8 CONSTRUCTION CONTRACTS (I

- Page 82 and 83:

2. Costs that are attributable to c

- Page 84 and 85:

4. Revenue, costs, and profits to b

- Page 86 and 87:

Facts 34 Construction contracts Mil

- Page 88 and 89:

ecognized as revenue. Therefore, $7

- Page 90 and 91:

The Standard Applies to the Account

- Page 92 and 93:

ACCOUNTING FOR DEFERRED TAX To acco

- Page 94 and 95:

TEMPORARY DIFFERENCES NOT RECOGNIZE

- Page 96 and 97:

Required Show the impact on the fin

- Page 98 and 99:

Solution Zero. There is no temporar

- Page 100 and 101:

Solution Facts CASE STUDY 13 East i

- Page 102 and 103:

Since 20X4, Frontier has incurred s

- Page 104 and 105:

calculated that the liability and e

- Page 106 and 107:

Chapter 10 PROPERTY, PLANT, AND EQU

- Page 108 and 109:

Required 2. Initial delivery and ha

- Page 110 and 111:

disposal. Any gain on disposal is t

- Page 112 and 113:

financing liability and the financi

- Page 114 and 115:

Chapter 11 LEASES (IAS 17) BACKGROU

- Page 116 and 117:

the fair value of the asset. During

- Page 118 and 119:

ate in the lease is 9.3% (approxima

- Page 120 and 121:

Discuss how this transaction should

- Page 122 and 123:

The basic lease accounting model ha

- Page 124 and 125:

6. The lease of land and buildings

- Page 126 and 127:

Chapter 12 REVENUE (IAS 18) BACKGRO

- Page 128 and 129:

• Do not involve the same counter

- Page 130 and 131:

• The costs incurred and the cost

- Page 132 and 133:

Up to March 31, 20X9, the value of

- Page 134 and 135:

e that the real estate developer as

- Page 136 and 137:

Turnover is recognized when the ris

- Page 138 and 139:

Chapter 13 EMPLOYEE BENEFITS (IAS 1

- Page 140 and 141:

The accounting for a defined contri

- Page 142 and 143:

The amount of the expense or income

- Page 144 and 145:

• Fair value of plan assets: $50

- Page 146 and 147:

8. Past service cost: $115 million.

- Page 148 and 149:

Pensions Employee costs Employee co

- Page 150 and 151:

9. An entity operates a defined ben

- Page 152 and 153:

For quite some time, it has been un

- Page 154 and 155:

Solution Citimart Inc. would need t

- Page 156 and 157:

The Standard does not favor either

- Page 158 and 159:

Chapter 15 THE EFFECTS OF CHANGES I

- Page 160 and 161:

Facts An entity purchases equipment

- Page 162 and 163:

The exchange difference is calculat

- Page 164 and 165:

disposal was recognized. The same a

- Page 166 and 167:

Difference 7 Total 89.5 (say 90m) T

- Page 168 and 169:

ate on December 31, 20X9 is $1 =

- Page 170 and 171:

On December 1, 2009, Compassionate

- Page 172 and 173:

1. In order to capitalize the borro

- Page 174 and 175:

Chapter 17 RELATED-PARTY DISCLOSURE

- Page 176 and 177:

Solution Yes, under IAS 24 (revised

- Page 178 and 179:

warrant disclosure because it may n

- Page 180 and 181:

Facts Zeeba Inc. is part of a major

- Page 182 and 183:

The Used Equipment Co (Pty) Limited

- Page 184 and 185:

Key management personnel are define

- Page 186 and 187:

Chapter 18 ACCOUNTING AND REPORTING

- Page 188 and 189:

Total accounts payable 41,000 Accru

- Page 190 and 191:

Employee contributions 50,000 Total

- Page 192 and 193:

Chapter 19 CONSOLIDATED AND SEPARAT

- Page 194 and 195:

2. Noncontrolling interests in the

- Page 196 and 197:

When an entity loses control of a s

- Page 198 and 199:

Initially, the fair value of the as

- Page 200 and 201:

c. The ultimate parent entity produ

- Page 202 and 203:

EQUITY METHOD Under the equity meth

- Page 204 and 205:

What is the relationship between Co

- Page 206 and 207:

What amount should be shown in A’

- Page 208 and 209:

(f) (g) (h) December 31 60 73 Assoc

- Page 210 and 211:

. The carrying value of the associa

- Page 212 and 213:

PRACTICAL INSIGHT Turkiye Petrol Ra

- Page 214 and 215:

Cash 5,150 Share capital (300/100

- Page 216 and 217:

Chapter 22 INTERESTS IN JOINT VENTU

- Page 218 and 219:

Facts Three entities decide to form

- Page 220 and 221:

current period (IFRIC 1.5). Thus in

- Page 222 and 223:

