EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

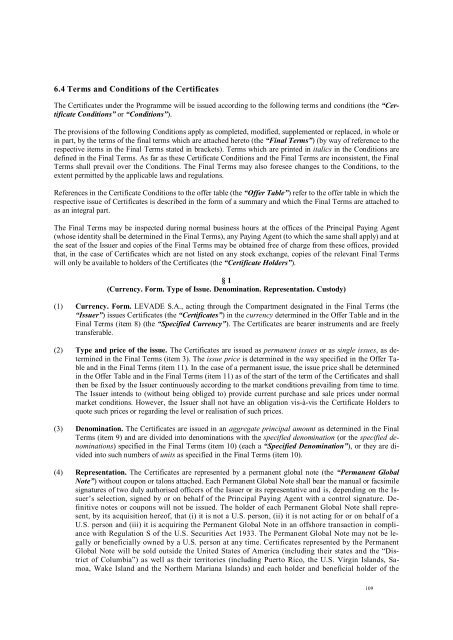

6.4 Terms and Conditions of the Certificates<br />

The Certificates under the Programme will be issued according to the following terms and conditions (the “Certificate<br />

Conditions” or “Conditions”).<br />

The provisions of the following Conditions apply as completed, modified, supplemented or replaced, in whole or<br />

in part, by the terms of the final terms which are attached hereto (the “Final Terms”) (by way of reference to the<br />

respective items in the Final Terms stated in brackets). Terms which are printed in italics in the Conditions are<br />

defined in the Final Terms. As far as these Certificate Conditions and the Final Terms are inconsistent, the Final<br />

Terms shall prevail over the Conditions. The Final Terms may also foresee changes to the Conditions, to the<br />

extent permitted by the applicable laws and regulations.<br />

References in the Certificate Conditions to the offer table (the “Offer Table”) refer to the offer table in which the<br />

respective issue of Certificates is described in the form of a summary and which the Final Terms are attached to<br />

as an integral part.<br />

The Final Terms may be inspected during normal business hours at the offices of the Principal Paying Agent<br />

(whose identity shall be determined in the Final Terms), any Paying Agent (to which the same shall apply) and at<br />

the seat of the Issuer and copies of the Final Terms may be obtained free of charge from these offices, provided<br />

that, in the case of Certificates which are not listed on any stock exchange, copies of the relevant Final Terms<br />

will only be available to holders of the Certificates (the “Certificate Holders”).<br />

§ 1<br />

(Currency. Form. Type of Issue. Denomination. Representation. Custody)<br />

(1) Currency. Form. LEVADE S.A., acting through the Compartment designated in the Final Terms (the<br />

“Issuer”) issues Certificates (the “Certificates”) in the currency determined in the Offer Table and in the<br />

Final Terms (item 8) (the “Specified Currency”). The Certificates are bearer instruments and are freely<br />

transferable.<br />

(2) Type and price of the issue. The Certificates are issued as permanent issues or as single issues, as determined<br />

in the Final Terms (item 3). The issue price is determined in the way specified in the Offer Table<br />

and in the Final Terms (item 11). In the case of a permanent issue, the issue price shall be determined<br />

in the Offer Table and in the Final Terms (item 11) as of the start of the term of the Certificates and shall<br />

then be fixed by the Issuer continuously according to the market conditions prevailing from time to time.<br />

The Issuer intends to (without being obliged to) provide current purchase and sale prices under normal<br />

market conditions. However, the Issuer shall not have an obligation vis-à-vis the Certificate Holders to<br />

quote such prices or regarding the level or realisation of such prices.<br />

(3) Denomination. The Certificates are issued in an aggregate principal amount as determined in the Final<br />

Terms (item 9) and are divided into denominations with the specified denomination (or the specified denominations)<br />

specified in the Final Terms (item <strong>10</strong>) (each a “Specified Denomination”), or they are divided<br />

into such numbers of units as specified in the Final Terms (item <strong>10</strong>).<br />

(4) Representation. The Certificates are represented by a permanent global note (the “Permanent Global<br />

Note”) without coupon or talons attached. Each Permanent Global Note shall bear the manual or facsimile<br />

signatures of two duly authorised officers of the Issuer or its representative and is, depending on the Issuer’s<br />

selection, signed by or on behalf of the Principal Paying Agent with a control signature. Definitive<br />

notes or coupons will not be issued. The holder of each Permanent Global Note shall represent,<br />

by its acquisition hereof, that (i) it is not a U.S. person, (ii) it is not acting for or on behalf of a<br />

U.S. person and (iii) it is acquiring the Permanent Global Note in an offshore transaction in compliance<br />

with Regulation S of the U.S. Securities Act 1933. The Permanent Global Note may not be legally<br />

or beneficially owned by a U.S. person at any time. Certificates represented by the Permanent<br />

Global Note will be sold outside the United States of America (including their states and the “District<br />

of Columbia”) as well as their territories (including Puerto Rico, the U.S. Virgin Islands, Samoa,<br />

Wake Island and the Northern Mariana Islands) and each holder and beneficial holder of the<br />

<strong>10</strong>9