EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

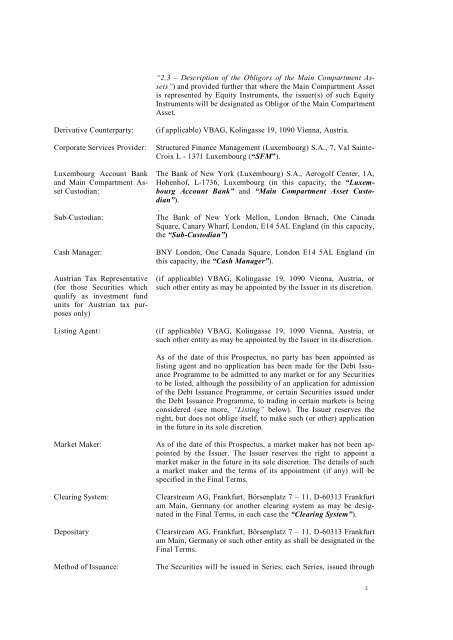

“2.3 – Description of the Obligors of the Main Compartment Assets”)<br />

and provided further that where the Main Compartment Asset<br />

is represented by Equity Instruments, the issuer(s) of such Equity<br />

Instruments will be designated as Obligor of the Main Compartment<br />

Asset.<br />

Derivative Counterparty: (if applicable) VB<strong>AG</strong>, Kolingasse 19, <strong>10</strong>90 Vienna, Austria.<br />

Corporate Services Provider: Structured Finance Management (Luxembourg) S.A., 7, Val Sainte-<br />

Croix L - 1371 Luxembourg (“SFM”).<br />

Luxembourg Account Bank<br />

and Main Compartment Asset<br />

Custodian:<br />

The Bank of New York (Luxembourg) S.A., Aerogolf Center, 1A,<br />

Hohenhof, L-1736, Luxembourg (in this capacity, the “Luxembourg<br />

Account Bank” and “Main Compartment Asset Custodian”).<br />

.<br />

Sub-Custodian: The Bank of New York Mellon, London Brnach, One Canada<br />

Square, Canary Wharf, London, E14 5AL England (in this capacity,<br />

the “Sub-Custodian”)<br />

Cash Manager: BNY London, One Canada Square, London E14 5AL England (in<br />

this capacity, the “Cash Manager”).<br />

Austrian Tax Representative<br />

(for those Securities which<br />

qualify as investment fund<br />

units for Austrian tax purposes<br />

only)<br />

(if applicable) VB<strong>AG</strong>, Kolingasse 19, <strong>10</strong>90 Vienna, Austria, or<br />

such other entity as may be appointed by the Issuer in its discretion.<br />

Listing Agent: (if applicable) VB<strong>AG</strong>, Kolingasse 19, <strong>10</strong>90 Vienna, Austria, or<br />

such other entity as may be appointed by the Issuer in its discretion.<br />

As of the date of this Prospectus, no party has been appointed as<br />

listing agent and no application has been made for the Debt Issuance<br />

Programme to be admitted to any market or for any Securities<br />

to be listed, although the possibility of an application for admission<br />

of the Debt Issuance Programme, or certain Securities issued under<br />

the Debt Issuance Programme, to trading in certain markets is being<br />

considered (see more, “Listing” below). The Issuer reserves the<br />

right, but does not oblige itself, to make such (or other) application<br />

in the future in its sole discretion.<br />

Market Maker: As of the date of this Prospectus, a market maker has not been appointed<br />

by the Issuer. The Issuer reserves the right to appoint a<br />

market maker in the future in its sole discretion. The details of such<br />

a market maker and the terms of its appointment (if any) will be<br />

specified in the Final Terms.<br />

Clearing System: Clearstream <strong>AG</strong>, Frankfurt, Börsenplatz 7 – 11, D-60313 Frankfurt<br />

am Main, Germany (or another clearing system as may be designated<br />

in the Final Terms, in each case the “Clearing System”).<br />

Depositary Clearstream <strong>AG</strong>, Frankfurt, Börsenplatz 7 – 11, D-60313 Frankfurt<br />

am Main, Germany or such other entity as shall be designated in the<br />

Final Terms.<br />

Method of Issuance: The Securities will be issued in Series; each Series, issued through<br />

2