Methods of valuation techniques use

- Page 224 and 225:

of impairment exists, the carrying

- Page 226 and 227:

Chapter 23 FINANCIAL INSTRUMENTS: P

- Page 228 and 229:

Contracts for contingent considerat

- Page 230 and 231:

has the unconditional right to refu

- Page 232 and 233:

principal and interest cash flows)

- Page 234 and 235:

On January 15, 20X5, Entity A issue

- Page 236 and 237:

instruments. A financial instrument

- Page 238 and 239:

The major components of market risk

- Page 240 and 241:

Credit risk is the risk that a cust

- Page 242 and 243:

1. Are there any circumstances when

- Page 244 and 245:

• A purchased put option to sell

- Page 246 and 247:

• Sales that are so close to matu

- Page 248 and 249:

eceived nothing on entering into th

- Page 250 and 251:

price plus interest. In this case,

- Page 252 and 253:

CASE STUDY 4 This case illustrates

- Page 254 and 255:

financial liabilities measured at f

- Page 256 and 257:

Example If Entity A receives a cash

- Page 258 and 259:

If the reporting period does not co

- Page 260 and 261:

cash flow pattern, credit quality,

- Page 262 and 263:

of the cash flows. 2. Entity A purc

- Page 264 and 265:

PRACTICAL INSIGHT IAS 39 does not p

- Page 266 and 267:

This case illustrates how to accoun

- Page 268 and 269:

This case illustrates how to accoun

- Page 270 and 271:

This case illustrates when to separ

- Page 272 and 273:

change in fair value of the derivat

- Page 274 and 275:

A cash flow hedge is a hedge of the

- Page 276 and 277:

This case illustrates the accountin

- Page 278 and 279:

PRACTICAL INSIGHT It is often possi

- Page 280 and 281:

Derivatives are measured on the bal

- Page 282 and 283:

15. Which of the following is not o

- Page 284 and 285:

• As amounts attributable to the

- Page 286 and 287:

