Download PDF - Hiscox

Download PDF - Hiscox

Download PDF - Hiscox

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Insurance carriers<br />

Syndicate 33<br />

<strong>Hiscox</strong> can trace its origins in the Lloyd’s<br />

Market to 1901. Today, <strong>Hiscox</strong> Syndicate 33<br />

is one of the largest composite syndicates at<br />

Lloyd’s, and has an A.M. Best syndicate rating<br />

of A (Excellent). Syndicate 33 underwrites<br />

a mixture of reinsurance, major property and<br />

energy business, as well as a range of specialty<br />

lines including contingency, technology and<br />

media risks among others. The business is<br />

mainly property-related short-tail business;<br />

there is little exposure to aviation or motor<br />

business. Syndicate 33 trades through the<br />

Lloyd’s worldwide licences and ratings. It also<br />

benefits from the Lloyd’s brand. Lloyd’s has<br />

an A (Excellent) rating from A.M. Best, an A+<br />

(Strong) from Standard & Poor’s, and an A+<br />

(Strong) rating from Fitch.<br />

The geographical and currency splits are shown<br />

to the right. One of the main advantages of<br />

trading through Lloyd’s is the considerably<br />

lower capital ratios that are available due<br />

to the diversification of business written in<br />

Syndicate 33 and in Lloyd’s as a whole. For<br />

2010 Syndicate 33 has a capital requirement<br />

ratio of approximately 43% of Syndicate<br />

capacity. The size of the Syndicate is increased<br />

or reduced according to the strength of the<br />

insurance environment in its main classes.<br />

At present, <strong>Hiscox</strong> owns approximately 72.5%<br />

of the Syndicate, with 27.5% being owned by<br />

third party Lloyd’s Names. <strong>Hiscox</strong> receives<br />

a fee and a profit commission of approximately<br />

17.5% of profit on the element it does not own.<br />

For the 2010 year of account, Syndicate 33’s<br />

capacity has been increased from £750 million<br />

to £1 billion, primarily to reflect the<br />

strengthening US Dollar.<br />

The chart to the right shows the gross premiums<br />

written of Syndicate 33 for the last nine years.<br />

28<br />

Insurance carriers <strong>Hiscox</strong> Ltd Report and Accounts 2009<br />

Syndicate 3624<br />

Syndicate 3624 is a wholly owned syndicate<br />

which began underwriting for the 2009 year of<br />

account with an underwriting capacity of £80<br />

million. Syndicate 3624 writes certain business<br />

lines including the US E&O account written<br />

through the <strong>Hiscox</strong> underwriting agency in<br />

Armonk, New York and a 50% quota share of<br />

Syndicate 33’s TMT business written by <strong>Hiscox</strong><br />

owned underwriting agencies. Syndicate 3624<br />

has a capital requirement ratio of 69% of<br />

syndicate capacity. Total underwriting capacity<br />

of Syndicate 3624 has been increased to £150<br />

million for the 2010 year of account.<br />

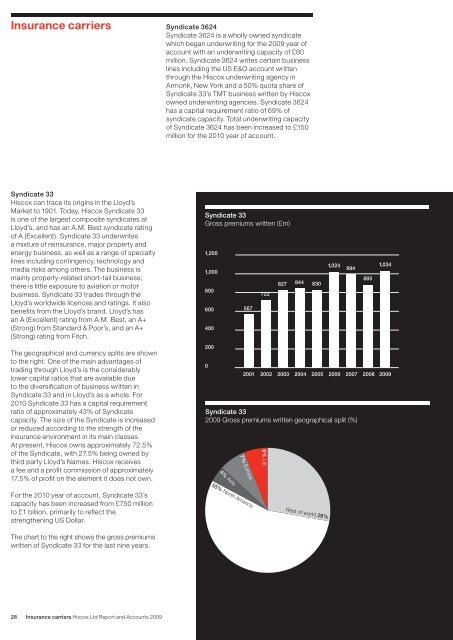

Syndicate 33<br />

Gross premiums written (£m)<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Syndicate 33<br />

2009 Gross premiums written geographical split (%)<br />

4% Asia<br />

567<br />

2001<br />

7% Europe<br />

55% North America<br />

722<br />

2002 2003 2004 2005 2006 2007 2008<br />

6% UK<br />

827<br />

844<br />

830<br />

Rest of world 28%<br />

1,024<br />

994<br />

885<br />

1,034<br />

2009