The theoretical ex-rights fair valu

- Page 288 and 289: Diluted earnings per share Adjusted

- Page 290 and 291: Earnings: diluted earnings per shar

- Page 292 and 293: • Basic and diluted earnings per

- Page 294 and 295: The numbers of shares included in t

- Page 296 and 297: Chapter 26 INTERIM FINANCIAL REPORT

- Page 298 and 299: should be applied and previously re

- Page 300 and 301: Consolidated balance sheet at June

- Page 302 and 303: 1. Under IAS 34, interim financial

- Page 304 and 305: was $5 million. It was planned at t

- Page 306 and 307: development costs. An impairment lo

- Page 308 and 309: The fair value less cost to sell of

- Page 310 and 311: can be reasonably allocated. 3. Thi

- Page 312 and 313: PRACTICAL INSIGHT Austrian Airlines

- Page 314 and 315: Impairments charge in the year Ther

- Page 316 and 317: . Loss on goodwill. c. Loss on a bu

- Page 318 and 319: Recognition of Provisions Those lia

- Page 320 and 321: An onerous contract is an agreement

- Page 322 and 323: In order to recognize a provision (

- Page 324 and 325: A Singapore-based shipping company

- Page 326 and 327: c. Because Amazon Inc. can avoid th

- Page 328 and 329: In order to meet the definition of

- Page 330 and 331: Examples of activities that may fai

- Page 332 and 333: • These costs can be measured rel

- Page 334 and 335: Entities are to apply the provision

- Page 336 and 337: Future changes in expected cash flo

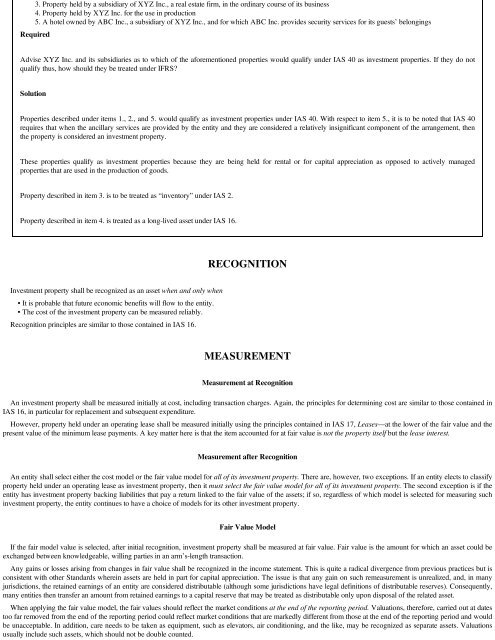

- Page 340 and 341: If, on acquisition, it is not possi

- Page 342 and 343: pool in which the fair value model

- Page 344 and 345: Chapter 31 AGRICULTURE (IAS 41) BAC

- Page 346 and 347: Required Value of biological asset

- Page 348 and 349: 2-year-old animal at November 1, 20

- Page 350 and 351: Notes to Group Financial Statements

- Page 352 and 353: d. There is no requirement in the S

- Page 354 and 355: Financial statements presented by a

- Page 356 and 357: Solution In order to prepare the op

- Page 358 and 359: • Identification of assets acquir

- Page 360 and 361: 2. No journal entry is required as

- Page 362 and 363: IFRS 1 discusses exemptions under t

- Page 364 and 365: Solution In valuing the shares of V

- Page 366 and 367: • Unilever was an early adopter (

- Page 368 and 369: Chapter 33 SHARE-BASED PAYMENTS (IF

- Page 370 and 371: date of the cancelation is deducted

- Page 372 and 373: party, to satisfy its obligations t

- Page 374 and 375: Playful has ordered an amount of in

- Page 376 and 377: May 31, 20X8 August 1, 20X8 5,000

- Page 378 and 379: Should the plans be valued at fair

- Page 380 and 381: 4. An entity issues fully paid shar

- Page 382 and 383: Chapter 34 BUSINESS COMBINATIONS (I

- Page 384 and 385: Future losses or other costs that a

- Page 386 and 387: 93 Interest (13) Profit before tax

- Page 388 and 389:

This choice of method of accounting

- Page 390 and 391:

The error in 20X9, regarding the om

- Page 392 and 393:

This makes a total NCI of $554m. c)

- Page 394 and 395:

$m J retained earnings 360 Share of

- Page 396 and 397:

Intercompany transactions and the r

- Page 398 and 399:

11. The “excess of the acquirer

- Page 400 and 401:

Chapter 35 INSURANCE CONTRACTS (IFR

- Page 402 and 403:

Required Discuss how the reinsuranc

- Page 404 and 405:

Guaranteed residual values Guarante

- Page 406 and 407:

Chapter 36 NONCURRENT ASSETS HELD F

- Page 408 and 409:

SUNDRY POINTS Exchanges of noncurre

- Page 410 and 411:

Before classification of the item a

- Page 412 and 413:

Noncurrent assets Current assets No

- Page 414 and 415:

c. At carrying value. d. In accorda

- Page 416 and 417:

IAS 8 specifies a hierarchy of crit

- Page 418 and 419:

fuel used, rig costs, delay rentals

- Page 420 and 421:

Chapter 38 FINANCIAL INSTRUMENTS: D

- Page 422 and 423:

other than credit risk (i.e., chang

- Page 424 and 425:

2. Whether fair values are determin

- Page 426 and 427:

d. Transfers into or out of Level 3

- Page 428 and 429:

equires that any derivative that do

- Page 430 and 431:

The amount recognized in the income

- Page 432 and 433:

a. To provide presentation and disc

- Page 434 and 435:

amongst the top management personne

- Page 436 and 437:

Recreational clubs $ 50 million vs

- Page 438 and 439:

Chapter 40 FINANCIAL INSTRUMENTS (I

- Page 440 and 441:

Discussion The entity’s objective

- Page 442 and 443:

The following are indicators of whe

- Page 444 and 445:

However as IFRS 9 eliminates the av

- Page 446 and 447:

Facts CASE STUDY 6 Hant has an equi

- Page 448 and 449:

Chapter 41 IFRS FOR SMEs INTRODUCTI

- Page 450 and 451:

the IFRS for SMEs, if an entity can

- Page 452 and 453:

2. The subsidiary’s business acti

- Page 454 and 455:

All grants are measured at the fair

- Page 456 and 457:

The present value of the fine will

- Page 458 and 459:

3. If SMEs choose to follow the Sta

- Page 460 and 461:

1. b 2. a 3. a 4. c 5. a 1. a 2. c*

- Page 462 and 463:

1. b 2. a 3. b 1. d 2. b 3. c 4. c

- Page 464 and 465:

2. b 3. b 4. a 5. a 6. b 7. b 8. b

- Page 466 and 467:

18. d* 19. b 20. b 21. a 22. b 23.

- Page 468 and 469:

INDEX Abandonment Accounting compou

- Page 470 and 471:

Control business combinations conso

- Page 472 and 473:

interests. See IAS 32, Financial In

- Page 474 and 475:

events after the reporting period G

- Page 476 and 477:

gross basis versus net basis indire

- Page 478 and 479:

IAS 18, Revenue amendment to backgr

- Page 480 and 481:

net assets available for benefits n

- Page 482 and 483:

fair value per share financial stat

- Page 484 and 485:

initial measurement interest income

- Page 486 and 487:

scope of share-based payment transa

- Page 488 and 489:

credit risk effective date fair val

- Page 490 and 491:

property, plant, and equipment Impa

- Page 492 and 493:

Market risk Materiality Measurement

- Page 494 and 495:

Recoverable amount, impairment loss

- Page 496 and 497:

usiness combinations financial inst